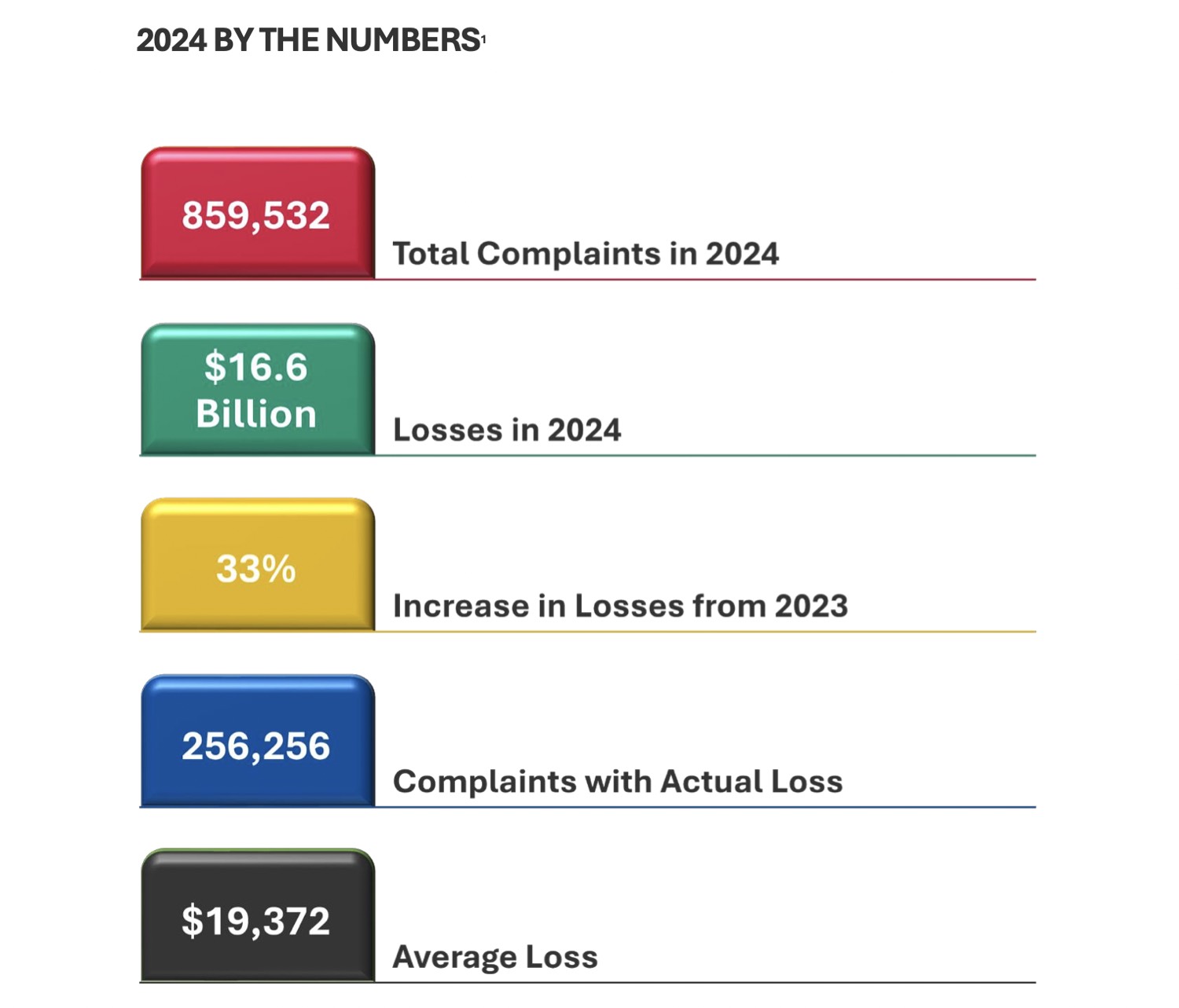

The Federal Bureau of Investigation (FBI) has released its annual 2024 Cybercrime Report, prepared by the Internet Crime Complaint Center (IC3). Below are the key numbers and facts.

Key outcomes in 2024

In 2024, IC3 received 859532 complaints and lost $16.6 billion (33% more than in 2023); the real loss was in 256256 complaints, with an average loss of $19372.

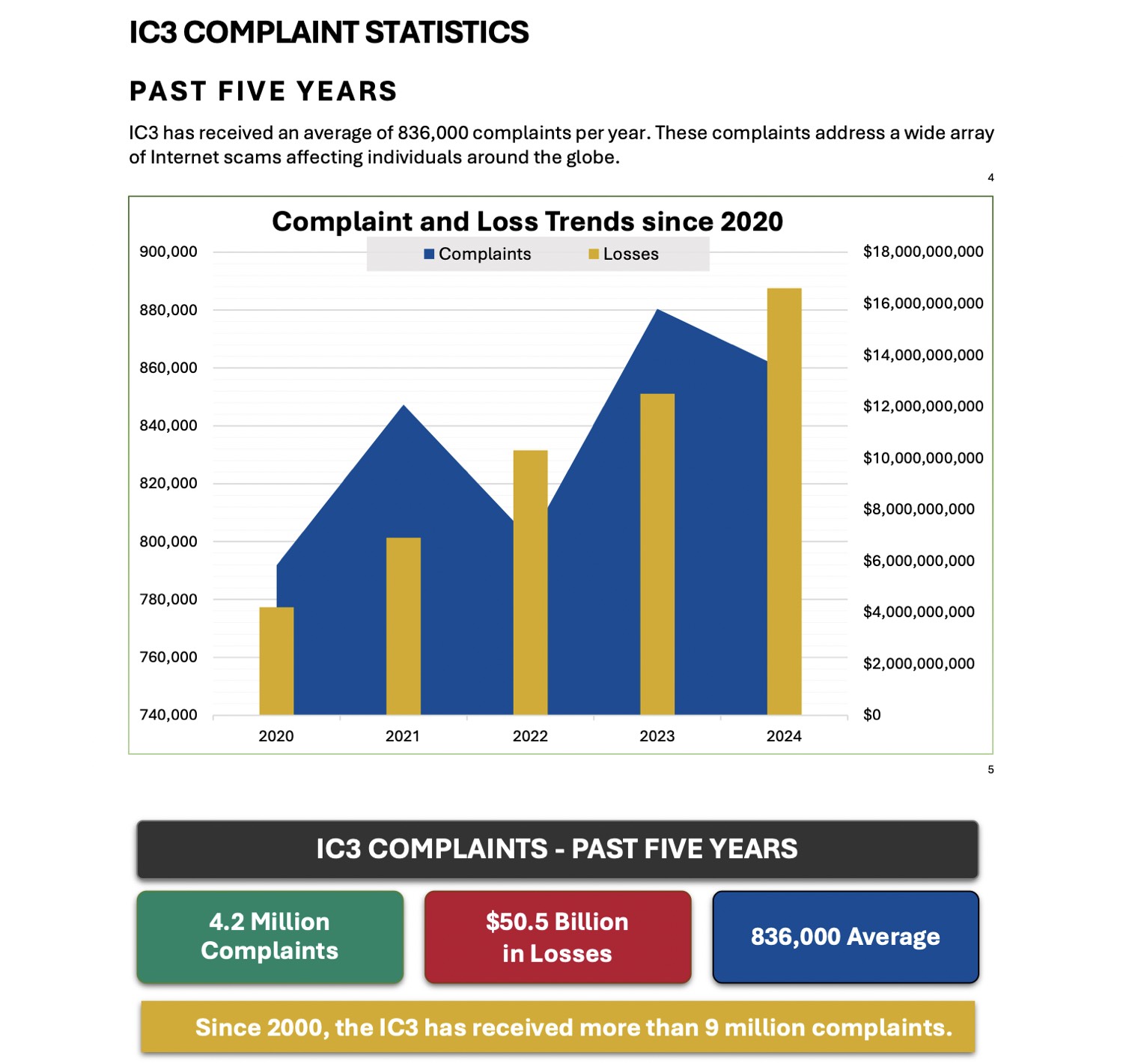

Over the past five years, IC3 has received 4.2 million complaints (average of 836k per year) and fraudsters stole $50.5 billion, with $16.6 billion in 2024 alone.

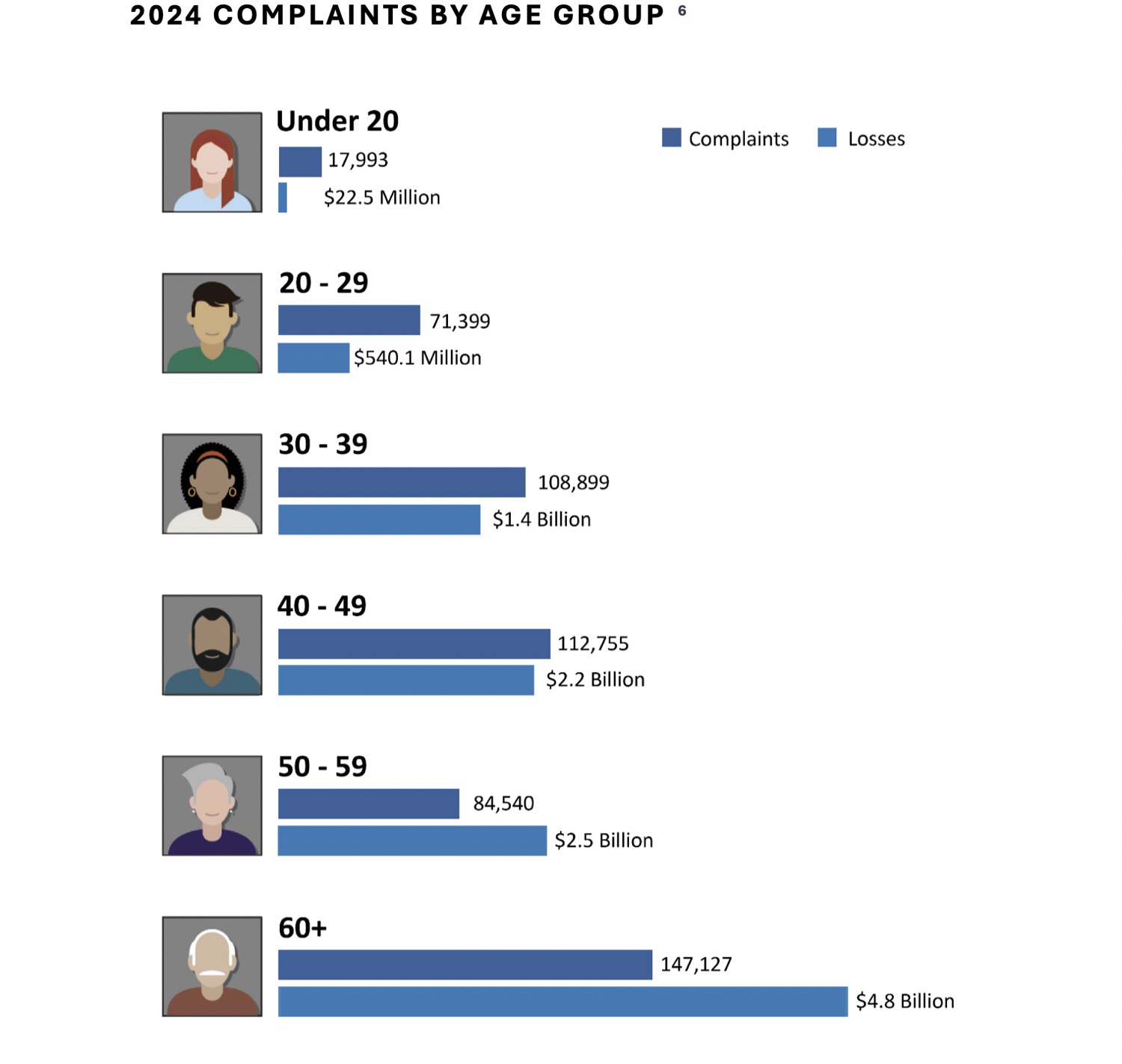

In 2024, people 60+ suffered the most: 147127 complaints and $4.8 billion in losses, followed by groups 50-59 (84.5 thousand complaints, $2.5 billion) and 40-49 (112.8 thousand; $2.2 billion), and the least complaints and losses were among young people under 20 – 18 thousand complaints and $22.5 million.

