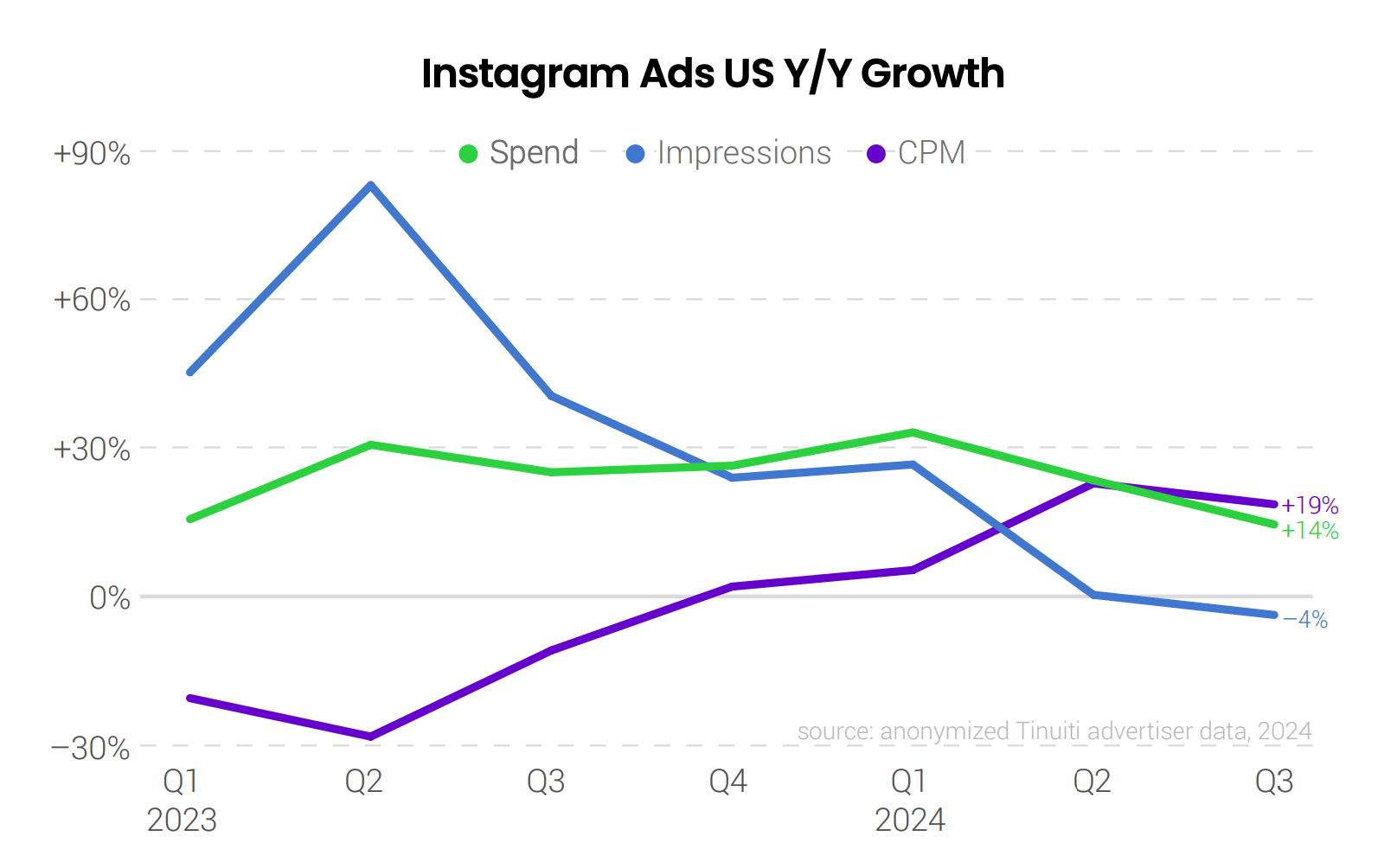

On Meta platforms (including Facebook and Instagram), ad spend growth slowed, showing a 9% increase from 10% in the second quarter. On Facebook, CPM was down 12% but impressions were up 20%. On Instagram, spending increased by 14% but the number of impressions decreased by 4% and CPM increased by 19%.

This is backed up by the Tinuiti Digital Ads Benchmark report, based on anonymized data from U.S. ad campaigns managed by Tinuiti, with a total annual digital ad spend of over $4 billion.

