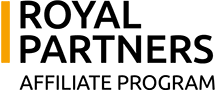

Google’s ad spend in Q3 2024 is up 11% year-on-year.

Overall click growth stabilized at 3%, while cost-per-click (CPC) growth slowed to 8%. Google Shopping ad spending increased by 16%. Overall, advertising strategies are stable despite changes due to the use of AI.

This is confirmed by the Tinuiti Digital Ads Benchmark report, based on anonymized data from U.S. ad campaigns managed by Tinuiti, with a total annual digital ad spend of over $4 billion.

Search Ads

- Spending on ads in Google’s search results increased by 11% year-over-year, down from 14% growth in the second quarter.

- Average cost-per-click (CPC) growth slowed from 12% in the second quarter to 8% in the third quarter.

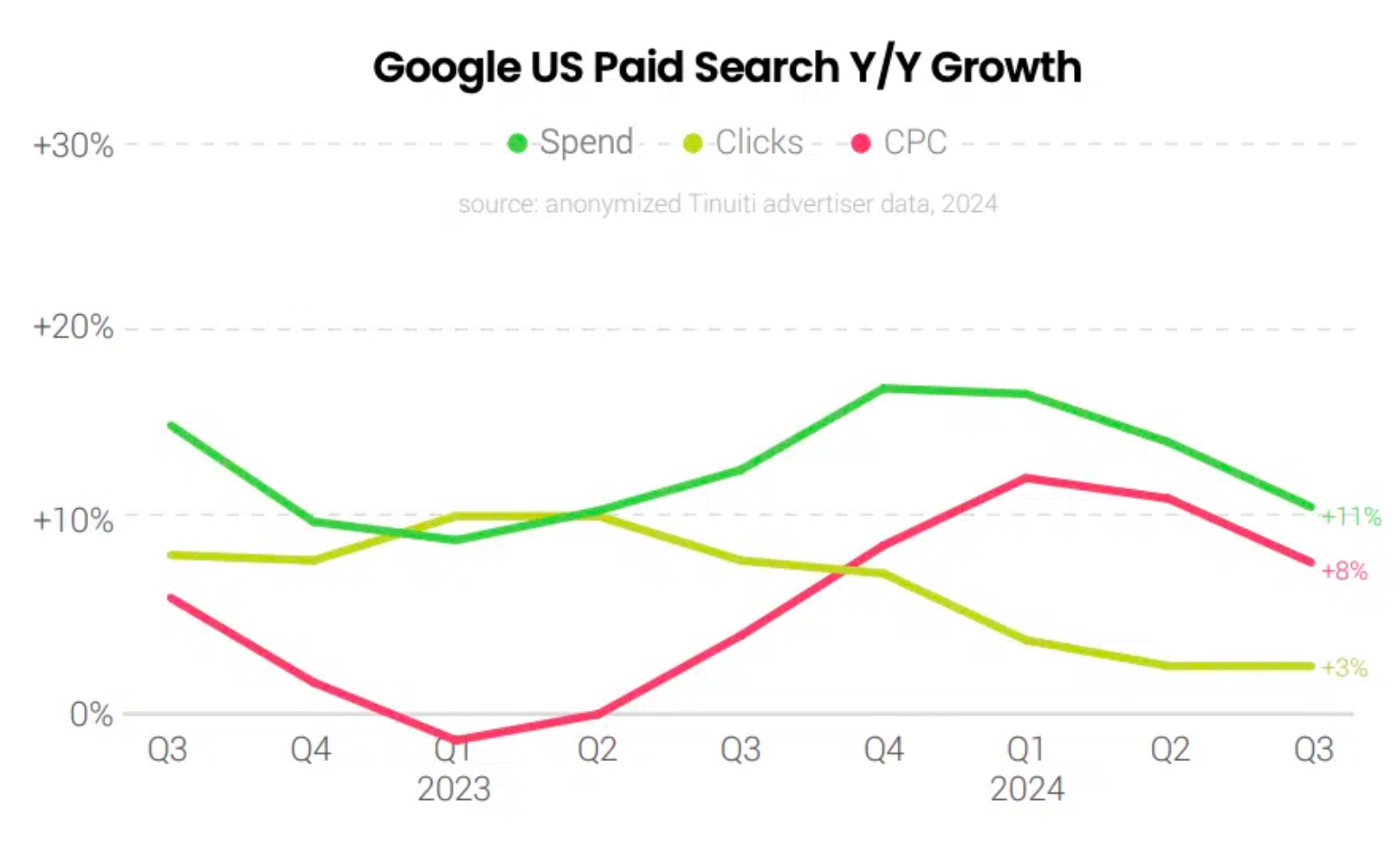

Google Shopping Campaigns

- Spending on Google Shopping increased by 16% compared to the same period last year.

- Clicks increased by 6%, which is better than the 4% increase in the second quarter.

- CPC growth for Shopping campaigns slowed to 9%.

