According to the recent study by the Bristol Hub for Gambling Harm Research (UK), gambling operators are increasingly choosing new offshore jurisdictions with more lenient regulations as an alternative to stricter oversight in established jurisdictions.

The study compiled a global map of offshore gambling regulators offering their services. Currently, more than 20 jurisdictions offer gambling licences, with several new regimes emerging in response to regulatory reforms in Curaçao, the Philippines, and the Isle of Man.

The authorities in Curaçao are introducing new rules and requirements for obtaining gambling licences: https://cpa.rip/en/gambling-betting/curacao-lok-2025/

New and popular jurisdictions issuing licences:

- Anjouan, an autonomous island in the Comoros archipelago, has become the most popular offshore regime, issuing 825 active gambling licences by May 2025. This jurisdiction offers licences with no tax on gross gambling revenue and processes applications in just two to three weeks.

- East Timor (a young state in Southeast Asia) recently passed legislation allowing the issuance of gambling licences targeted at foreign markets.

- The Commonwealth of the Northern Mariana Islands has also legalized the issuance of licences for foreign markets.

These jurisdictions attract operators with low taxes, fast licensing, and minimal oversight.

However, researchers warn that the proliferation of such ‘pseudo-regulators’ poses significant risks to player protection and also contributes to money laundering and match-fixing.

“What must increasingly be assessed is what role do the offshore gambling licensing ‘pseudo regulators’ play in the expansion of online illegal betting by providing camouflage to their actual illegality at the point of sale of bets to consumers”, said Martin Purbrick, a representative of the International Federation of Horseracing Regulatory Authorities.

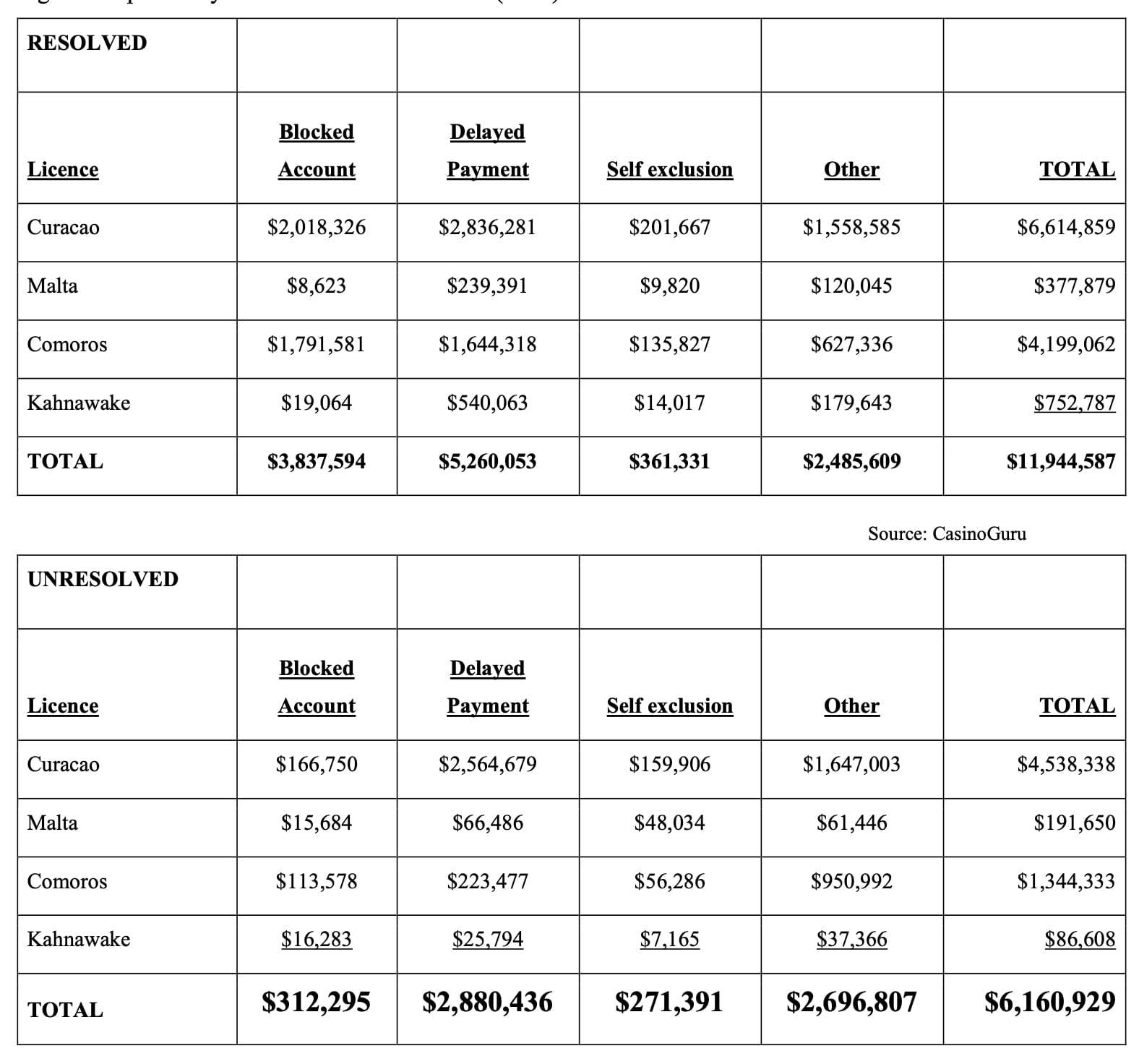

The transition to new offshore regulators also coincided with a significant increase in the number of unresolved player complaints. In 2024, the number of complaints against operators licensed in Anjouan increased by 90% (148 cases), including disputes over blocked accounts, payment delays, and self-exclusion issues.

“Playing at offshore operators is risky as there are few assurances of fair treatment. Their T&C might be structured unfavourably for the players and contain traps that will be used as a reason for confiscating money”, said Simon Winz, head of safe gambling at Casino Guru.

Unlike established regulators such as the Malta Gaming Authority, most offshore regimes do not require operators to appoint independent alternative dispute resolution providers.

The study also highlighted concerns about the transparency of beneficial ownership in many new jurisdictions.

While some territories, such as Estonia, require disclosure of ultimate beneficial owners, others, such as Anjouan, operate with minimal due diligence requirements.

The growth in offshore licensing is partly driven by cryptocurrency gambling, whose gross revenue, according to regulatory analytics platform data, increased fivefold between 2022 and 2024 to reach $81.4 billion.