Stablecoins

Stablecoin is a token stabilized by pegging it to fiat currency or exchange-traded commodity. In the current climate, stablecoins are a relatively safe option to secure money outside the banking system.

Keep in mind that stablecoins cannot completely eliminate risks inherent in geopolitics.

Centralized Stablecoins

The majority of stablecoins cannot be commonly referred to as cryptocurrency since they are curated by a central agency that provides its dollar liquidity and stabilizes the rate at 1:1. If required, it can block non-custodial funds.

Tether (USDT)

Tether (USDT) is the most fluid stablecoin in the crypto market, which is paired with all tokens traded on a majority of crypto platforms.

However, the stablecoin is managed on a centralized basis and the issuing company possesses the technical capacity to track the whole chain of transfers and freeze the required stablecoins where needed. Here are some known cases.

Decentralized Stablecoins

It is safer to opt for decentralized stablecoins to pay for products and services and to secure funds.

Such stablecoin is distinguished by its total decentralization. There’s no central management, so it’s impossible to block issued coins.

Let’s consider two decentralized stablecoin options:

- DAI – MakerDAO Blockchain

- UST – Terra Blockchain

DAI and UST are backed by coins of ETH and LUNA networks respectively. Besides, they are not backed by fiat currency, which is kept in banks like USDT. At the same time, they have low liquidity in trading pairs on exchange markets.

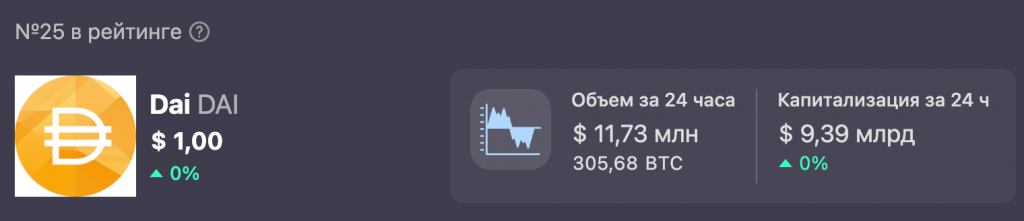

DAI Stablecoin

- Project website: https://makerdao.com

- Etherscan: https://etherscan.io/token/0x6b175474e89094c44da98b954eedeac495271d0f

DAI stablecoin is based on the Ethereum platform.

The project was created by way of alternative to pre-existing stablecoins for their lack of credibility. The DAI cryptocurrency differs from centralized stablecoins because it is created by users and secured by freezing ETH tokens in a smart contract at the current exchange rate. The DAI rate is either way maintained at $1 secured by special facilities.

How to Buy/Sell Dai (DAI) via Cryptocurrency Platforms?

You can buy it on the following platforms:

- Binance

- Coinbase Pro

- Okex

- HitBTC

- And others: https://crypto.ru/rynok-dai

DAI is also traded on the following decentralized exchanges:

- Uniswap (V2, V3)

- PancakeSwap.

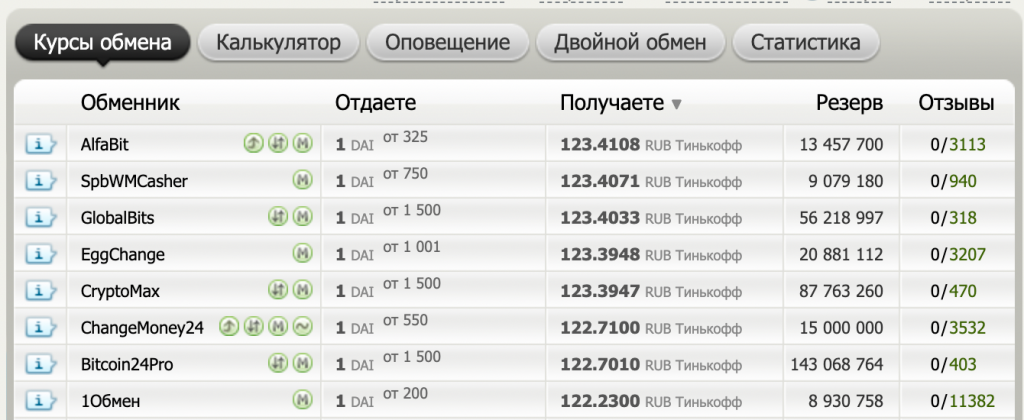

How to Buy/Sell Dai (DAI) via Exchangers?

Follow the link for the list of exchangers: https://www.bestchange.ru.