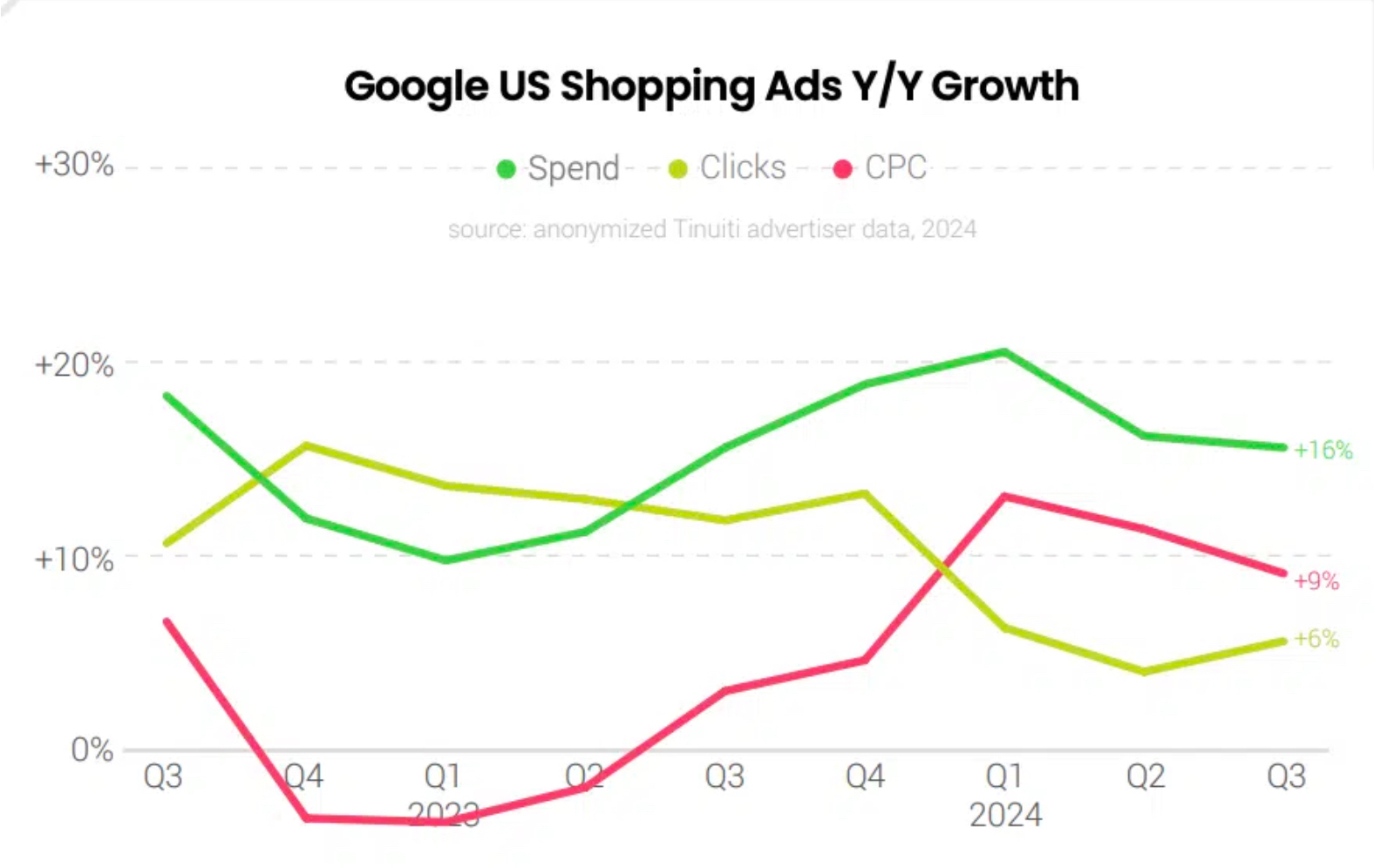

Performance Max (PMax)

- The utilization rate of Performance Max campaigns among advertisers placing Shopping ads on Google has reached 92%. This exceeds the 75% utilization rate recorded for Smart Shopping campaigns in mid-2022.

- Conversion rates for PMax campaigns were down 2% compared to regular Shopping campaigns, at the same time sales per click were down 3%.