Overall spending growth

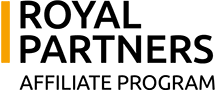

- Ad spending on Meta platforms grew 9% year-on-year, slightly down from the 10% increase in the second quarter.

- At the same time, CPM (price per thousand impressions) decreased by 3% compared to a 5% increase in the second quarter.

- The number of impressions rose 12%, significantly higher than the 4% increase in the second quarter.

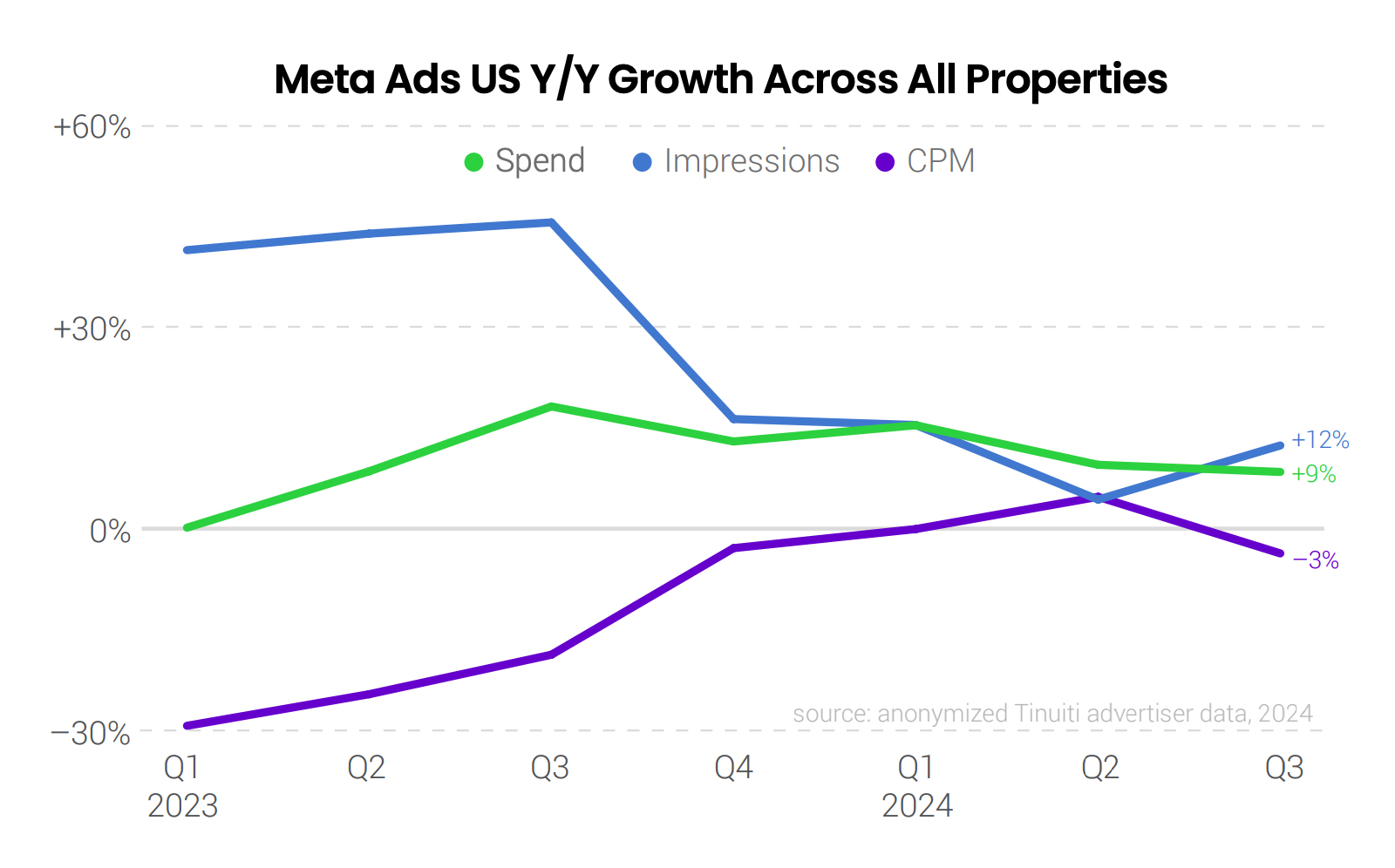

- Facebook’s CPM decreased 12% compared to the same period last year.

