The key event of Q4 2025 for Google was Amazon’s continued absence from advertising auctions, which led to a 13% increase in clicks for other advertisers – the highest figure since the beginning of 2021. Activity in text ads by clicks reached its highest level in the last five years. Total search advertising spend increased by 13%, while the cost per click (CPC) decreased. Performance Max campaigns remain in the lead, accounting for 62% of all product advertising spend. Target was the most successful in filling the void left by Amazon at the peak of the holiday sales season.

The Tinuiti Digital Ads Benchmark report served as the methodological basis for the analysis. The study is based on an array of anonymised data on the performance of advertising campaigns in the United States managed by the Tinuiti agency, with a combined annual budget exceeding $4 billion.

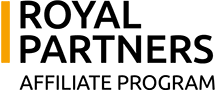

Search advertising

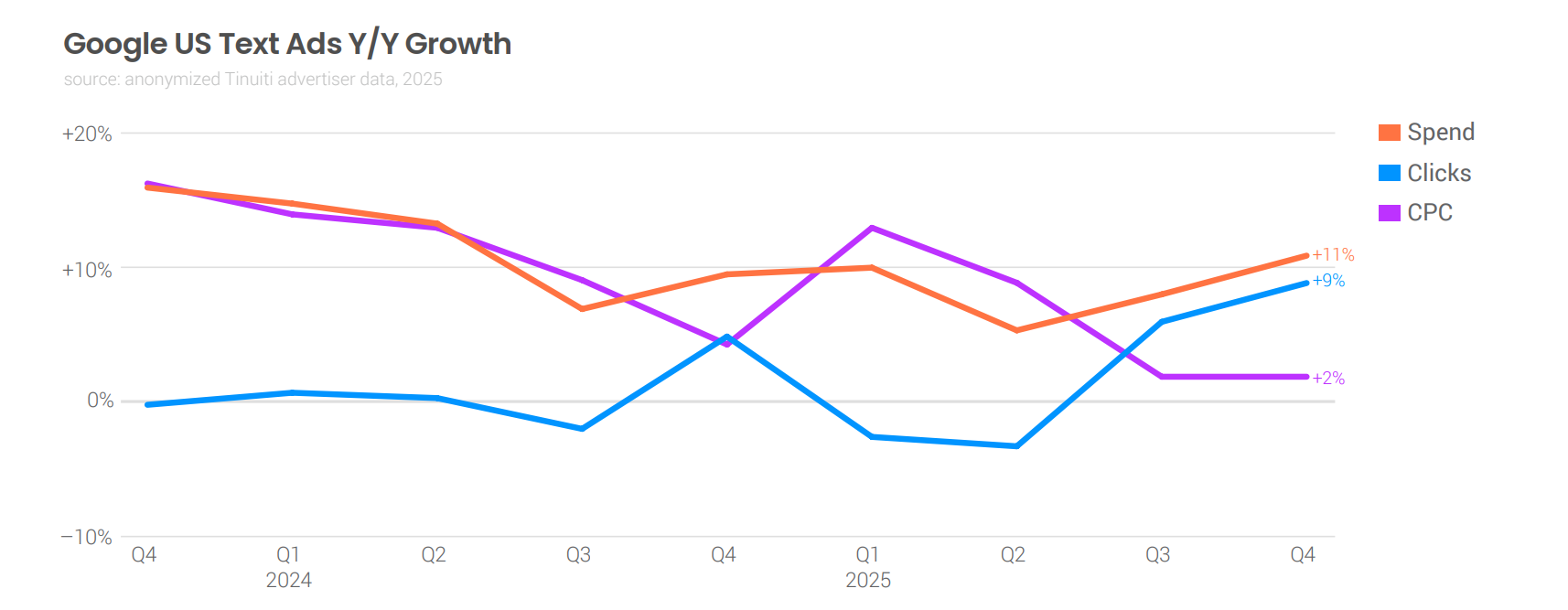

By the fourth quarter of 2025, growth in advertiser spending and the number of clicks in Google’s paid search had synchronized at +13%. At the same time, the growth in cost per click (CPC), which peaked in early 2024, slowed to approximately 0% year-on-year by the end of 2025, indicating that advertising budgets expanded mainly due to an influx of new traffic rather than an increase in the cost of clicks.