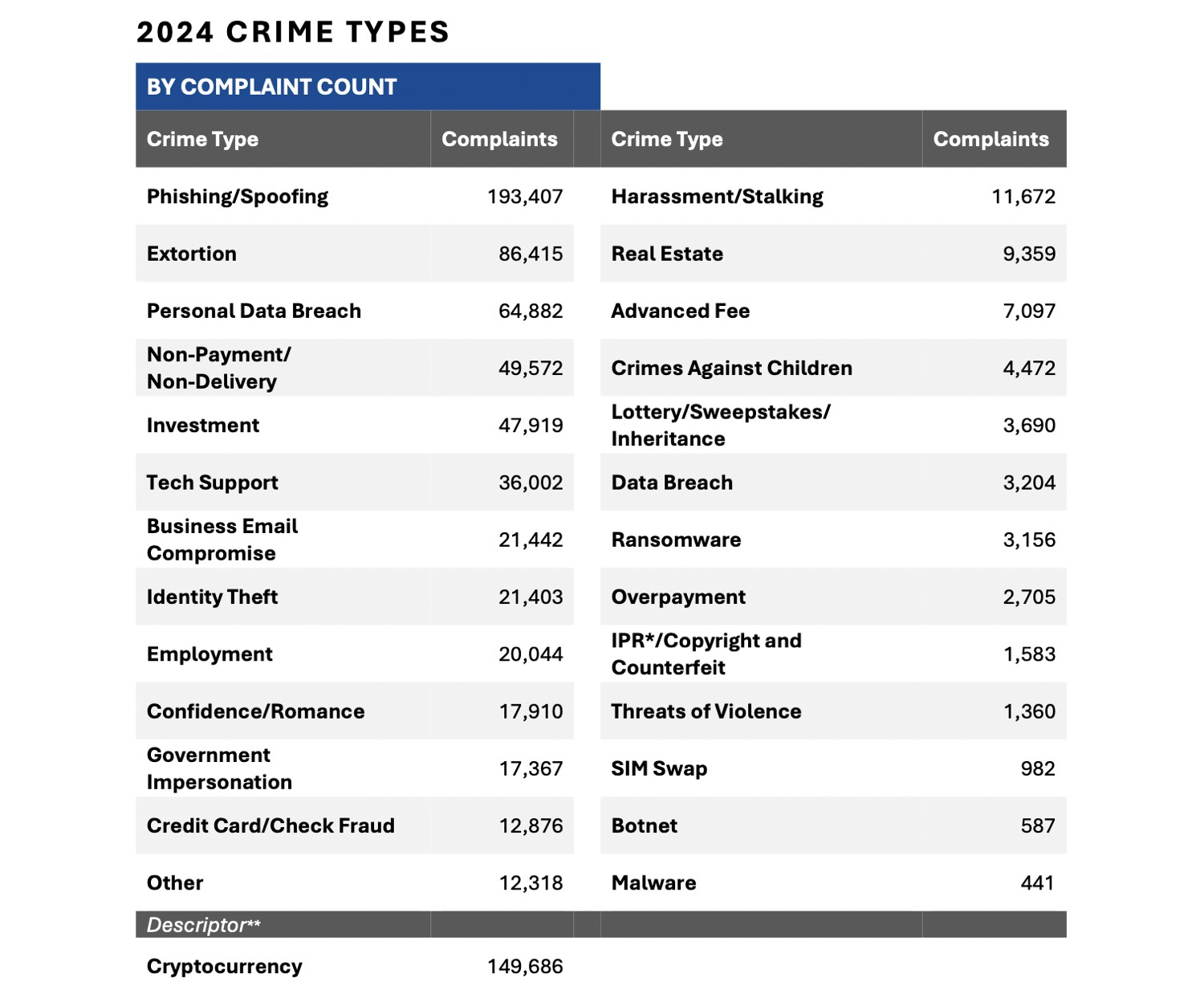

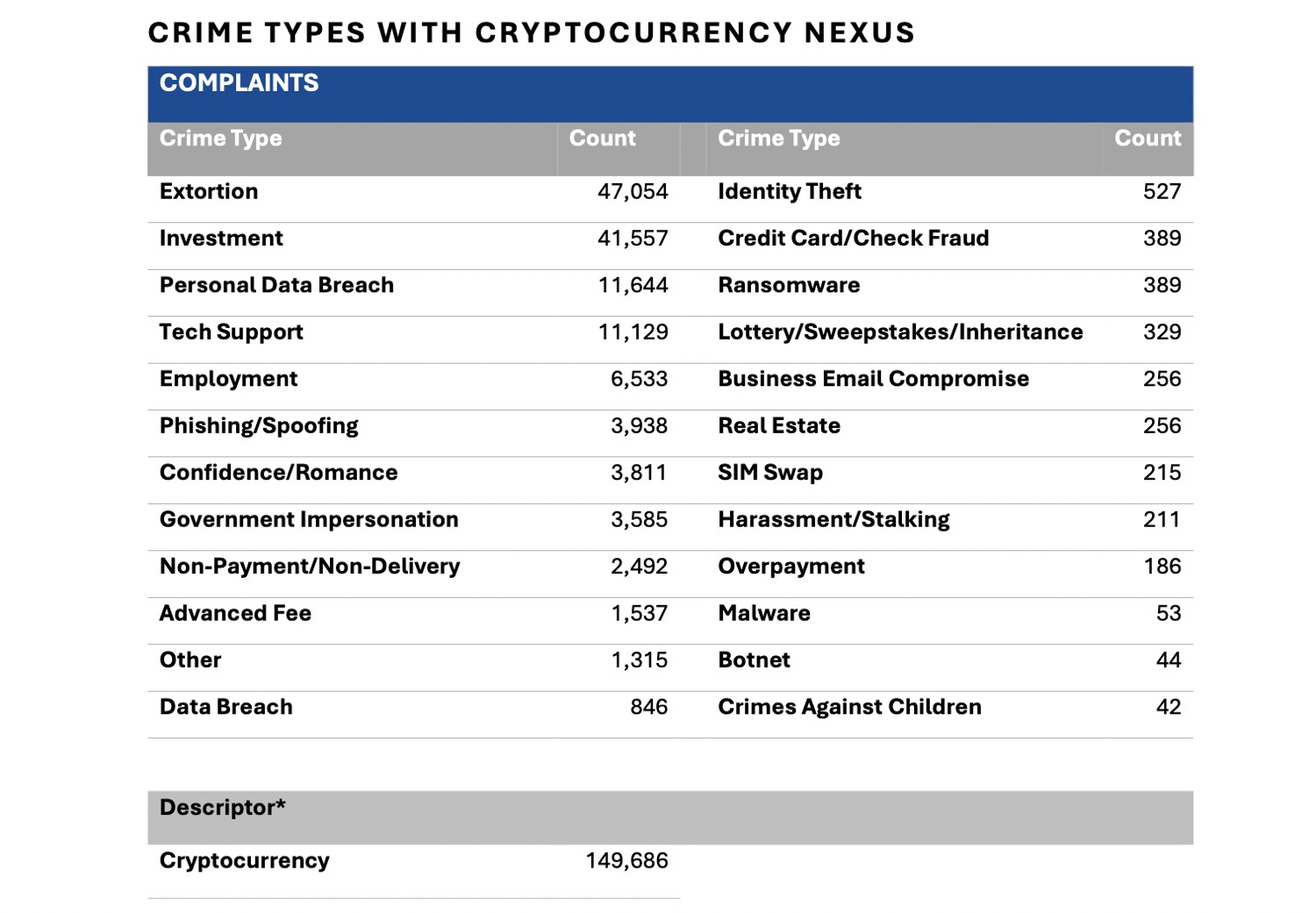

Most often people complained about phishing/forged emails (193 thousand), extortion (86 thousand), identity leaks (65 thousand), “paid – not received” schemes (50 thousand), and fake investments (48 thousand); less often people reported about phishing tech support, BEC, identity theft and so on, and cryptocurrency appeared in 150 thousand complaints as a payment method.

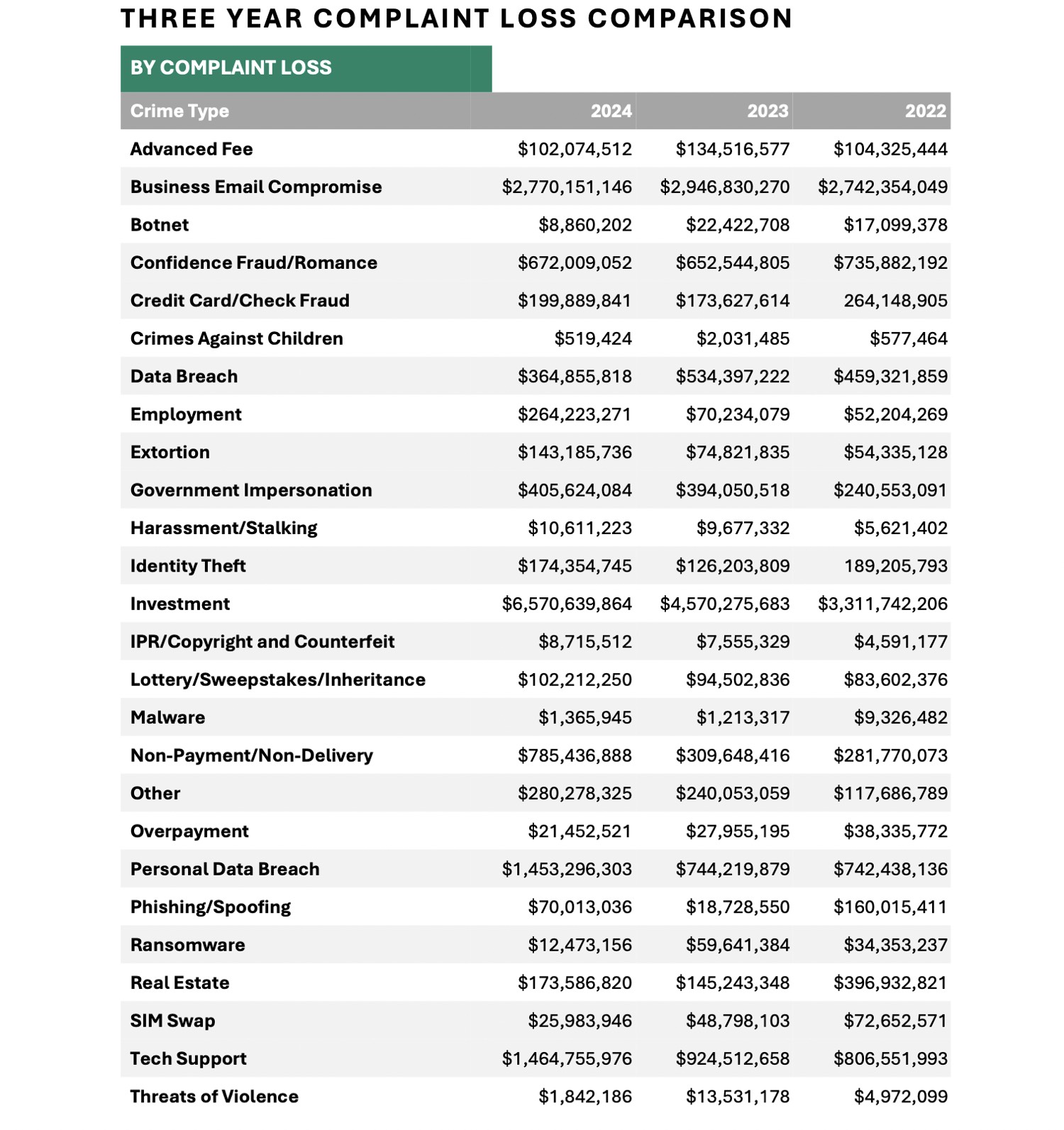

People lost the most money on fake investments – $6.6 billion, followed by fraudulent business emails (BEC) – $2.8 billion, “tech support” and personal data leaks – ~$1.45 billion each; in total, $9.3 billion was lost through cryptocurrency schemes.

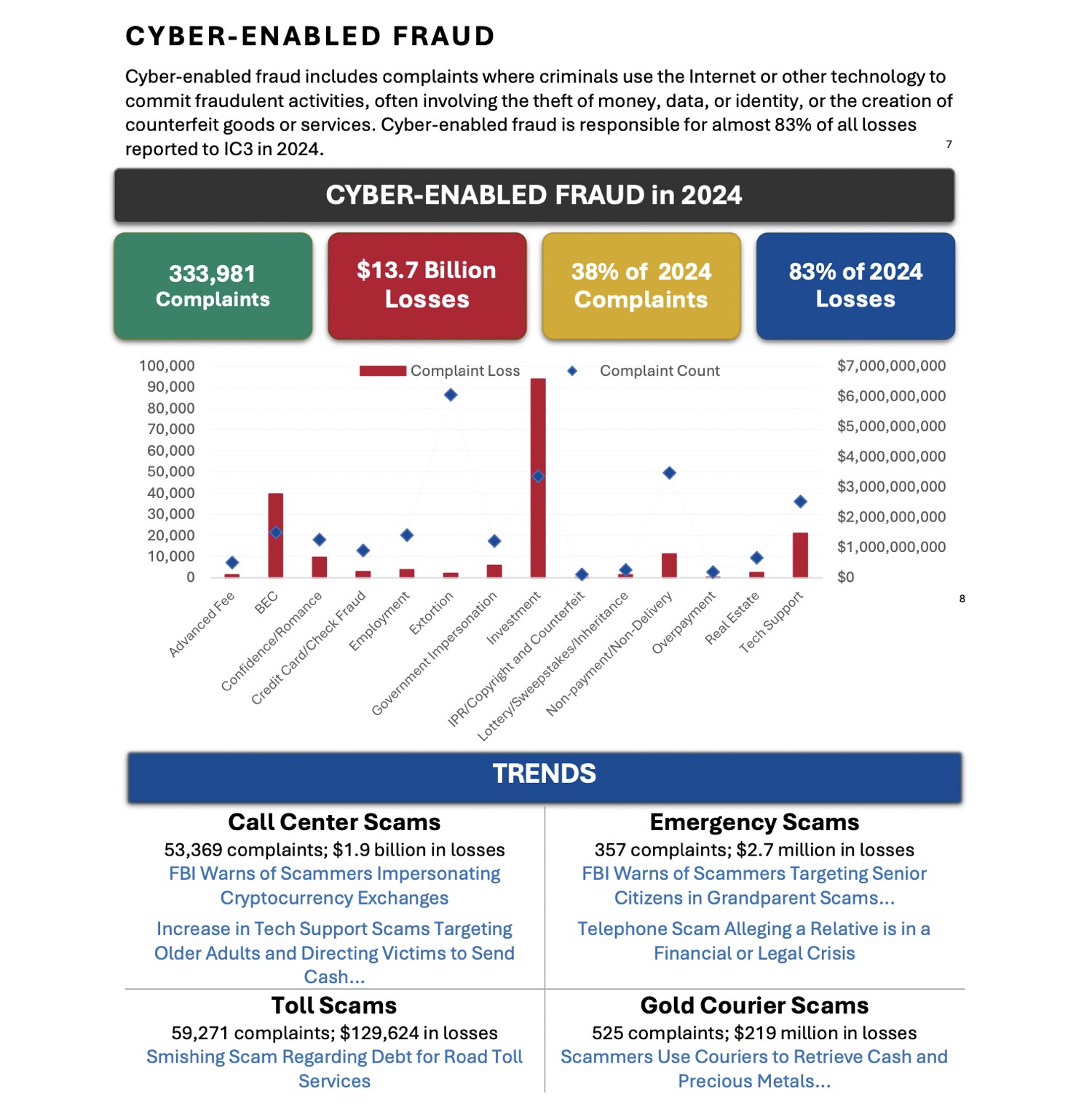

Internet fraud with direct theft of money or data in 2024 – 334k complaints and $13.7 billion in losses (38% of all complaints, but 83% of all losses). The top schemes are call centers, “urgent care” to relatives, fake traffic fines, and couriers who take cash or gold.