- The number of impressions increased by 20%, contributing to a 5% increase in total ad spending over the period.

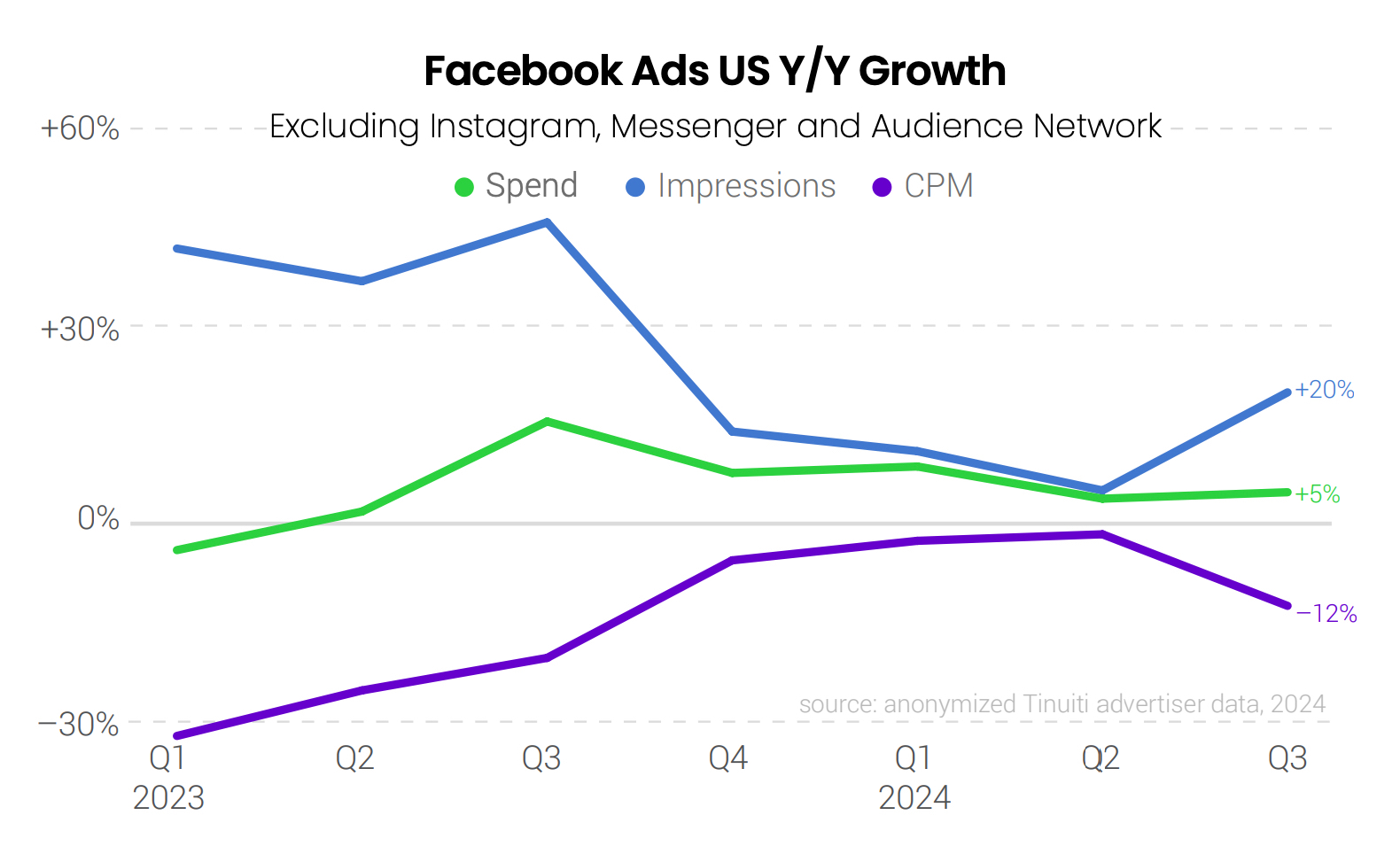

- Reels overlay ads accounted for more than 20% of all Facebook ad impressions (up from 12% in Q3 2023). Reels overlay ads, which are banners and stickers on video, accounted for 16% of all impressions.

