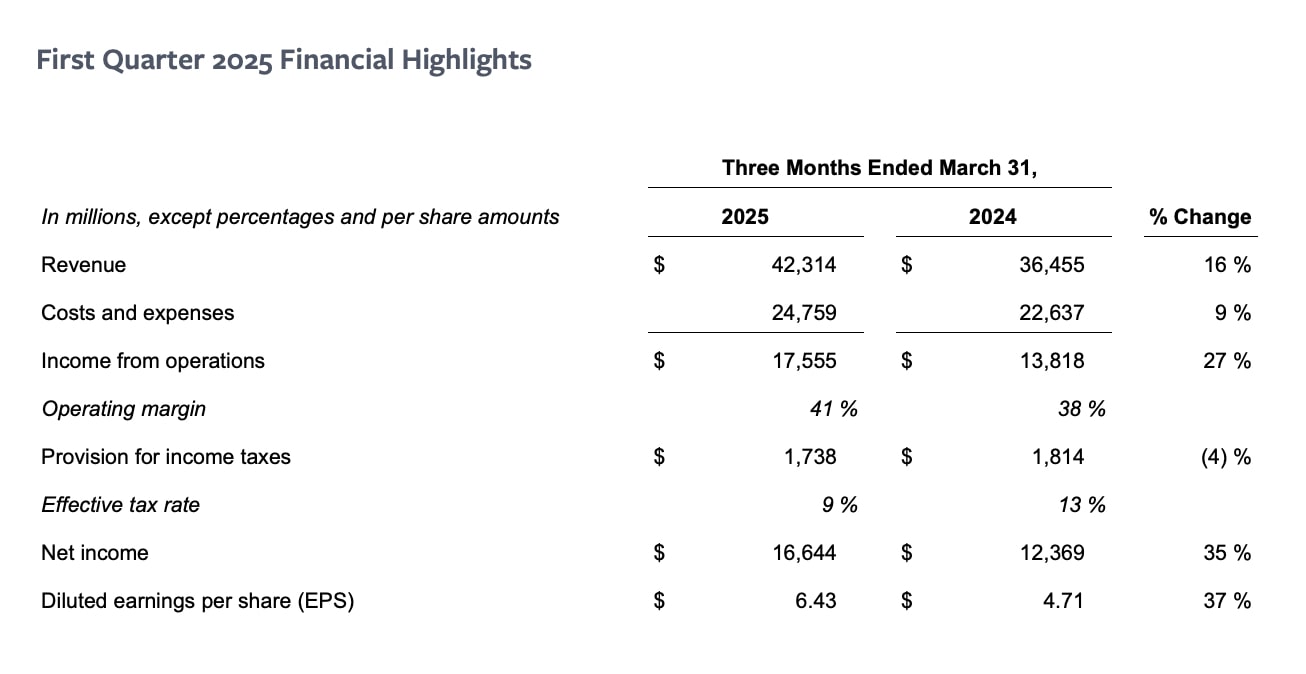

Meta Platforms, Inc. released its Q1 2025 financial report on April 30. Advertising continues to remain the company’s primary source of revenue and accounts for nearly 98% of revenue. Meta shares rose 5% after revenue and net income came in above Wall Street analysts’ expectations.

Key figures for the first quarter of 2025:

- The number of daily active people (DAP) averaged 3.43 billion in March 2025, up 6% year-over-year.

- Ad impressions. Ad impressions increased by 5% year-on-year.

- Average price per ad – The average price per ad increased by 10% compared to last year.

- Revenues increased 16% to $42.31 billion, up from $36.46 billion a year ago.

- Advertising revenues rose 16% to $41.392 billion.

- Net Income. Net income reached $16.644 billion, up 35% year-over-year.

- Costs and expenses. Total costs and expenses totaled $24.76 billion, up 9% year-over-year.

- Headcount. As of March 31, 2025, the headcount was 76,834, an 11% increase over the prior year.

Despite reduced digital ad spending in the U.S. by some large Chinese brands, overall trends in April were positive.

In a conference call with analysts, Zuckerberg said the company is in a good position to deal with ongoing economic “uncertainty”. And it plans to increase capital spending this year to $64 billion to $72 billion to build up its artificial intelligence capabilities.

“We’ve had a strong start to an important year, our community continues to grow, and our business is performing very well,” said Mark Zuckerberg. “We’re making good progress on AI Glasses and Meta AI, which now has almost 1 billion monthly actives.”

- The full report is available on Meta’s investor portal: https://investor.atmeta.com/investor-news/press-release-details/2025/Meta-Reports-First-Quarter-2025-Results/default.aspx