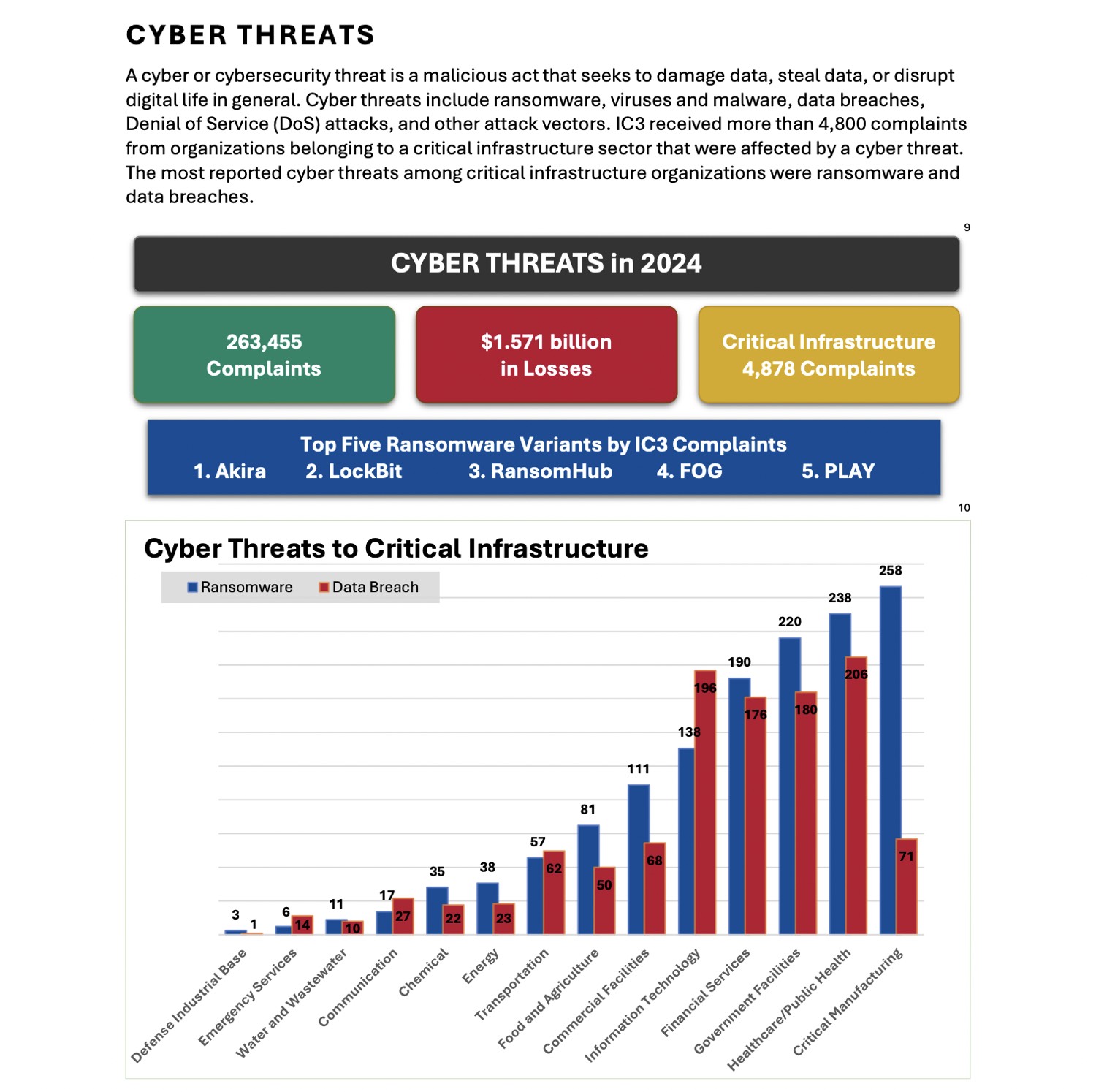

In 2024, IC3 received 263455 complaints about cyber attacks with a total loss of $1.57 billion (4878 of them from critical infrastructure), and the main trouble was ransomware – especially Akira, LockBit, RansomHub, FOG and PLAY – plus major data breaches.

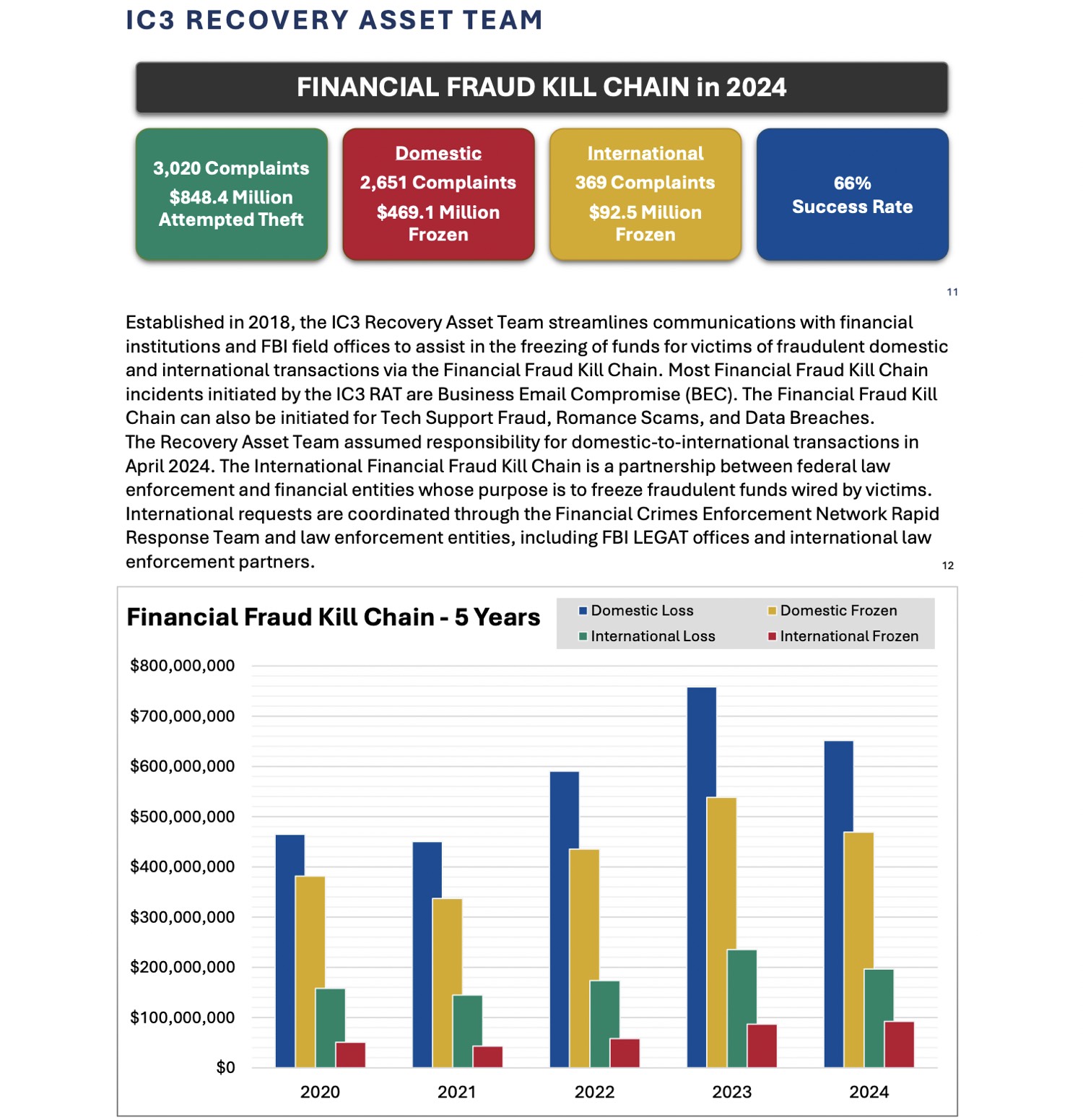

In 2024, IC3 in frames of the Financial Fraud Kill Chain scheme worked out 3,020 complaints for $848 million and managed to “freeze” 66% of the money – $469 million inside the U.S. (2,651 cases) and $92.5 million in overseas transfers (369 cases).

Special operations and work with foreign partners

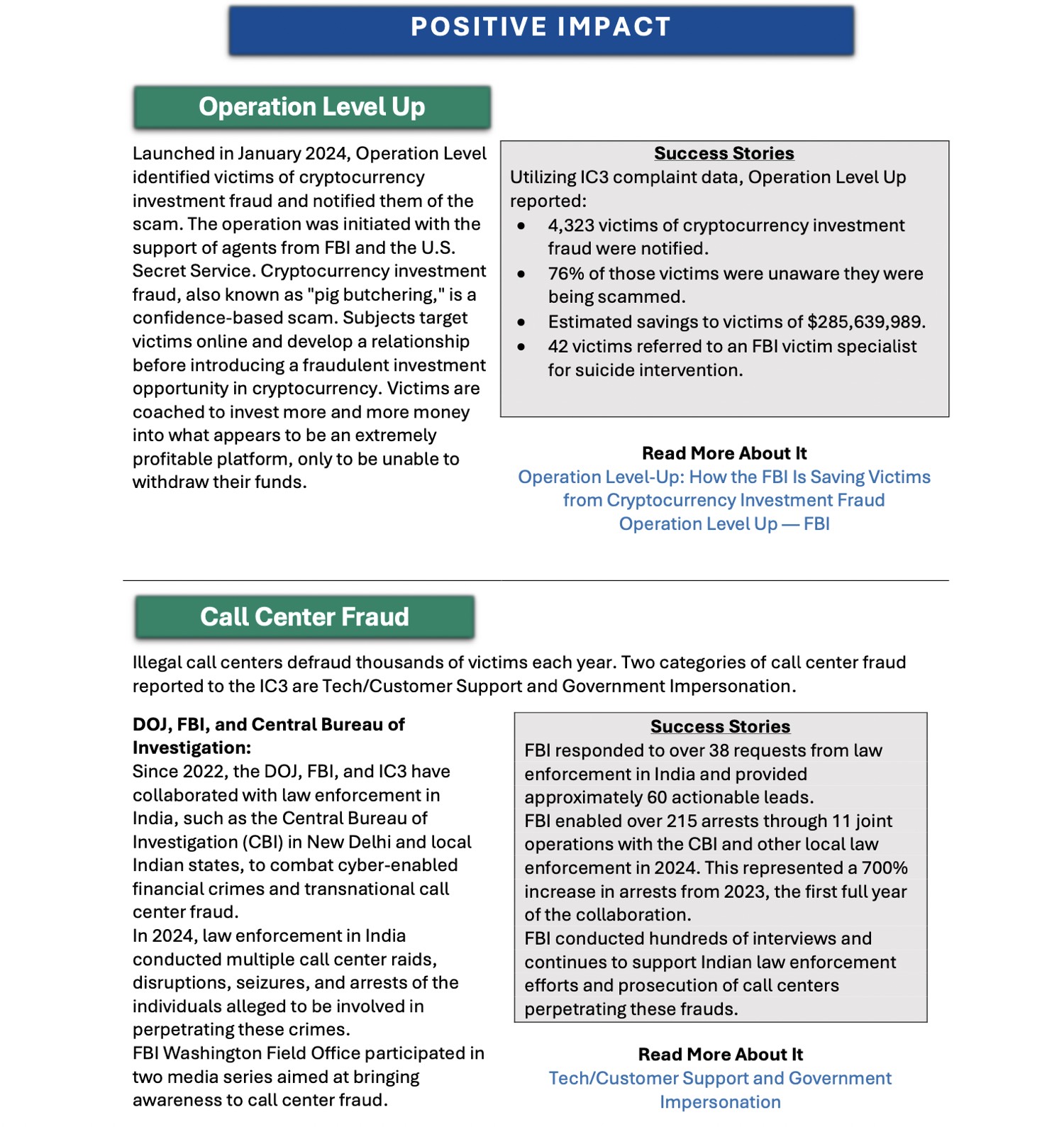

- Operation Level Up – in January 2024 the FBI and Secret Service found 4323 victims of crypto-invest scams, warned them (76% didn’t even know they were being scammed), and thus saved people ~$286 million; 42 victims were referred to psychologists.

