The field of mobile app promotion in the eCommerce niche is unique right now. We have collected the most interesting data on the development of the niche and talked to the head of the Adsbalance buying team, that led to x400 orders per day for the eCommerce app in September.

The situation in the world

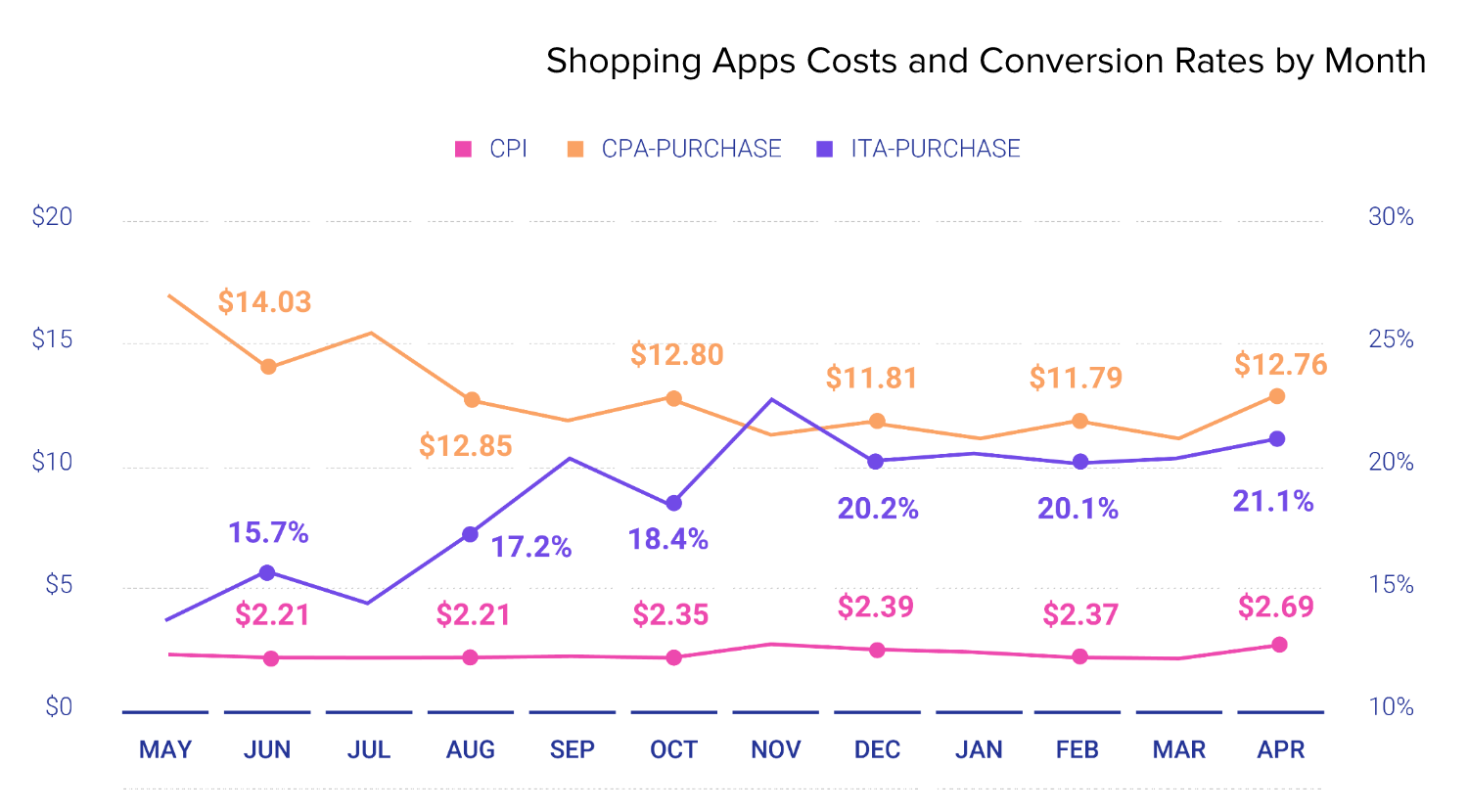

According to Liftoff, in 2021 about 80% of installs on large apps came from paid traffic. The conversion rate for online purchases is 18.5%, indicating that performance is attracting a new audience. The CPA performance model between May 2021 and April 2022 did not show as consistently. Conversion to purchases first fell, then stayed at the same level and only went up after March. The CPI format is more stable in eCommerce.

We talked to Mikhail Tsvetkov, head of the Adsbalance Buying Team, about the traffic to the eCommerce apps in more detail.

What are the main features of the sphere in 2022? Did something change, or did something new appear?

What are the main features of the sphere in 2022? Did something change, or did something new appear?

I do not observe any significant changes in this vertical, there were no breakthroughs, but there is no stagnation either. The peculiarity of this sphere can be characterized as predictability.

What can you say about the current situation with advertisers?

The situation has changed significantly in the local segment. Due to the departure of usual promo channels, there is a redistribution of advertising budgets to alternative ones. Local advertisers are more active than foreign ones in finding new channels to promote their products.

The situation with GEO in 2022. What trends can be noticed?

Again, more noticeable against the background of the other regions precisely because of the ongoing redistribution of advertising budgets. We cannot say the same about other markets, such changes are less noticeable there.

The best traffic sources.

All sources are good and everyone will praise his own set, we are not an exception. The main thing is the quality of delivered traffic and how it must meet the advertiser’s expectations (KPIs), which I think we do quite well on the local market and others.

What are your predictions for the future?

The planned growth of this market till the end of the year, but without significant breakthroughs compared to previous years, because we don’t see the prerequisites for them yet. On the other hand, long-term stagnation is not expected either. There can be short-term drops, the pandemic in early 2020 showed us that, but everything is expected to fall into place.

Case study

The profitability of working with Ecom is easy to show with the Lazada case study. Adsbalance has been working with this advertiser for almost four years. The company, owned by the Alibaba Group, is the leading eCommerce platform in Southeast Asia, with more than 50 million active customers a year. And the media buyers are helping it grow further. This time, we present the result of Lazada’s September promotion.

Working model: RevShare 2-7%

Mobile measuring partner: internal Lazada tracking platform

Results:

Number of orders per promo day: x400

Average % of delivered orders: 70%

Top product categories in descending order value: Beauty, Women’s Shoes and Clothing, Motors, Men’s Shoes and Clothing, Electronics

CR from click to order: 10%

Conclusion

Based on the results of their work and market monitoring, Adsbalance assumes that working with the eCommerce niche is profitable for those who specialise in mobile traffic. You’ll be able to follow the advertising campaigns’ results for October and beyond on the team’s LinkedIn account.