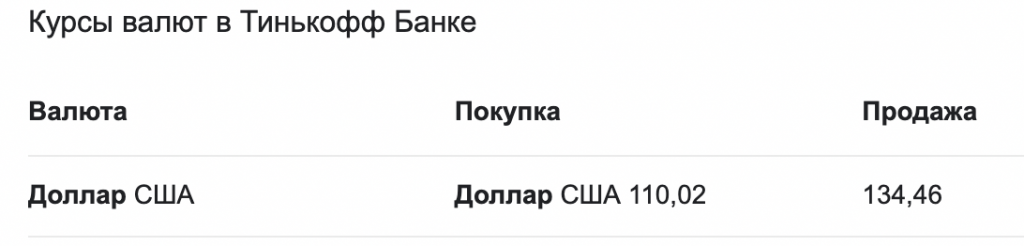

To date, many exchangers offer to swap the DAI token at an adequate rate. Let’s study the case of DAI withdrawal to Tinkoff Bank:

Considering the dollar exchange rate in Tinkoff Bank:

TerraUSD (UST) Stablecoin

- Project website: https://www.terra.money

- Etherscan: https://etherscan.io/token/0xa47c8bf37f92aBed4A126BDA807A7b7498661acD

Terra USD is a decentralized algorithmic stablecoin pegged to the US dollar. The exchange rate is fixed due to hard-and-fast policy and software, rather than fiat reserve backing. TerraUSD is backed by the LUNA cryptocurrency.

Luna coin is included in the Luna blockchain, which controls price volatility and stabilizes the rate of UST, SDT, MRT, KRT, and other currencies.

The Terra Bridge allows transferring crypto coins to the Harmony, Ethereum, and Binance Smart Chain.

How to Buy/Sell TerraUSD (UST) via Cryptocurrency Platforms?

You can buy it on the following platforms:

- Binance

- Huobi Global

- Coinbase Exchange

- Gate.io

- And others: https://crypto.ru/rynok-ust

UST is also traded on the following decentralized exchanges:

- Uniswap (V2, V3)

- PancakeSwap.

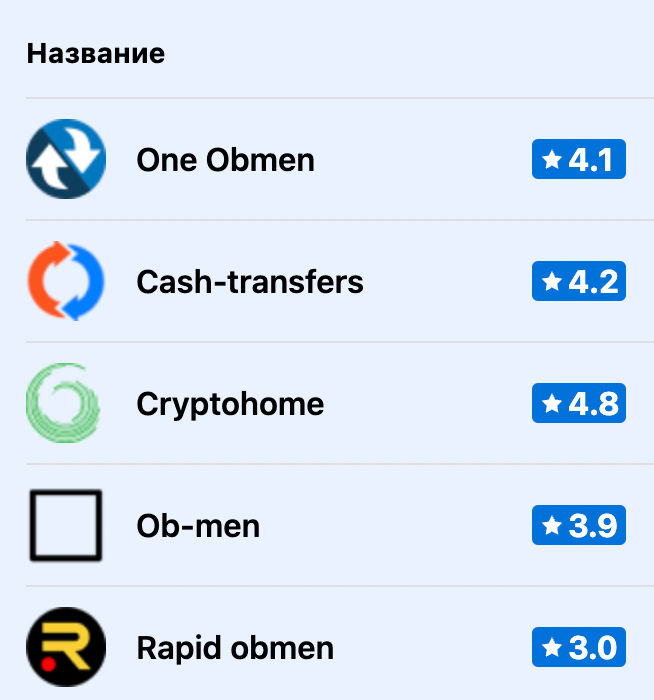

How to Buy/Sell TerraUSD (UST) via Exchangers?

There’s no UST option on bestchange.ru yet, but finding other exchangers won’t be a problem.

There’s simpleswap.io and some other exchangers:

Where to Store Dai and UST Cryptocurrency?

Non-custodial wallets are the best option. They are cryptocurrency wallets with keys and funds managed by the user.

Note that it’s unsafe to store coins in the BSC BNB Smart Chain (BEP20)

DAI stablecoins are based on the Ethereum platform, so you can store them on wallets that support the ERC-20 protocol, like:

- In this article: https://cpa.rip/crypto/ripcoin we have discussed the Metamask installation process and features in detail.

- Trust Wallet

- MyEtherWallet. Read more: https://maff.io/chto_takoe_myetherwallet

You can also store TerraUSD (UST) in Metamask and Trust Wallet. The creators of the project recommend using their in-house solution:

- The TerraStation Wallet was created for various transactions. It also allows you to interact with the project network.

All in all, the safest way to store cryptocurrency is a hardware-based (cold) wallet.