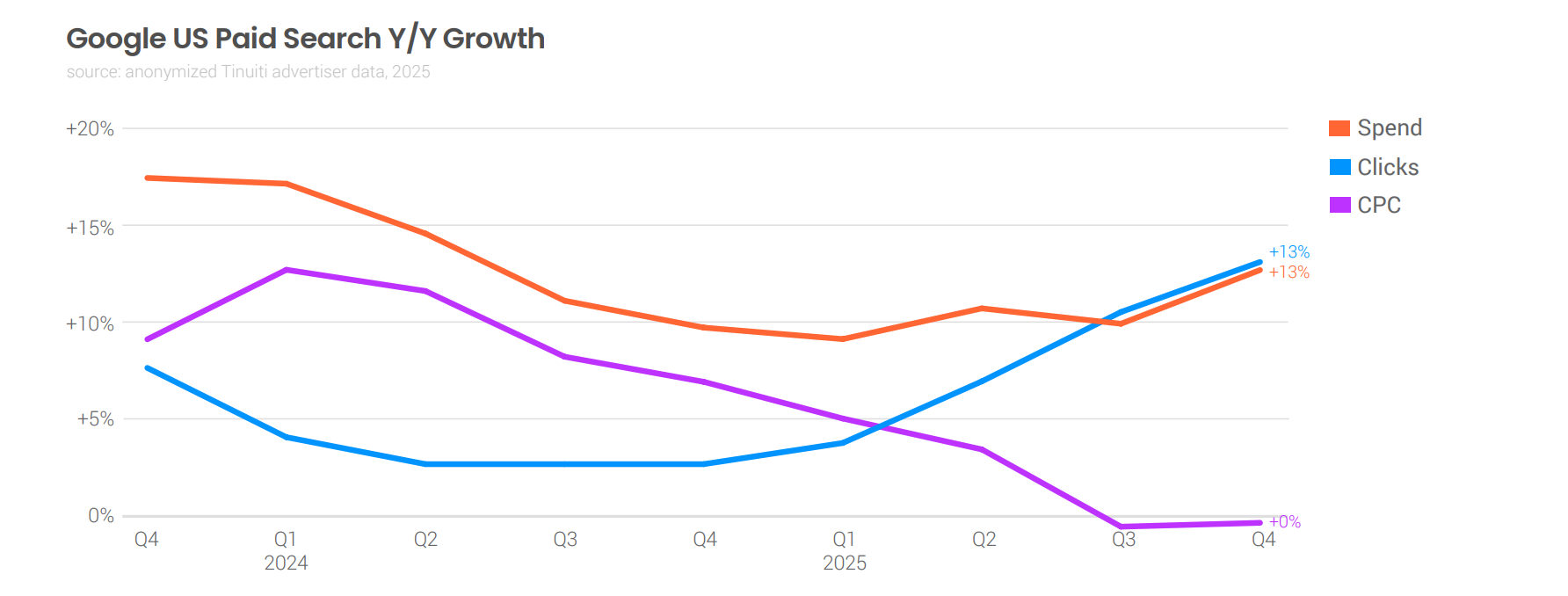

Google Shopping campaigns

By the fourth quarter of 2025, the growth in the number of clicks on Google Shopping Ads accelerated to 17%, while the increase in budgets was 16%. The cost per click (CPC) decreased by 1%, which can be explained by a combination of circumstances, the departure of Amazon, and reduced activity from Chinese giants Temu and Shein, which behaved more cautiously after returning to auctions due to customs restrictions.