- Ad spending on Instagram increased by 14% year-on-year, down from 24% growth in the second quarter but nearly three times the growth rate of Facebook.

- The number of impressions on Instagram decreased by 4%, while CPMs increased by 19%.

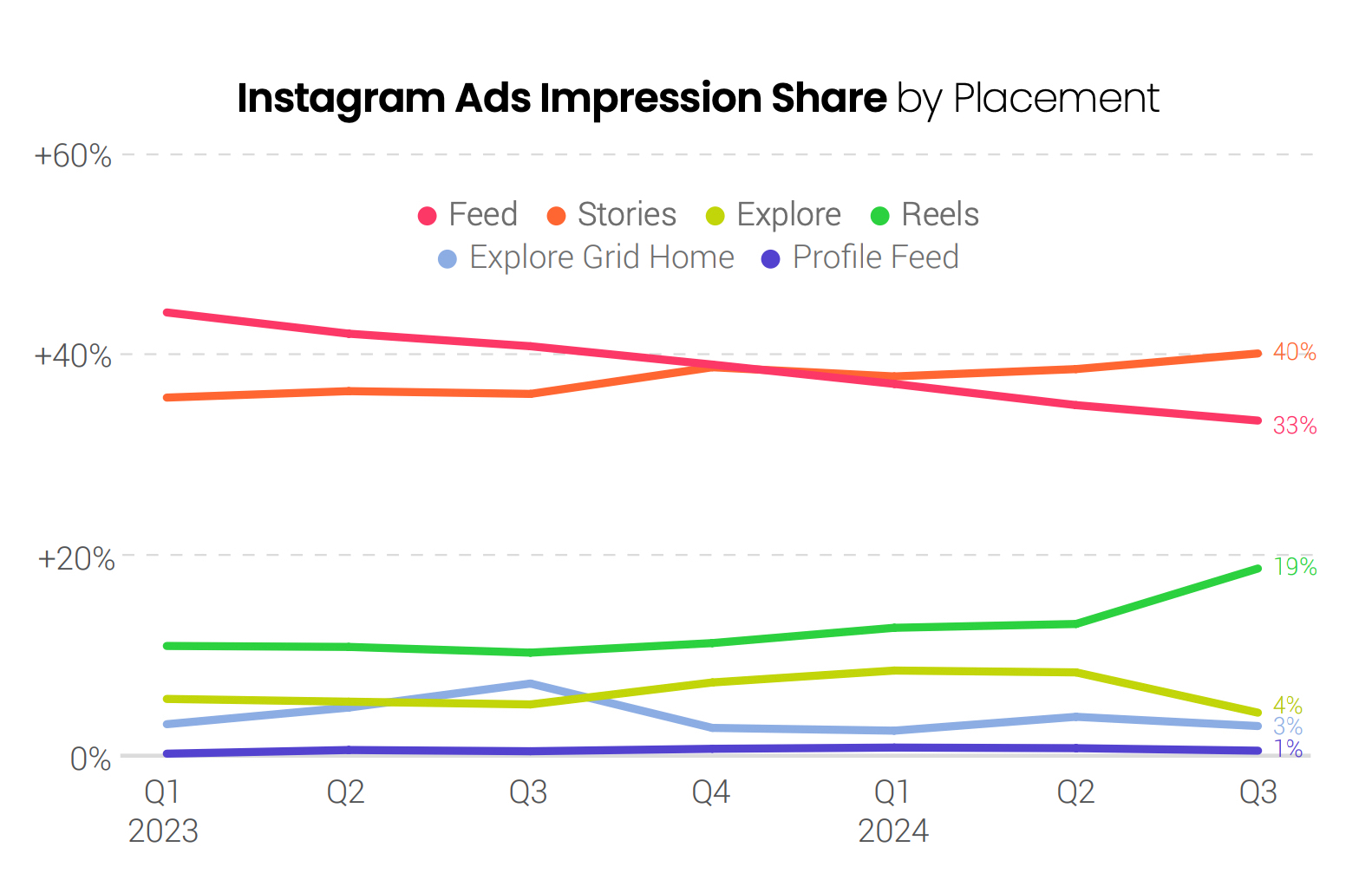

- The share of ads in Instagram Reels rose to 19% of all ad impressions on the platform, nearly double the 10% share in Q3 2023.