- Call-center fraud – the FBI along with Indian police conducted 11 joint raids in 2024, provided ~60 useful leads, and made 215 arrests (seven times more than the year before).

Ransomware:

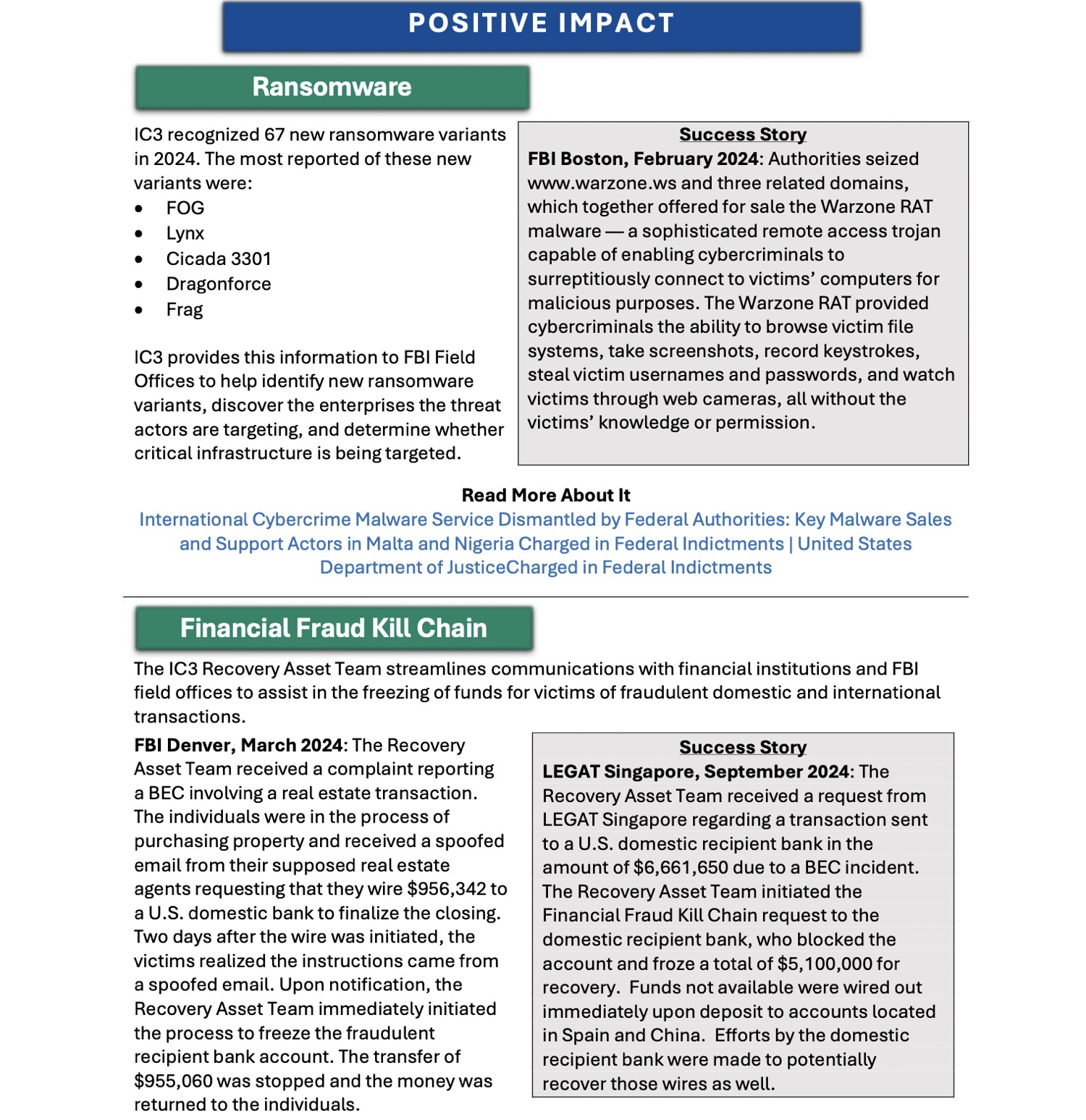

- In 2024, IC3 spotted 67 new ransomware (FOG, Lynx, Cicada 3301, Dragonforce, Frag, etc.) and leaked info so the FBI could quicker find who and where being hit.

- Example: in February, the Boston FBI shut down warzone.ws, a site that sold the Warzone RAT virus.

Financial Fraud Kill Chain:

- IC3 team helps banks stop stolen transfers.

- Denver: The family almost lost $956k on fake “realtor mail,” IC3 froze and refunded the money.

- Singapore: stopped $5.1m of the $6.66m that went into a US account after a complaint from a legatee; the bank is now looking for the balance, which had already gone to Spain and China.

International geography of complaints and transfers

The most foreign complaints came from Britons (102 thousand), and stolen transfers in 2024 most often went to Hong Kong, Vietnam, and Mexico.

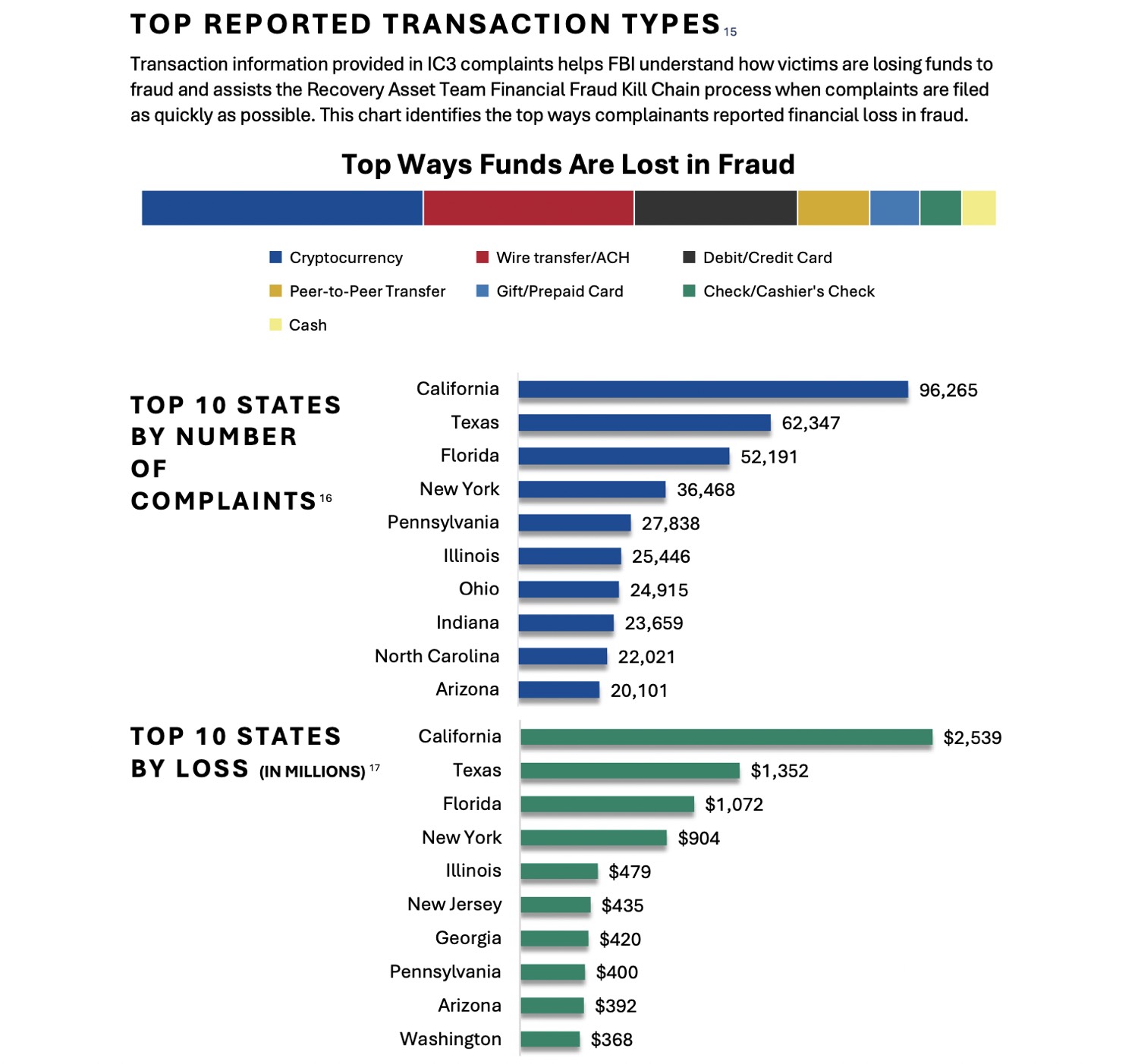

Money is stolen mostly like this:

- cryptocurrency,

- wire transfer,

- debit/credit card,

- p2p services,

- gift cards,

- checks,

- cash.

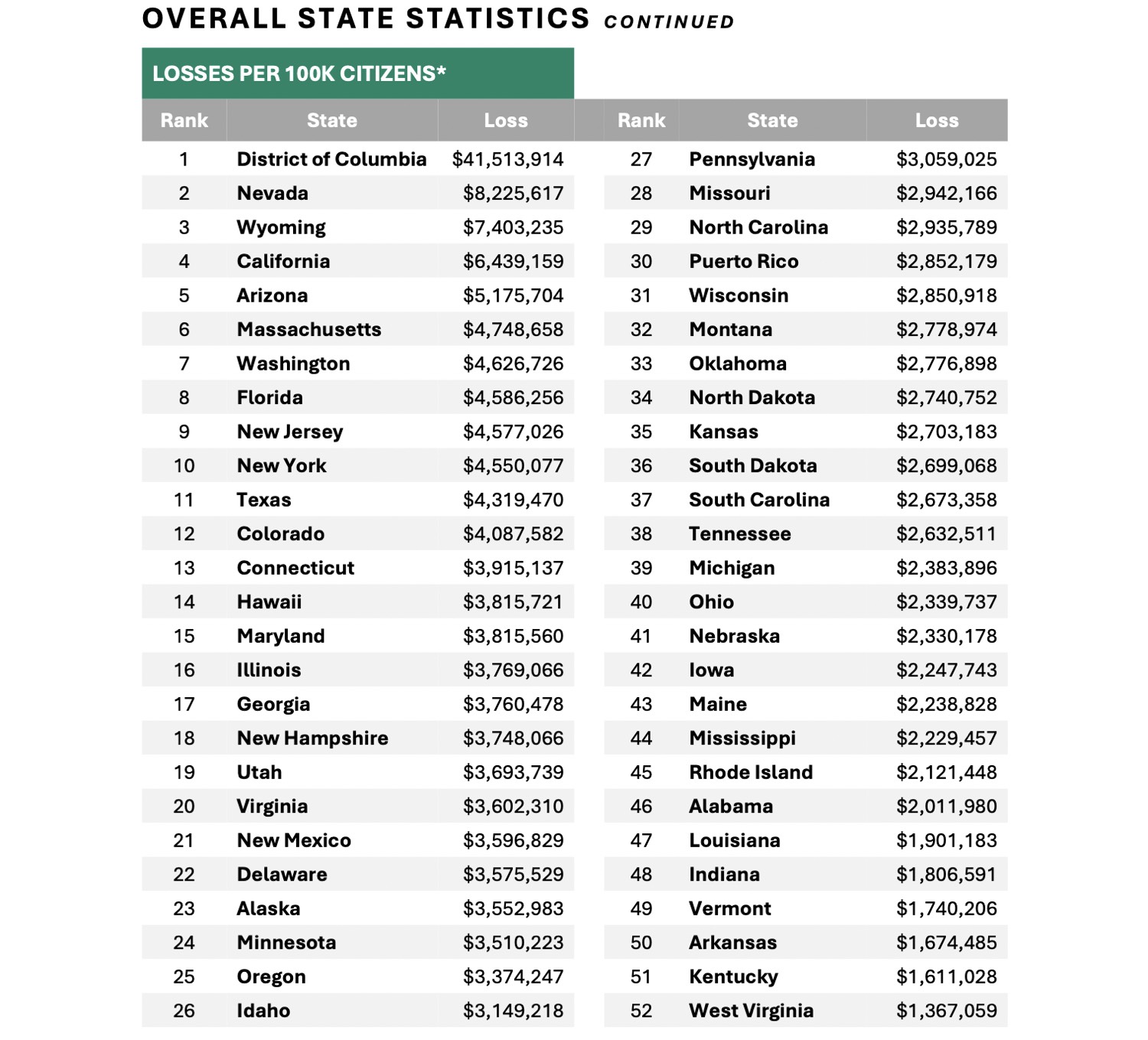

Complaints and losses by U.S. state

Where the most complaints are:

- California 96265,

- Texas 62347,

- Florida 52191,

- New York 36468,

- Pennsylvania 27838,

- Illinois 25446,

- Ohio 24915,

- Indiana 23659,

- North Carolina 22021,

- Arizona 20101.