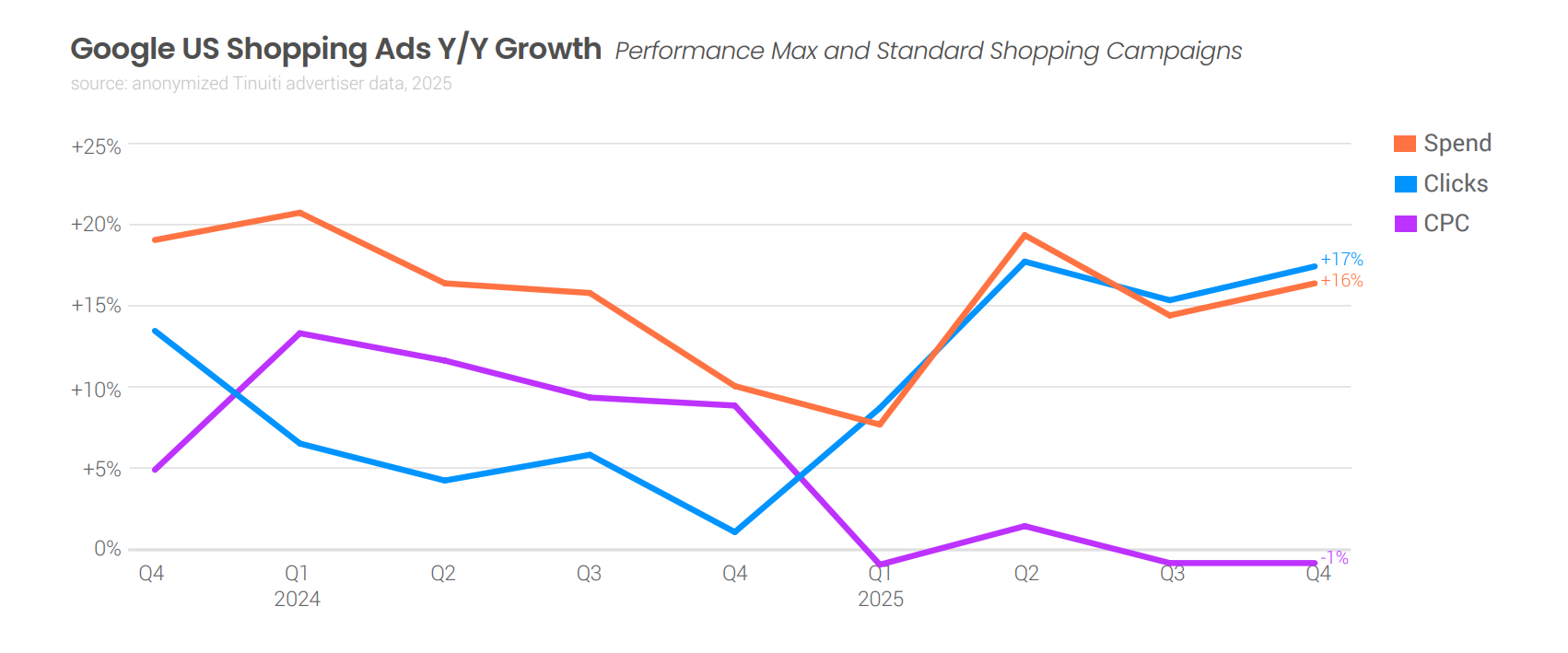

Performance Max (PMax)

Performance Max campaigns maintain their dominant position in Google product advertising, accounting for 62% of budgets in Q4 2025. Although this is below last year’s high of 69%, PMax’s share has recovered significantly after falling sharply to 53% at the beginning of the year.