- Feed ads on Instagram reached the lowest level of impressions share, accounting for only one-third of all ad impressions.

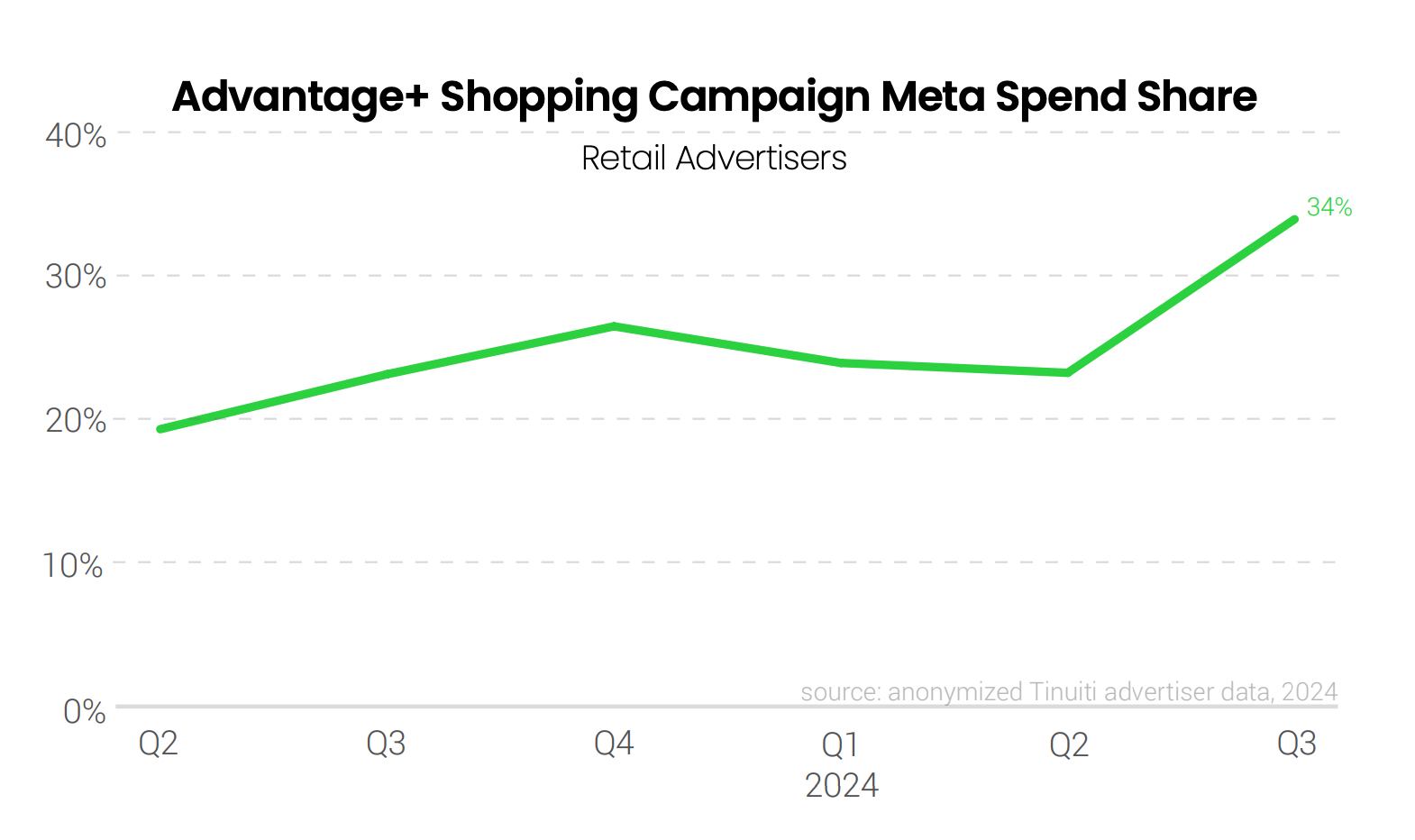

Advantage+ (AI-powered ads)

- Advantage+ campaigns (ASCs) that use artificial intelligence to optimize advertising accounted for 34% of all retail and e-commerce spending in the third quarter of 2024, up from 23% in the same period in 2023 and the second quarter of 2024.