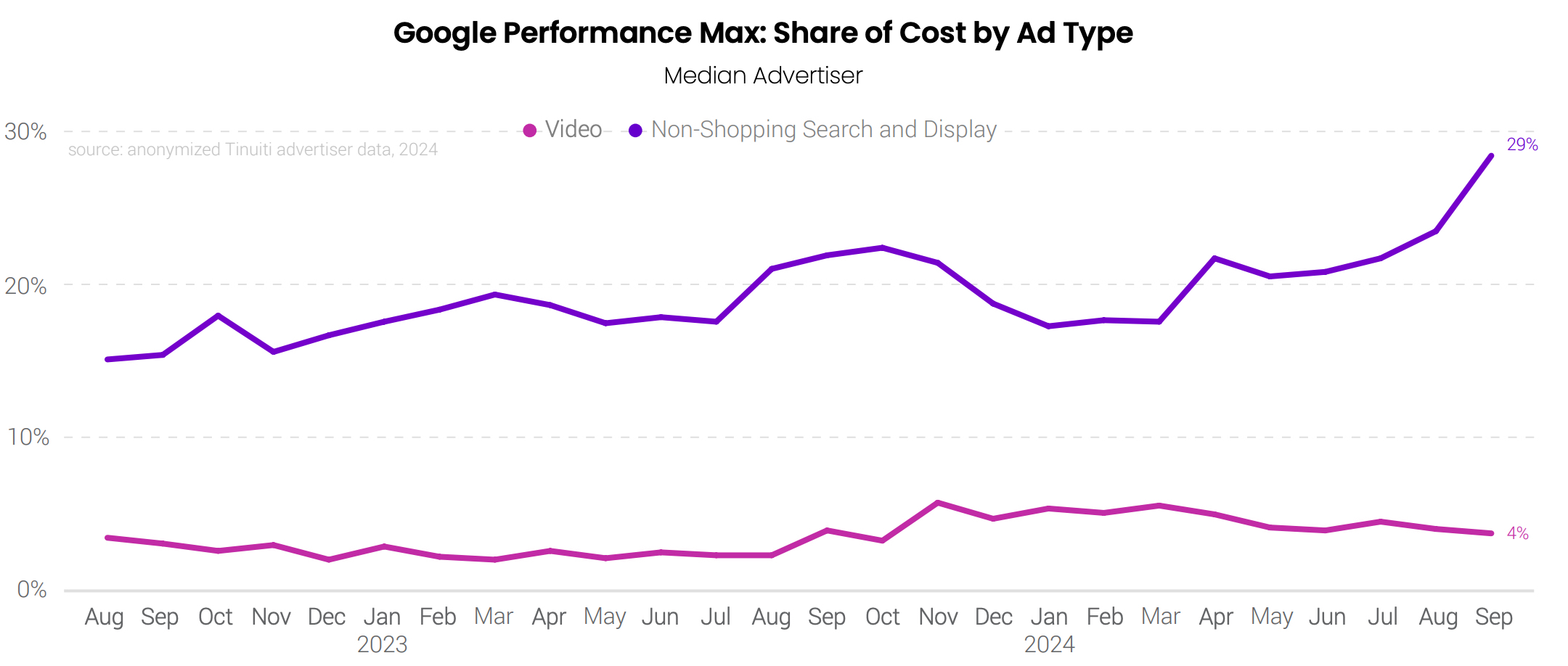

- There was also growth in non-shopping PMax campaigns towards the end of the third quarter. They accounted for 29% of