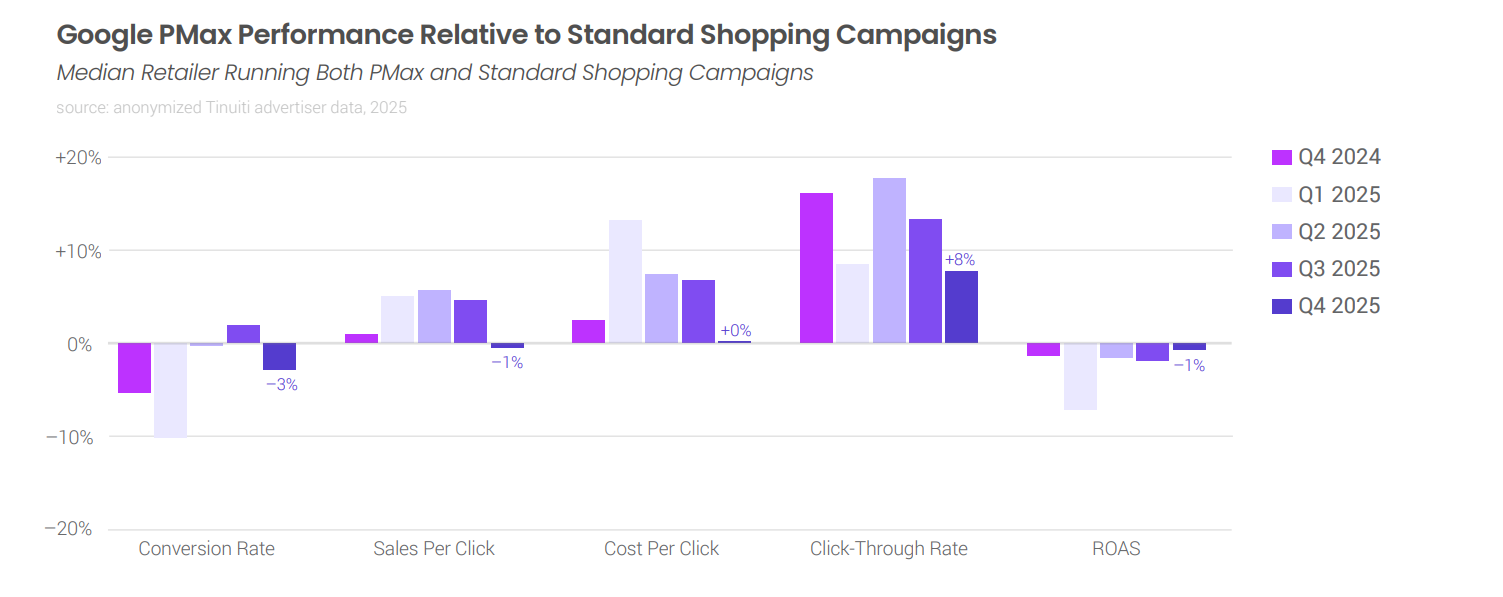

In the fourth quarter of 2025, the relative effectiveness of Performance Max (PMax) declined compared to standard shopping campaigns. The PMax conversion rate was 3% lower than the standard, losing the advantage it had in the previous quarter, and the sales-per-click metric declined by 1%. However, thanks to click price optimization, PMax’s total return on ad spend (ROAS) was only 1% lower than the standard, while the format retains a significant advantage in click-through rate (CTR) at +8%.