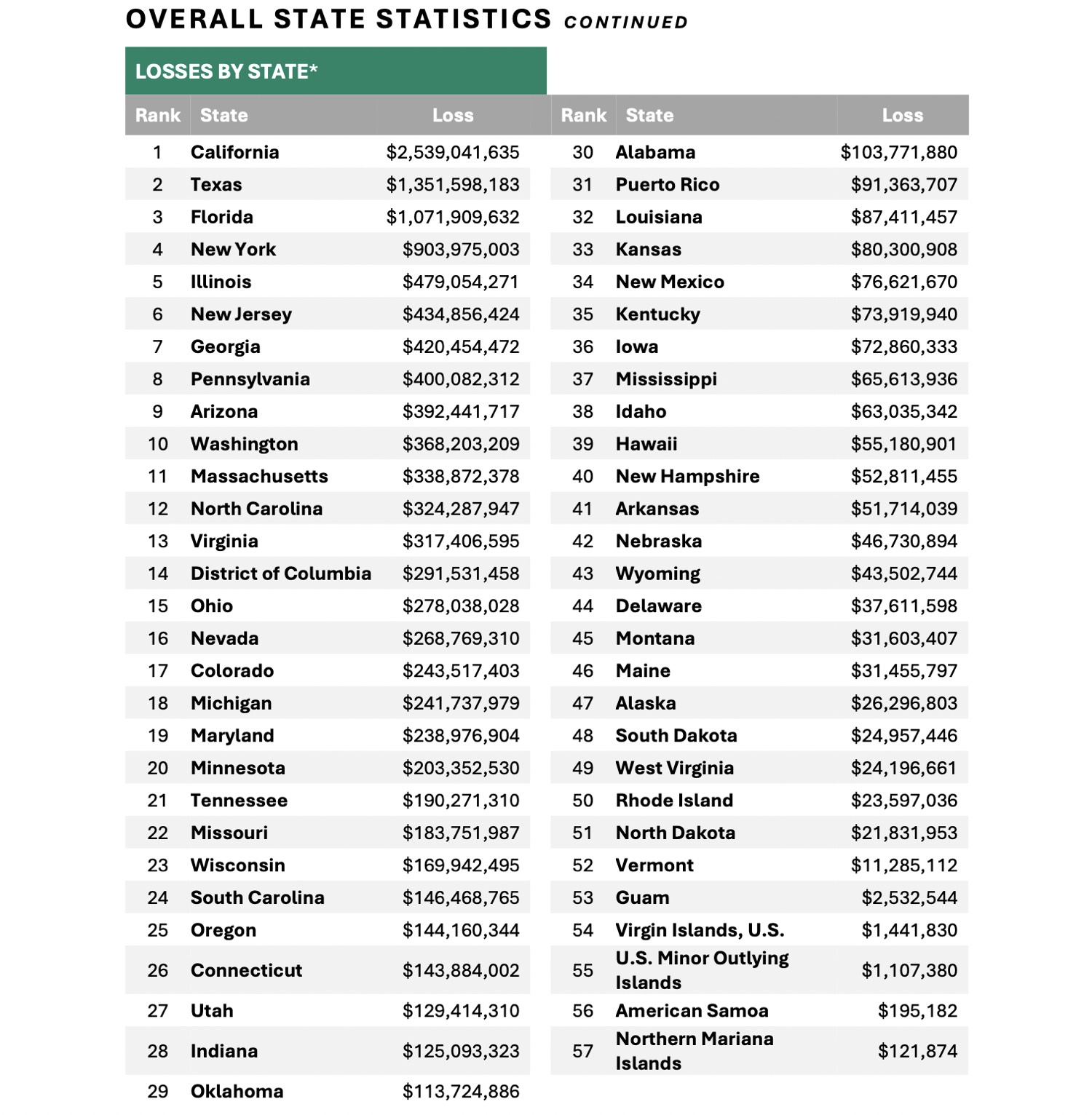

Where the most money was stolen (million $):

- California 2539,

- Texas 1352,

- Florida 1072,

- New York 904,

- Illinois 479,

- New Jersey 435,

- Georgia 420,

- Pennsylvania 400,

- Arizona 392,

- Washington 368.

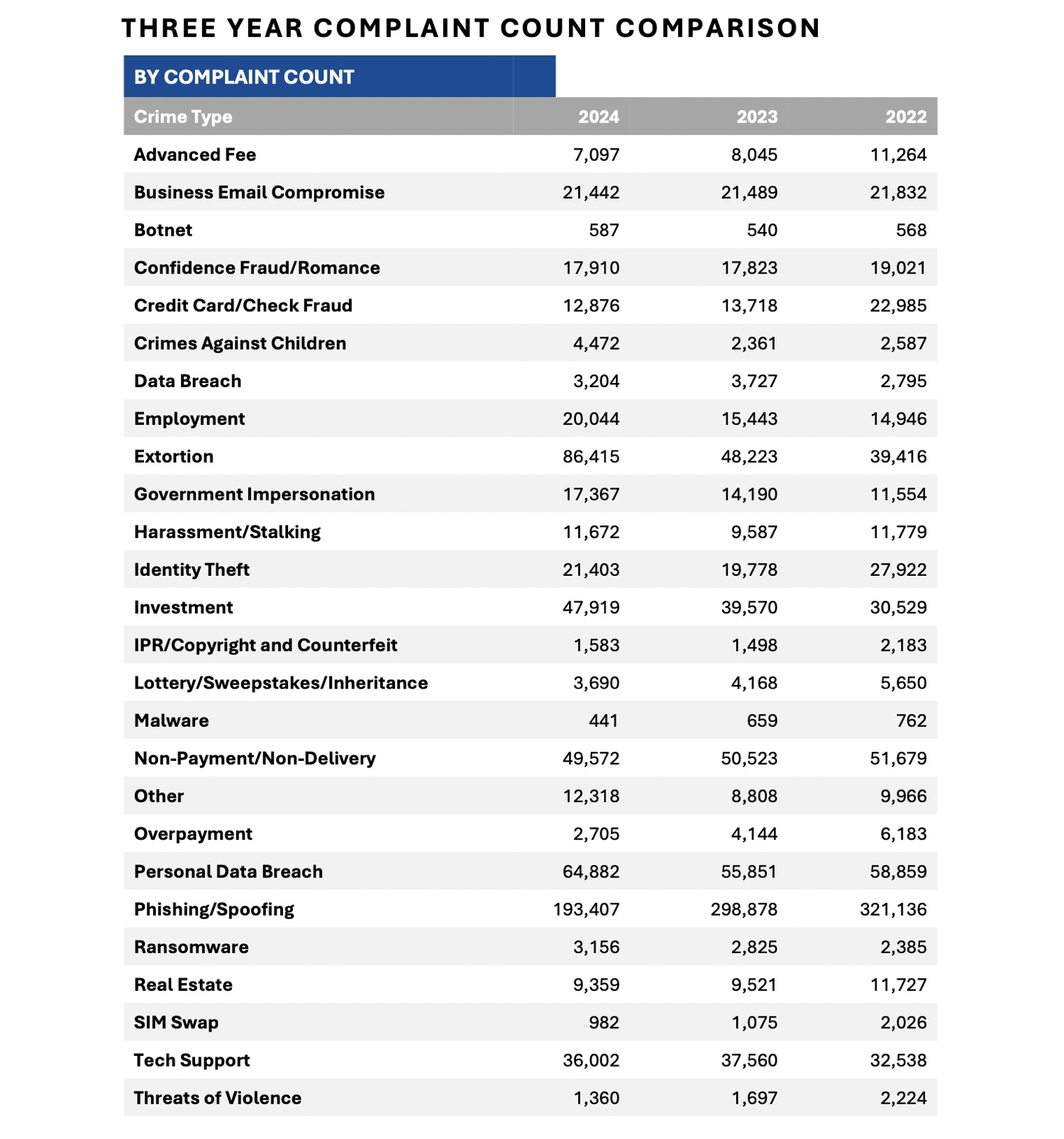

Dynamics of popular fraud schemes (2022-2024)

Number of complaints for 2022-2024, by type of cyber fraud.

Main:

- Strong increase – extortion 86k vs. 39k in 2022; investment scams 48k vs. 31k; job scams 20k vs. 15k; identity leaks 65k vs. 59k.

- Falling – phishing/spoofing from 321k to 193k; credit card/check fraud 23k vs. 13k vs. 13k; SIM-swap 2k vs. 1k.

- Steadily high – BEC ~21k, “didn’t pay/didn’t receive” ~50k, tech support-fraud ~35k.

That is, in three years, the number of complaints has shifted from mass phishing to more costly schemes: extortion, investment, and fake job offers.

From 2022 to 2024, the money has mostly gone to investment scams (up to 6.6 billion), fake tech support (1.5 billion), and identity leaks (1.45 billion), BEC is holding steady at ~2.8 billion, and phishing is down significantly.

Top 3 states for number of complaints – California 96k, Texas 62k, Florida 52k, and the quietest – Guam 96k and Northern Mariana Islands – 21k.

The top 3 states for money lost are California $2.54 billion, Texas $1.35 billion, Florida $1.07 billion, with Guam $2.5 million and Northern Mariana Islands $0.12 million at the end of the list.

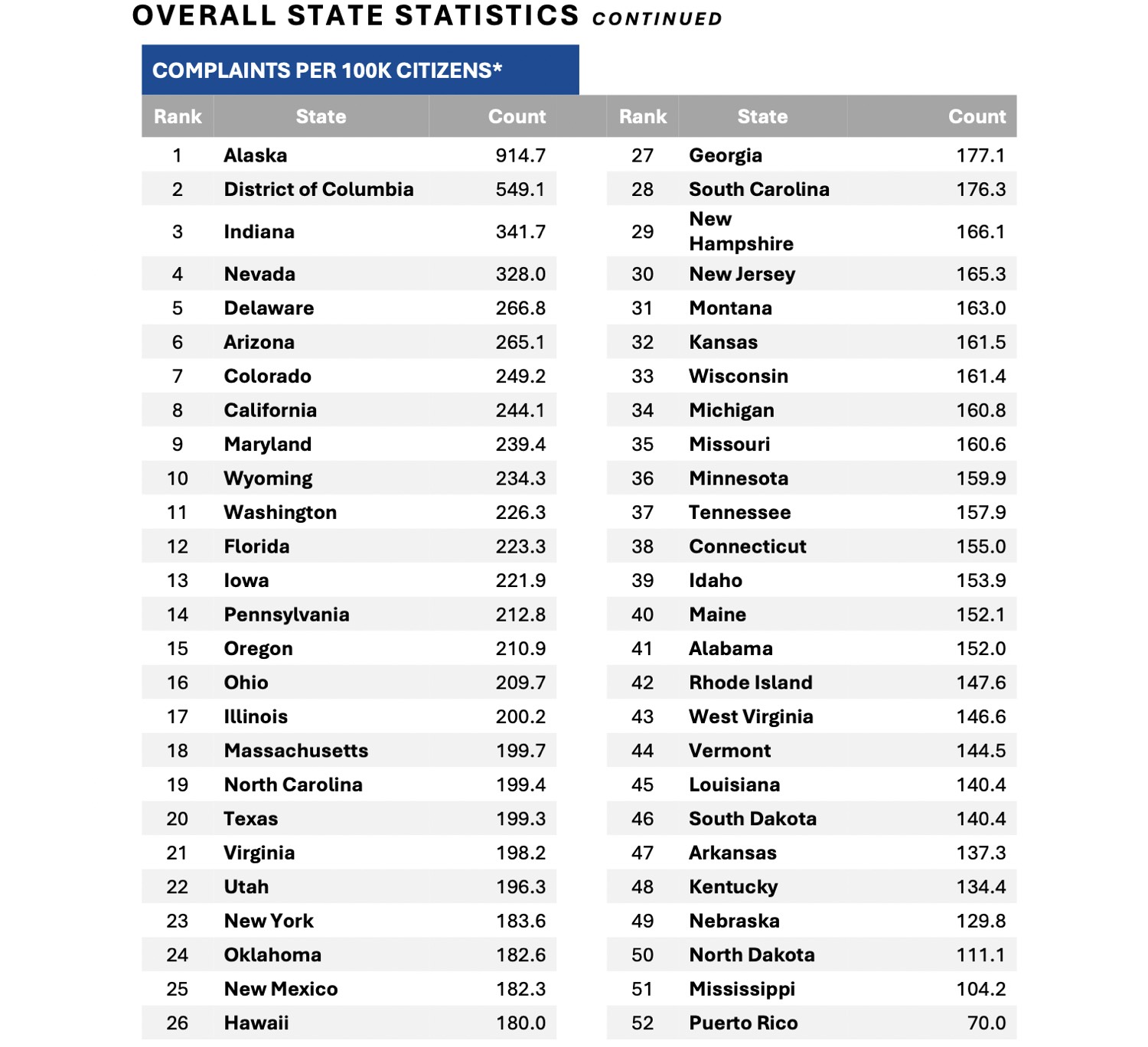

Alaska (~915), Washington (~549), and Indiana (~342) have the most complaints per 100,000 residents, while Puerto Rico (~70) has the least.

The District of Columbia has the highest losses per 100,000 residents (~$41.5 million) and West Virginia has the lowest (~$1.4 million).