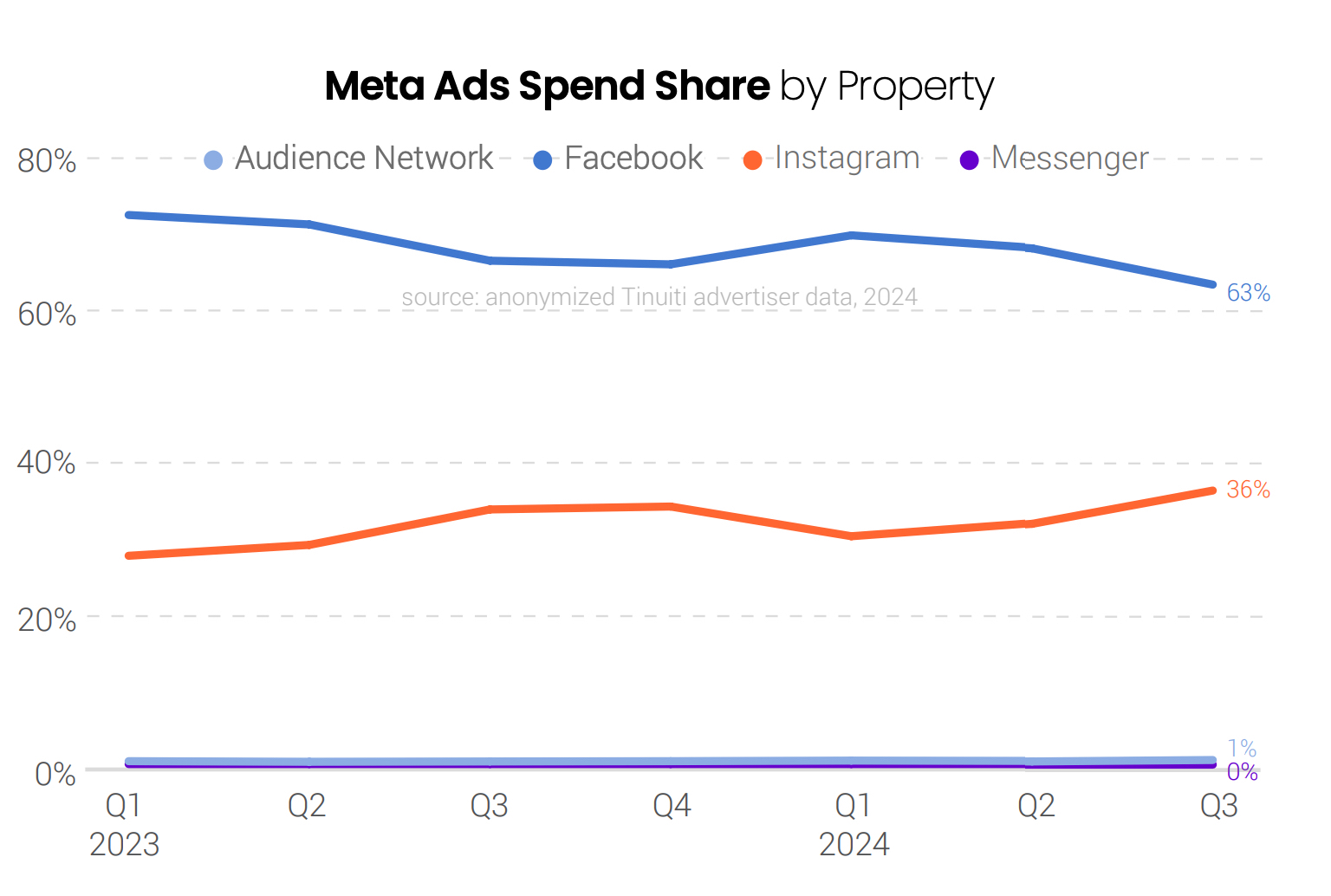

- Instagram’s share of ad spending on Meta rose to 36% in the third quarter of 2024, up from 34% a year ago.

- Facebook still accounts for 63% of all ad spending on Meta platforms, while Audience Network and Messenger remain at less than 1% of total spending.

This data demonstrates the steady growth of advertising on Meta platforms, with a focus on formats such as Reels, and the use of AI technology to improve campaign performance.

- Read more in the Tinuiti Digital Ads Benchmark report.