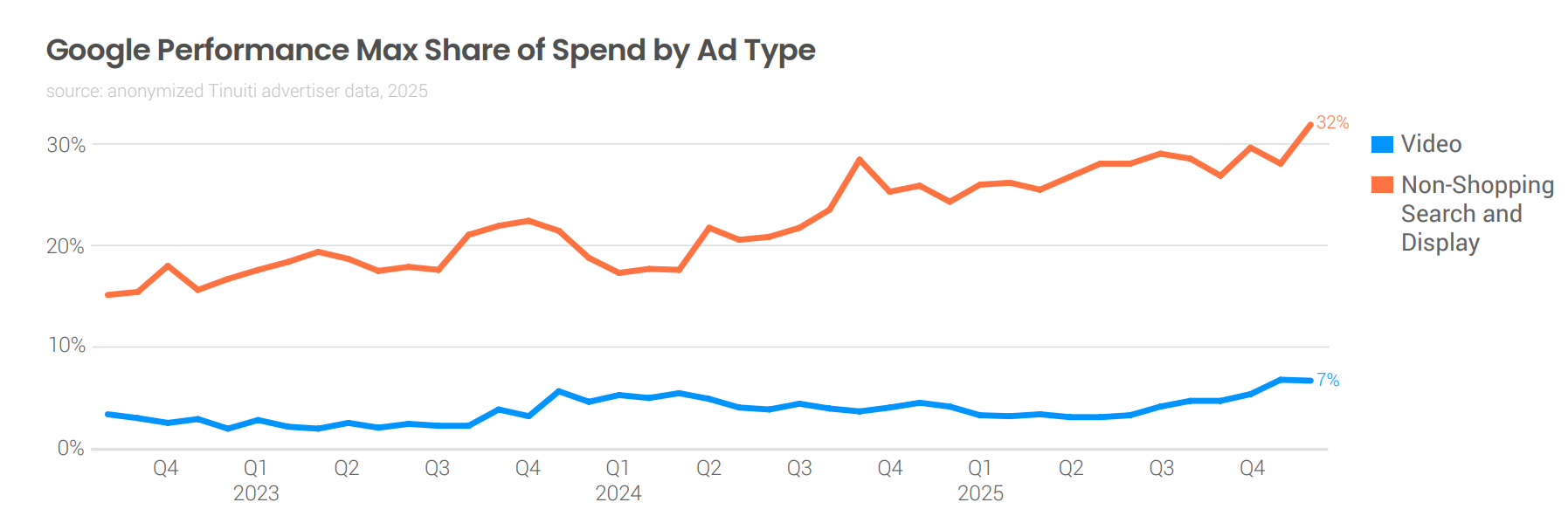

In Performance Max (PMax) campaigns, 39% of the total budget was spent on other types of advertising rather than product cards by the end of 2025.

- 32% on text ads and banners (images).

- 7% on video advertising.