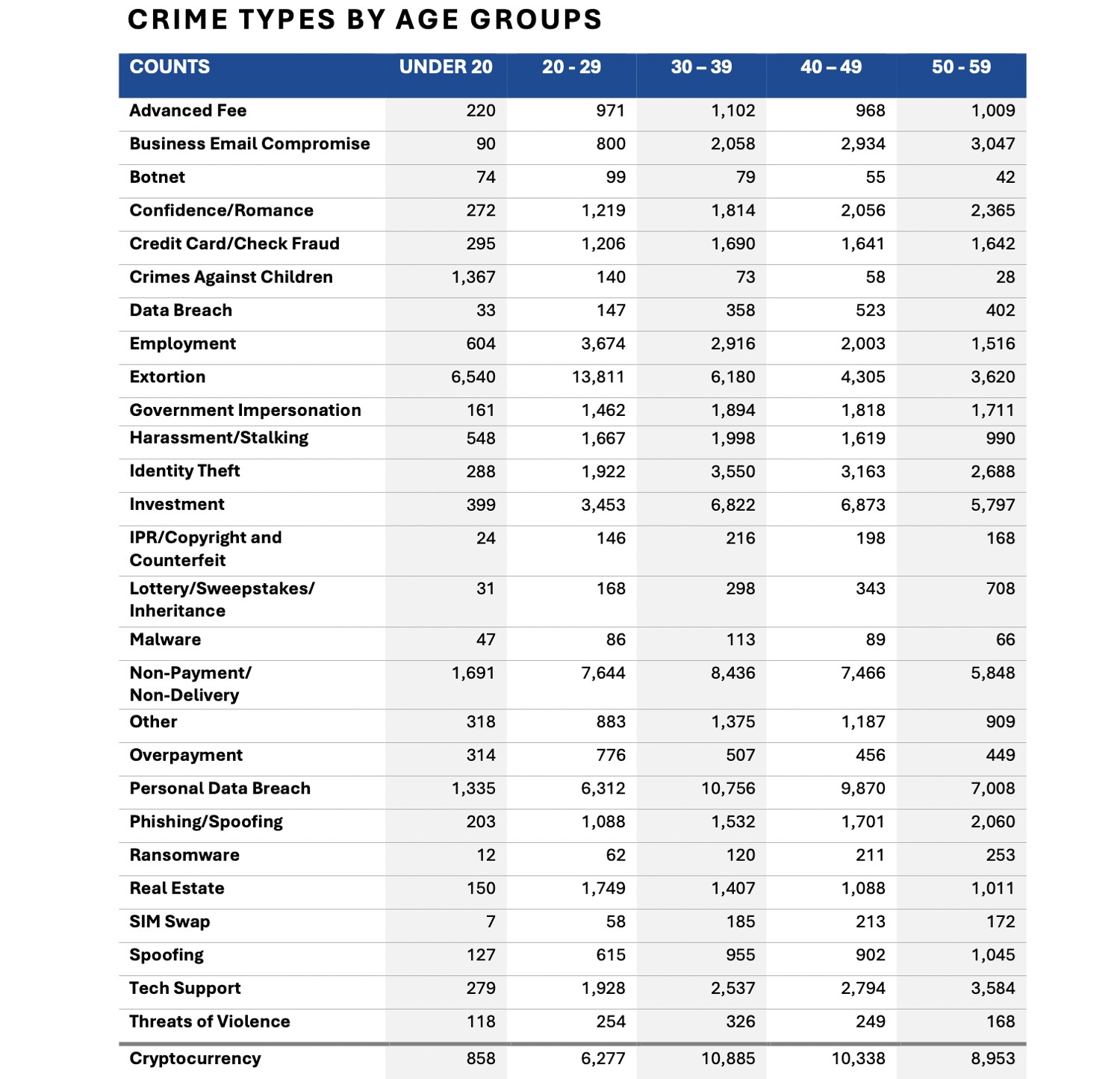

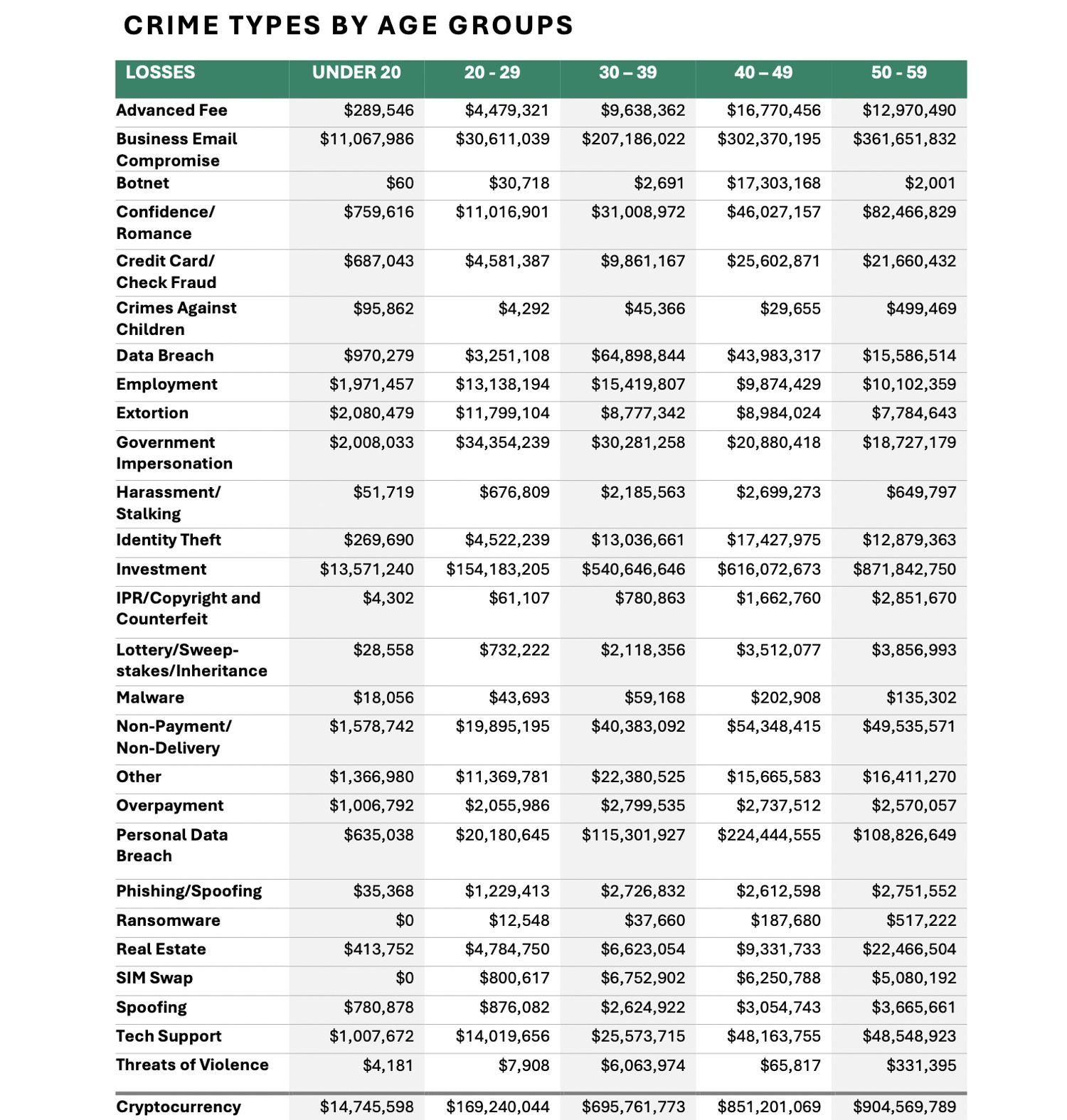

Fraud schemes by age group

Who is more likely to fall for scams and their types (number of complaints in 2024):

- < 20s – blackmail (6.5k) and “childish” incidents (1.4k) top the list; many more complaints about personal leaks and “didn’t pay – didn’t get”.

- 20-29 – extortion (13.8k) and investment schemes (3.5k) are the most common; fake jobs (3.7k) and tech support (1.9k).

- 30-39 – investments (6.8k) + BEC emails (2.1k) are the leaders; identity theft (3.6k) and “don’t pay, don’t get” (8.4k) are frequent.

- 40-49 – investing again (6.9k) and BEC (2.9k); lots of identity leaks (9.9k).

- 50-59 – investment scams (5.8k) and tech support (3.6k); phishing grows to 2.1k.

Crypto appears more frequently in 30-39 and 40-49 (~11k and 10k complaints).

The top money loss for all ages is “profitable investments”: 20-29s lost $154m, 30-39s lost $541m, 40-49s lost $616m, 50-59s lost $872m (add BECs at $200-360m and “tech support” up to $49m), and youth <20s lose much less – tens of millions.