PMax spending among retail advertisers, up from 21% in June 2024.

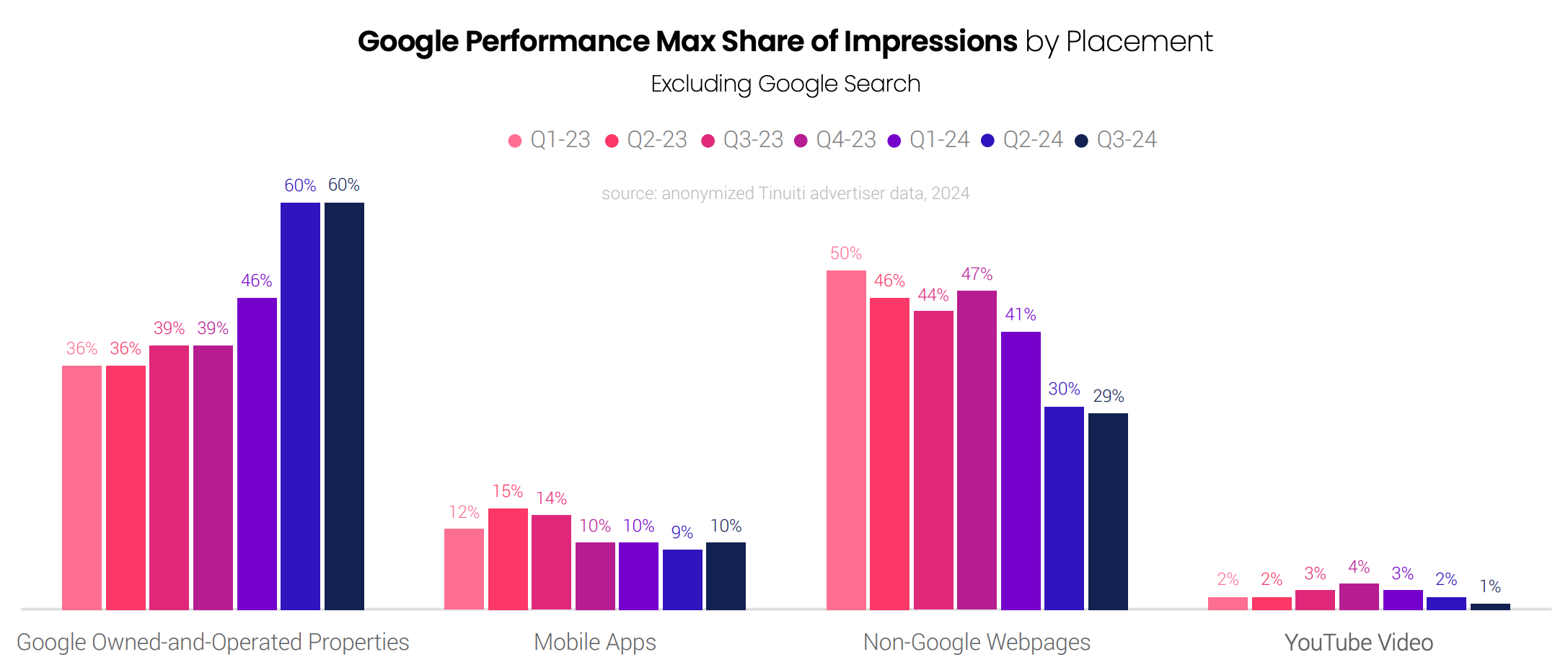

- YouTube accounted for just 1% of PMax impressions.