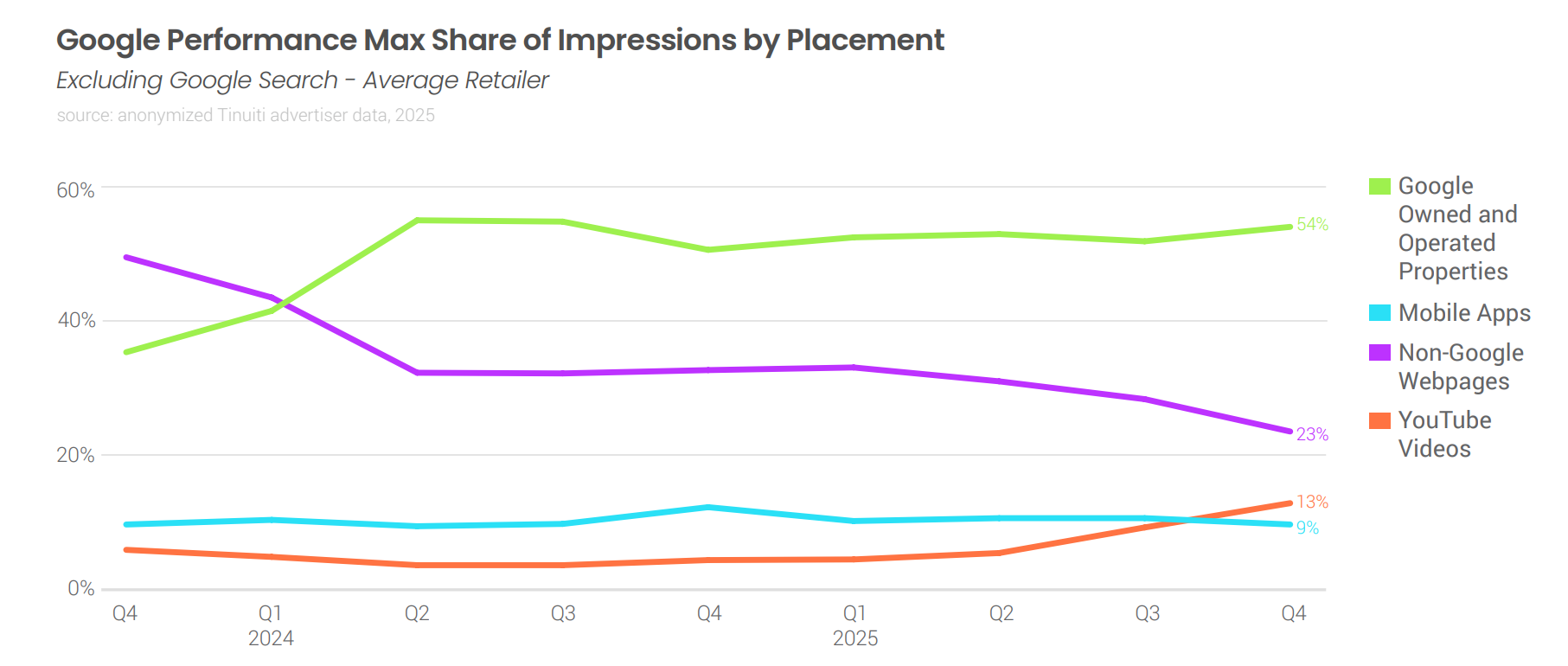

By the end of 2025, YouTube’s share grew from 4% to 13%, and Google’s own services strengthened their leadership, accounting for 54% of impressions. This growth comes amid a sharp decline in the popularity of third-party sites, whose share has fallen to 23%, while the mobile app segment remains stable at 9%.