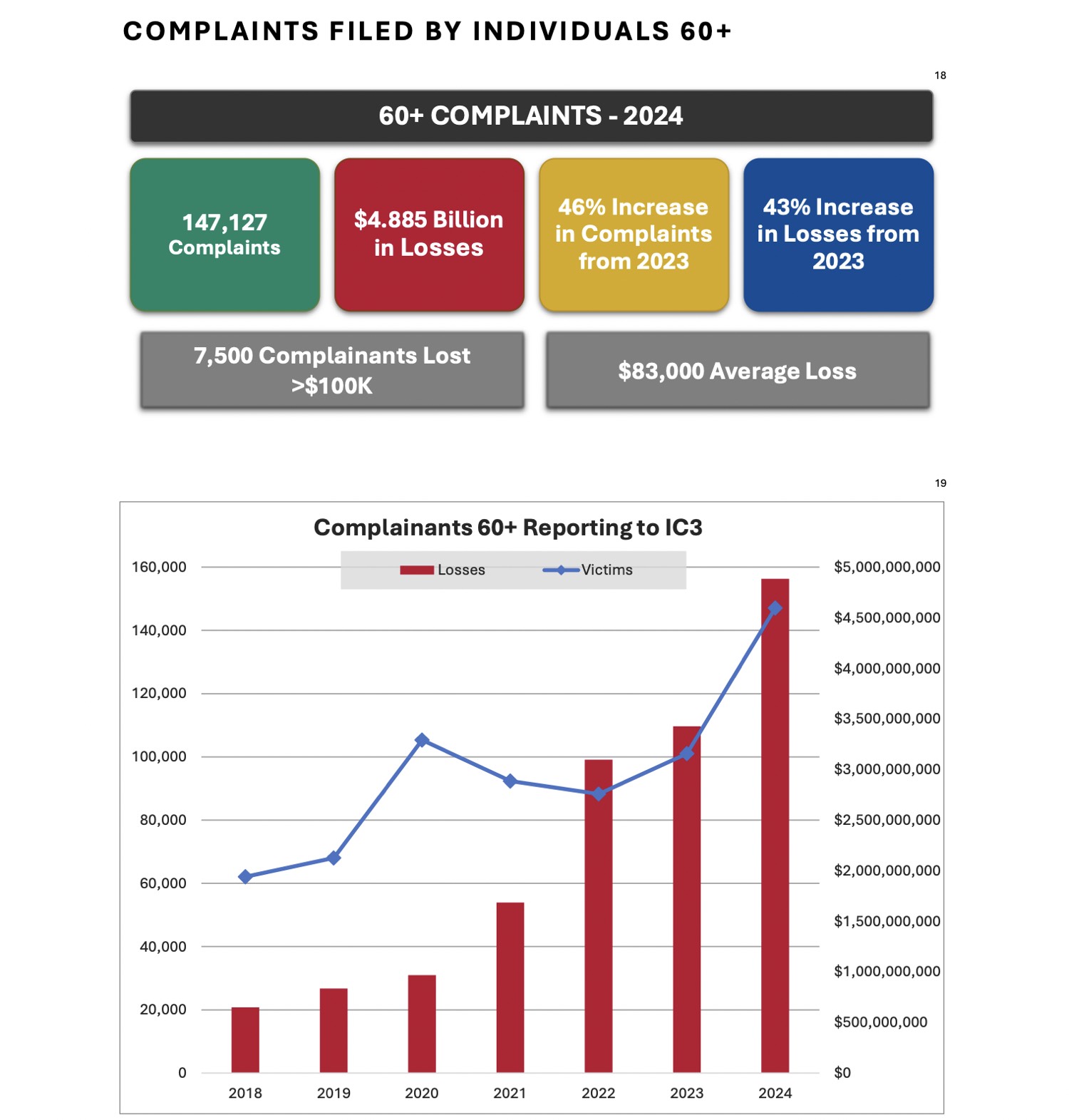

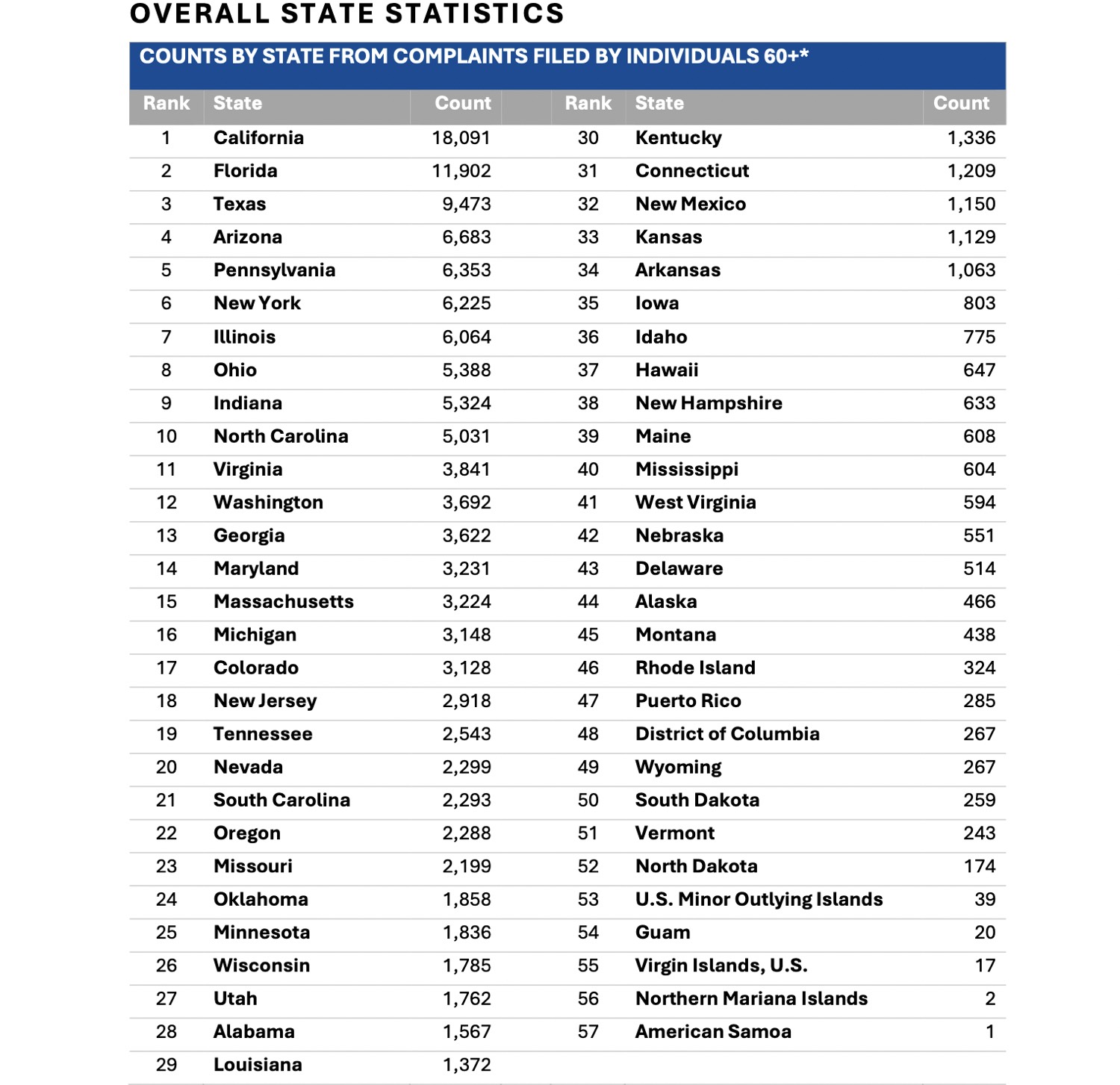

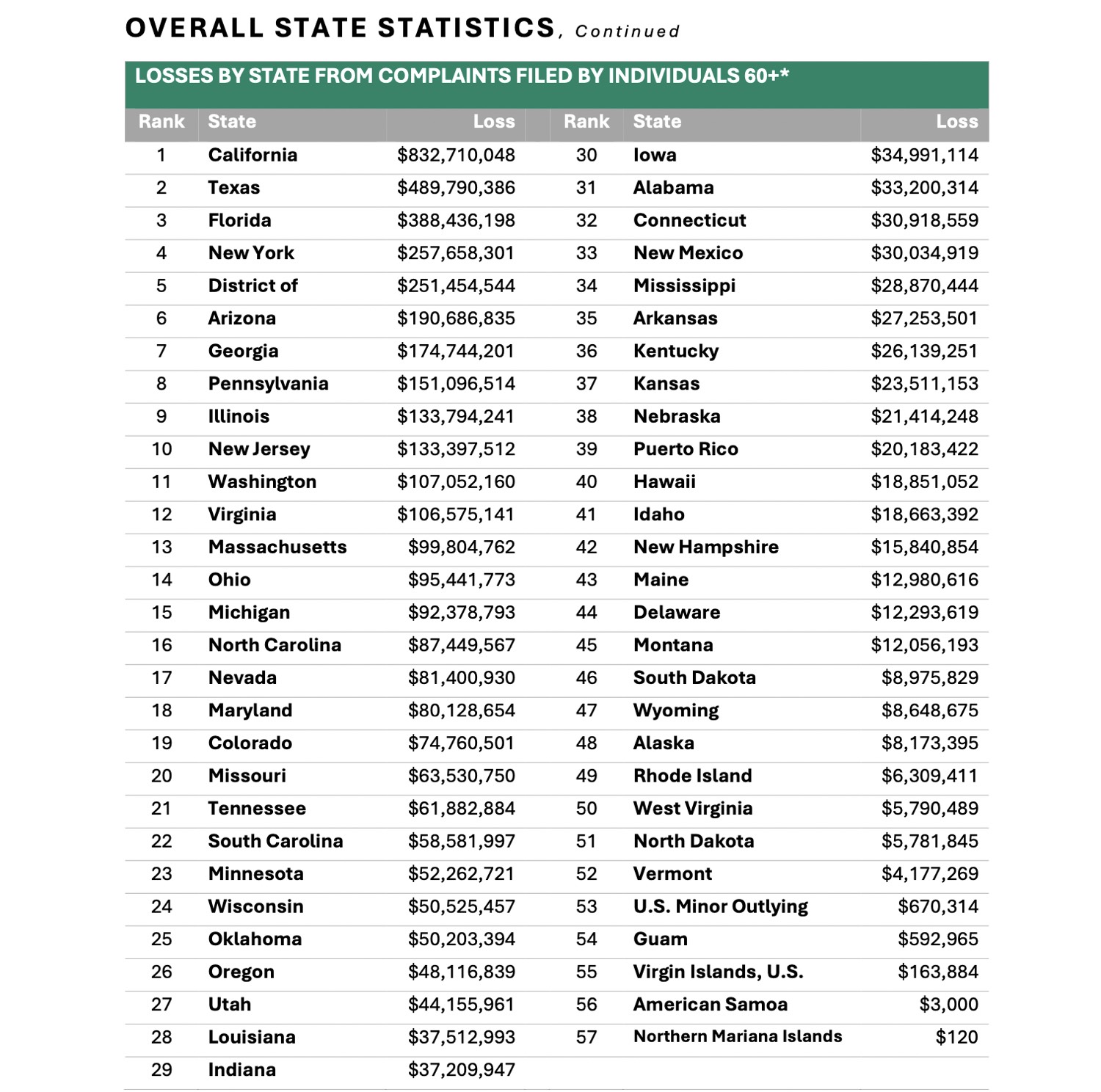

Retirees (60+): complaints, losses, geography

People 60+ filed 147k complaints and lost $4.9 billion in 2024 – that’s 46% more complaints and 43% more money than the year before; 7,500 retirees had losses exceeding $100k, with an average check of $83k.

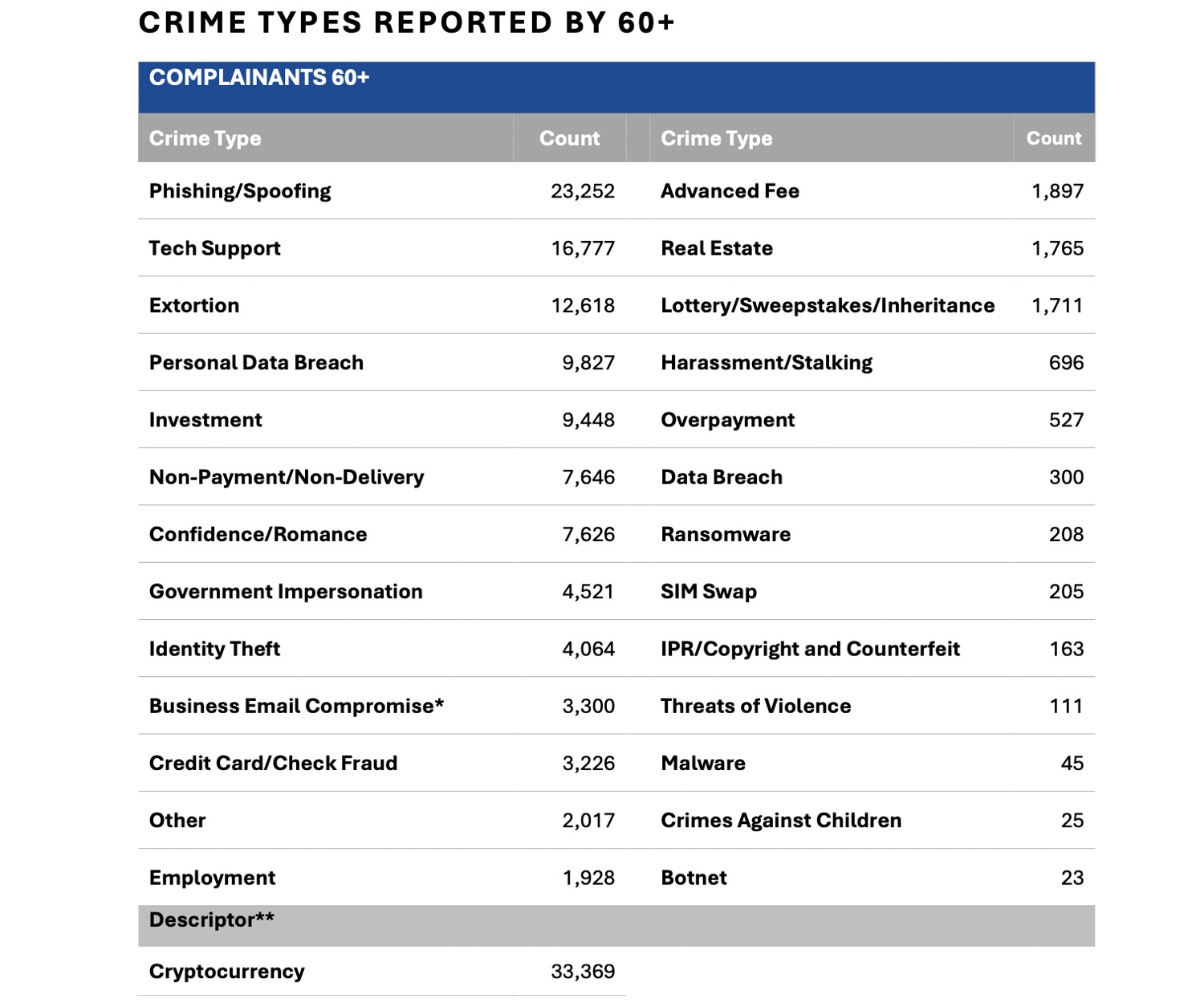

Seniors have the most complaints about phishing (23k), fake tech support (17k), extortion (13k), identity leaks (9.8k), and “profitable investments” (9.4k); crypto is mentioned in 33k claims.

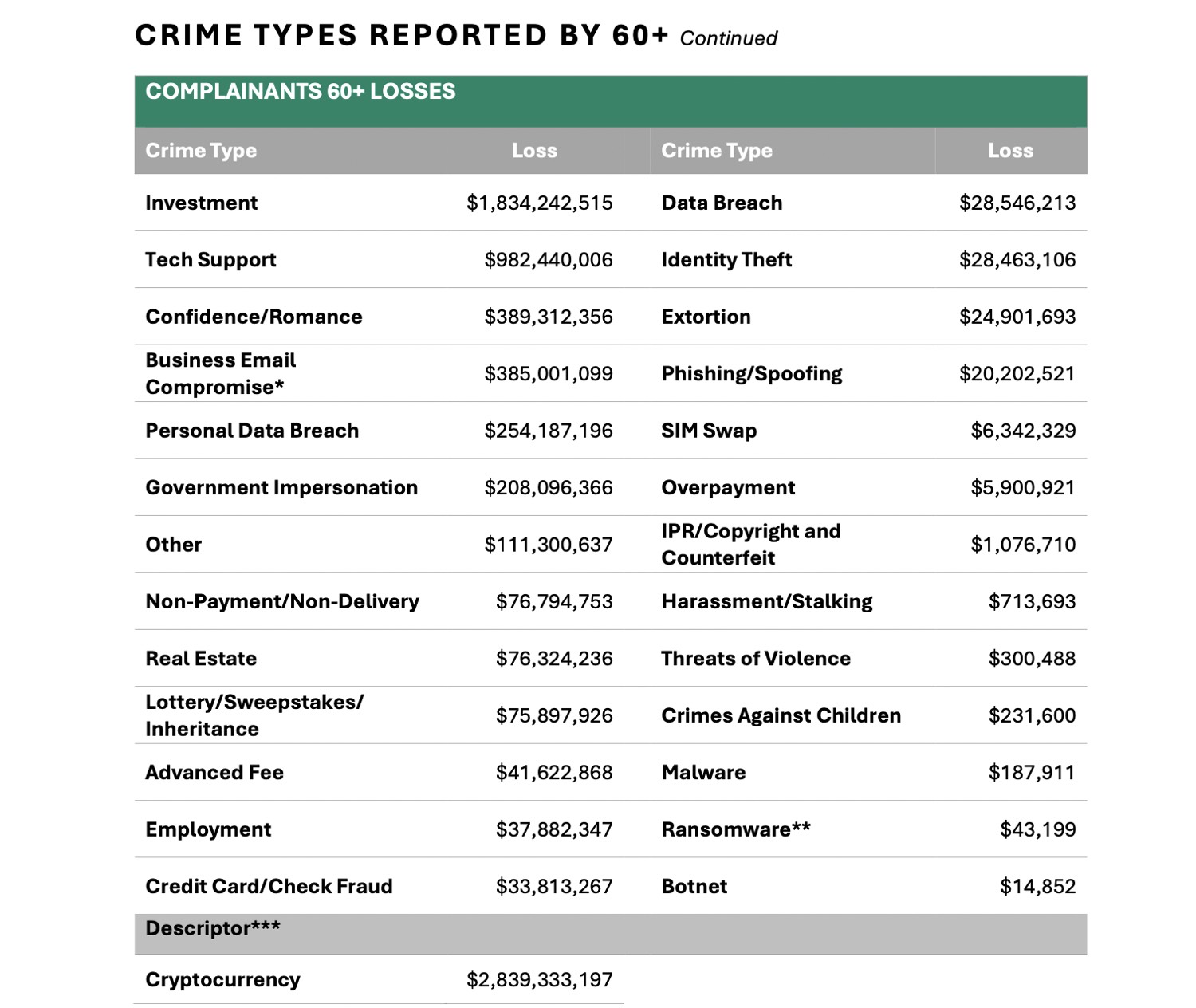

People 60+ had the most money spent on “profitable investments” – $1.8 billion, followed by fake tech support $0.98 billion, romance schemes $0.39 billion, compromise of emails (BEC) $0.39 billion, identity leaks $0.25 billion and “officials” $0.21 billion; in total, cryptocurrency figured in $2.84 billion in complaints from this group.