- Mobile apps maintained a stable share of 10% of impressions.

Text Ads

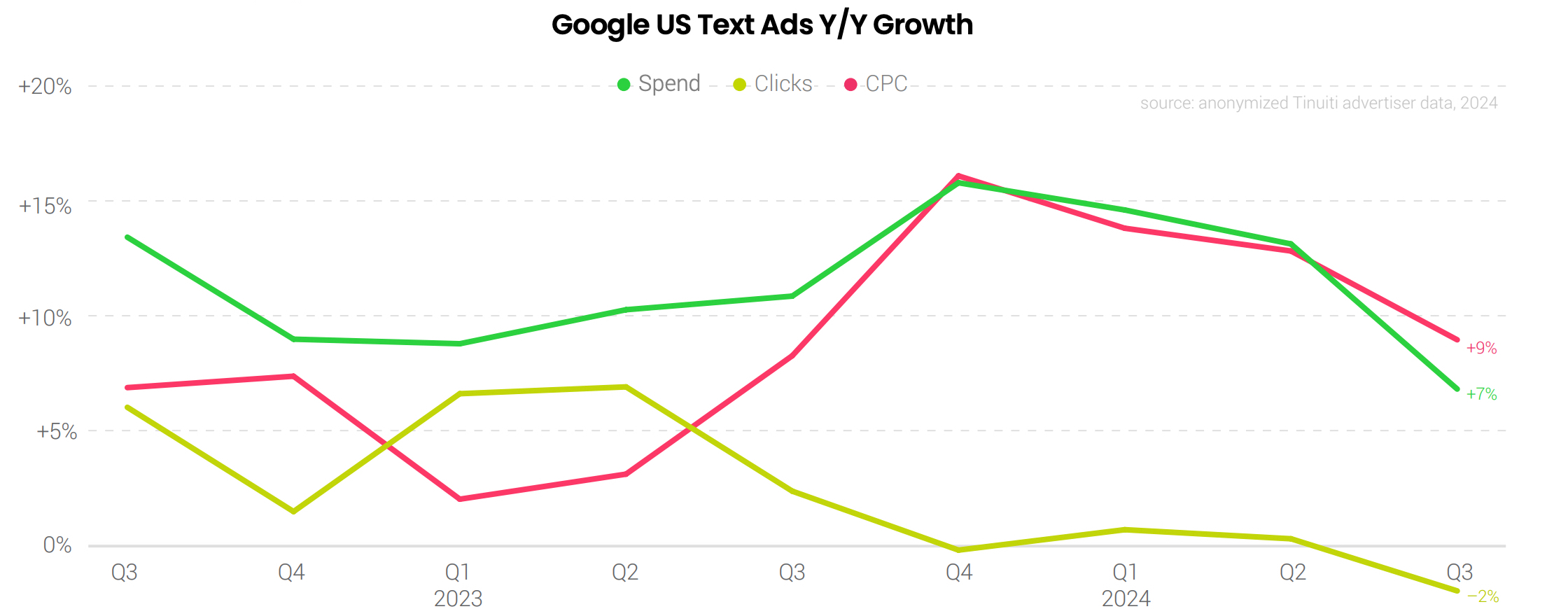

- Spending on Google’s text ad campaigns grew 7% year-on-year, down from 13% growth in the second quarter. Growth in this category was mainly driven by CPC growth as click growth was weak.