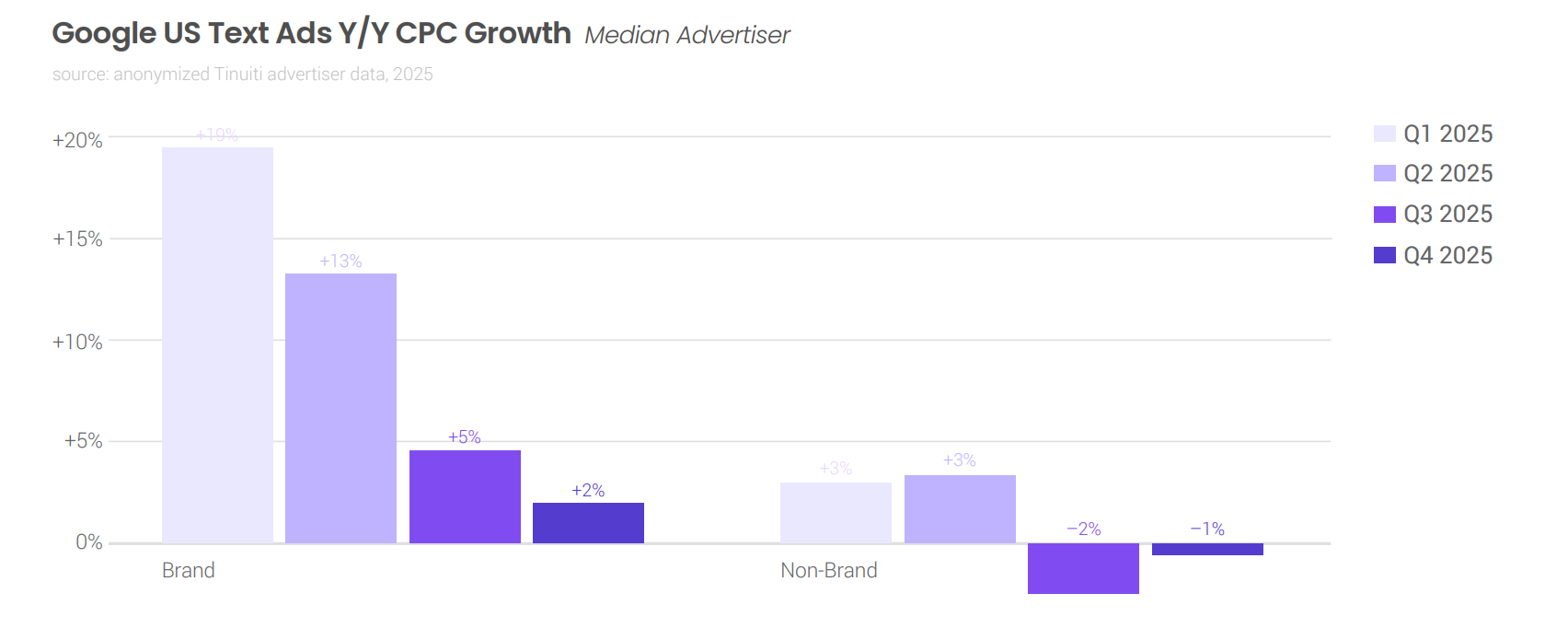

Text ads

- Google’s text ad segment in the US showed its highest click growth in 19 quarters, up 9%, and an 11% year-on-year increase in spending.

- Cost-per-click (CPC) growth slowed to 2%.

- Branded queries: A slight price increase of 2%.

- Non-branded queries: A price decrease of 1%.

Video и Display Network

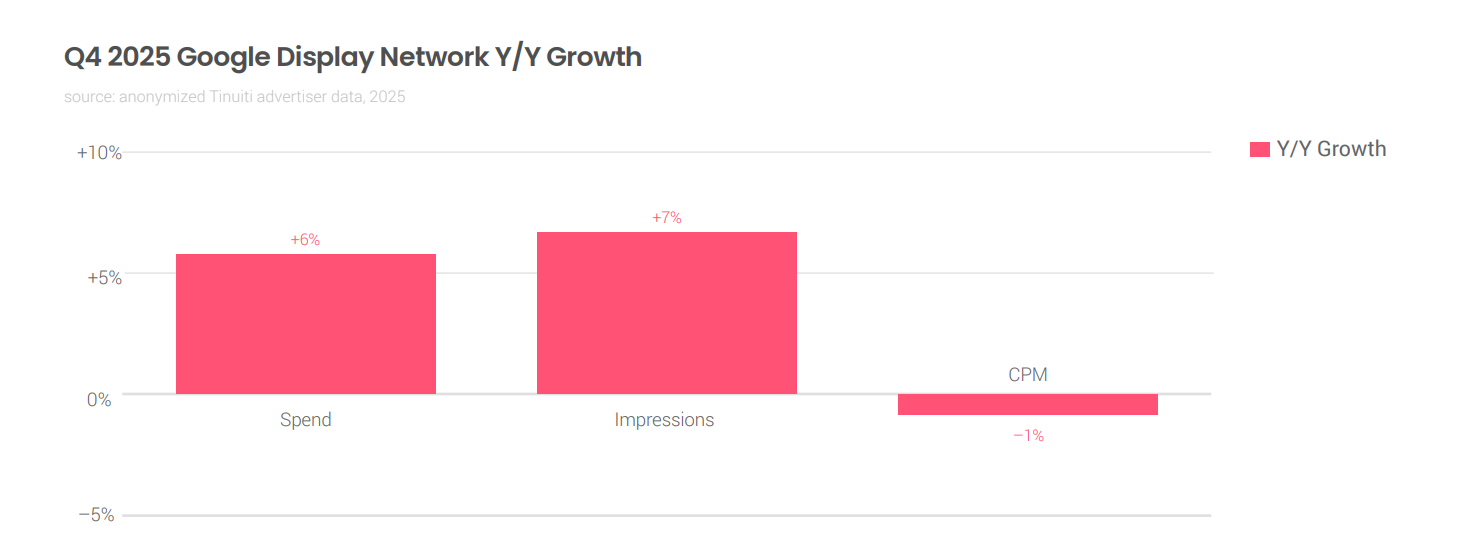

Advertiser spending on the Google Display Network (including Demand Gen campaigns and apps) grew 6% year-on-year, accelerating from 4% growth in the previous quarter. This positive trend was entirely driven by an increase in advertising inventory, with impressions rising 7%, which offset a decline in advertising costs (CPM fell 3%).

- For more details, see the Tinuiti Digital Ads Benchmark.