- Amazon reduced its share of impressions in Google’s text ad auctions for much of the third quarter, weakening competition in this sphere.

Video and Display Network

- YouTube’s video ad growth slowed to 11%. The bulk of YouTube’s ad spending was on TV screens, where spending increased by 24% year-over-year.

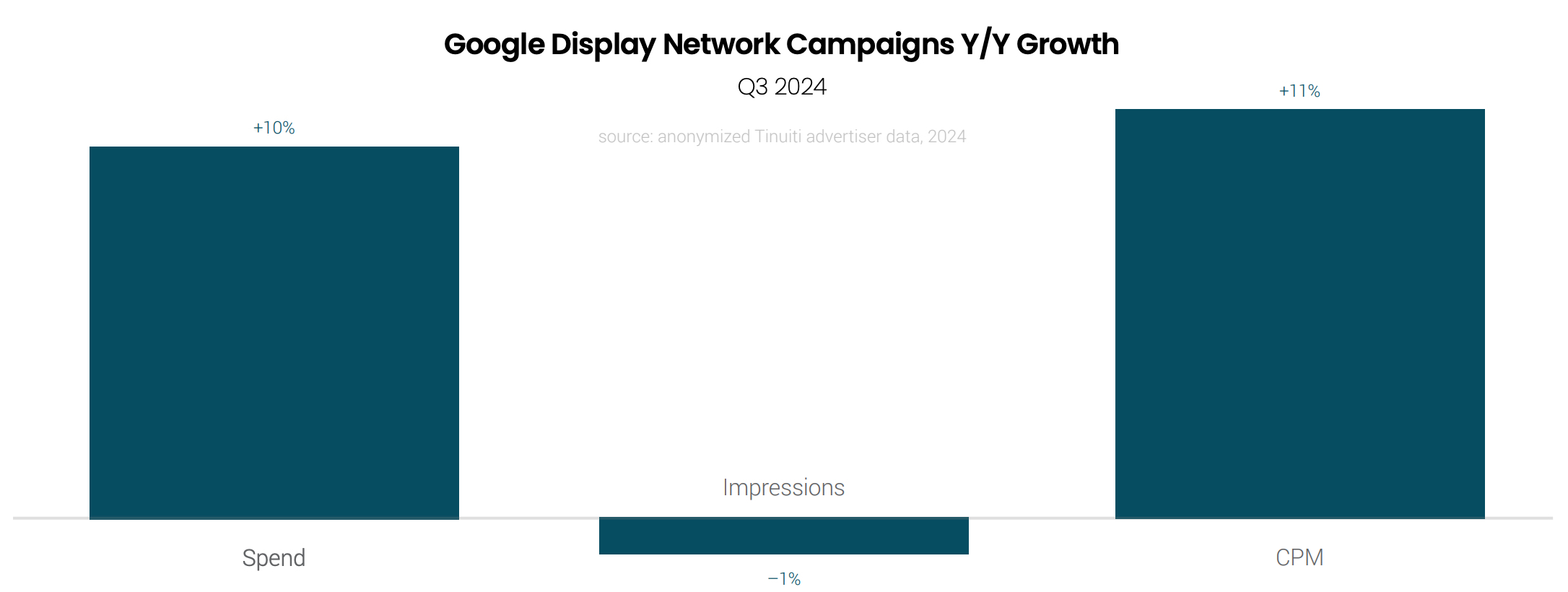

- The average price per thousand impressions (CPM) on the Google Display Network was up to 11% year-over-year, while the total number of impressions was down 1%.

Impact of Google AI Overviews on Advertising

The launch of Google’s artificial intelligence (AI) reviews, which began in May 2024, has led to a decline in click-through rate (CTR) across many segments of text ads. This particularly affected non-branded keywords on mobile devices, where the drop from April to July was 14%. However, by September CTR began to recover, remaining 4% below April levels.

- Read more in the Tinuiti Digital Ads Benchmark report.