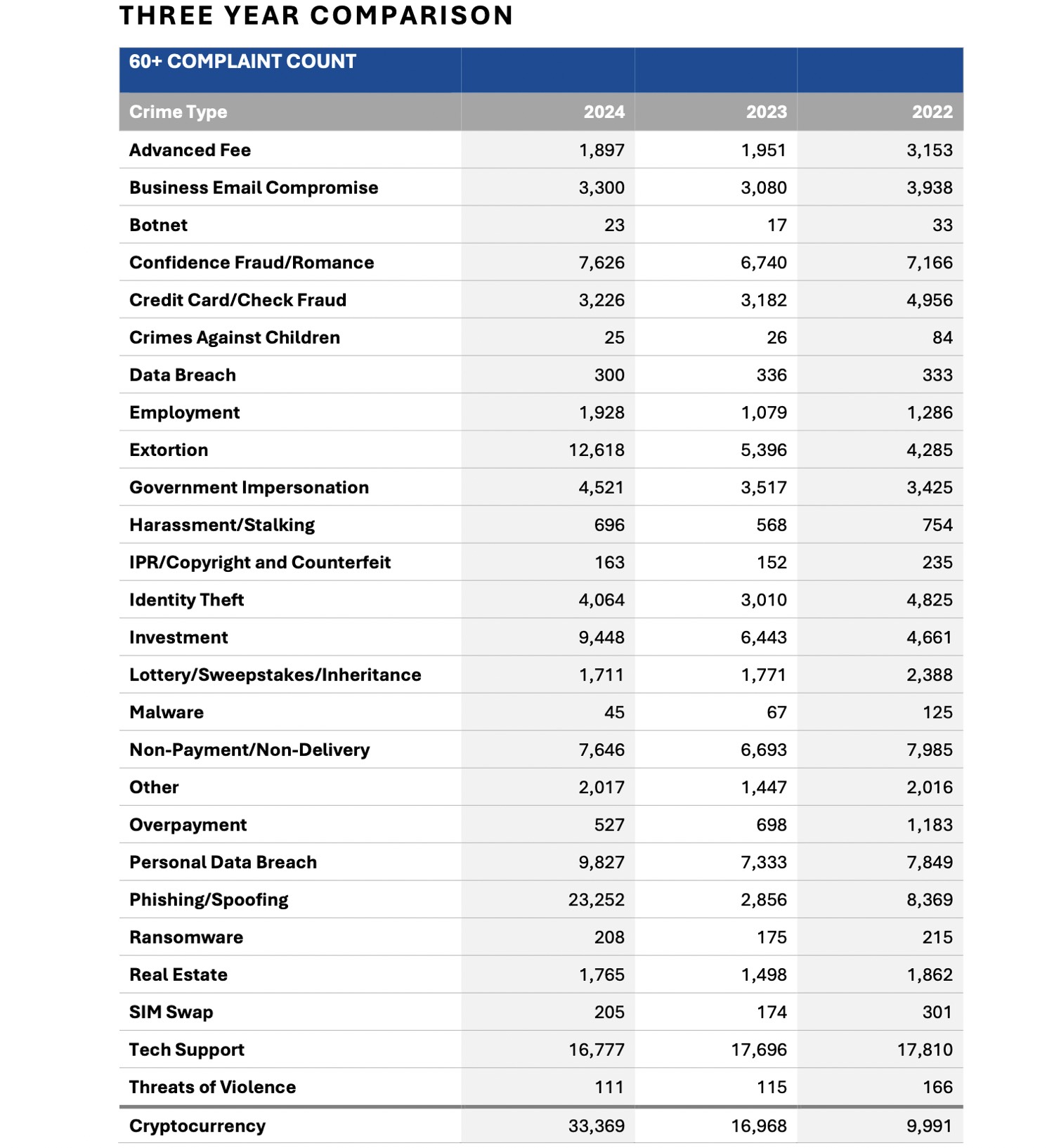

Over the three years, 60+ saw the strongest growth in complaints about phishing (up 23k), extortion (13k), “investments” (9k), identity leaks (~10k), and crypto schemes (33k), while advanced-fee, overpayment, card fraud, and SIM-swap decreased, and fake tech support, BEC, and “didn’t pay – didn’t get” remained almost unchanged.

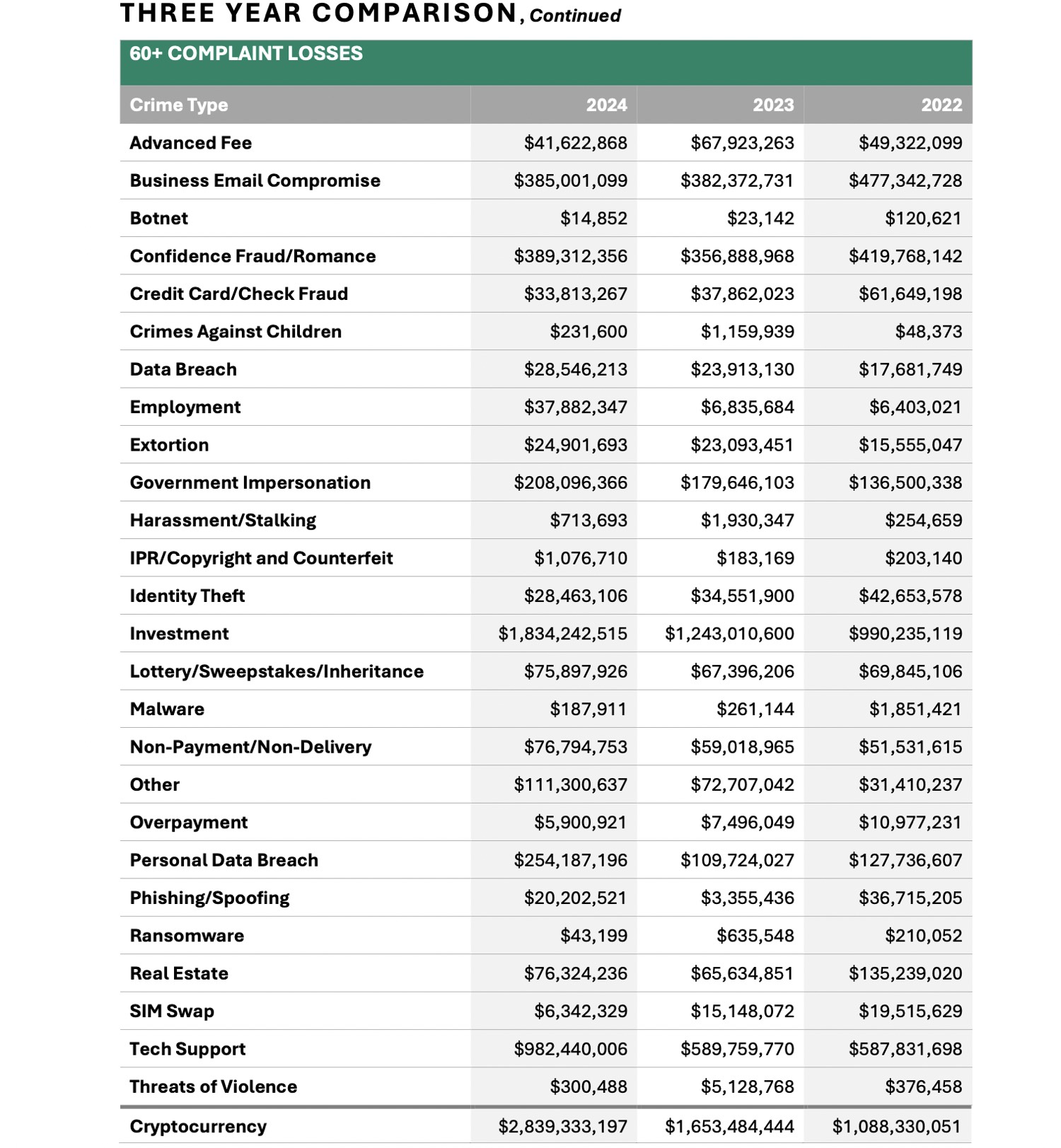

The 60+ mostly lose on “investments” ($1.8 billion), tech support ($0.98 billion), and identity leaks ($0.25 billion) – all of which are growing, while losses from BEC, card scams, SIM-swap, and phishing have been declining over three years.

Among retirees 60+, the most complaints came from California (18,000), Florida (12,000) and Texas (9,000), and the fewest from Guam (20), the Virgin Islands (17) and the Northern Marianas (2).

Retirees lost the most money in California ($833 million), Texas ($490 million), Florida ($388 million), New York ($258 million), and the District of Columbia ($251 million), while in the Virgin Islands (about $164k) and Northern Marianas (about $120) lost the least.

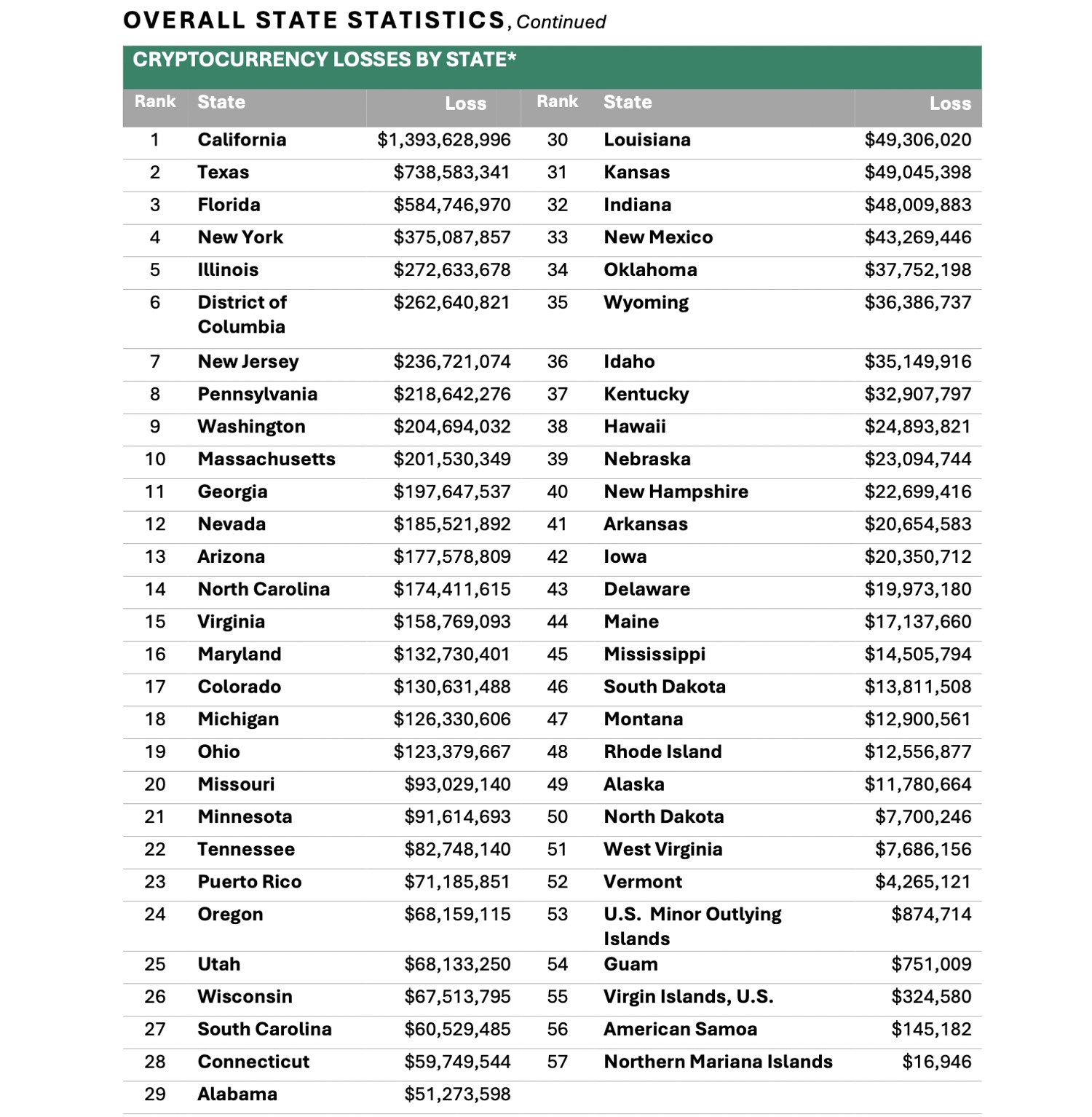

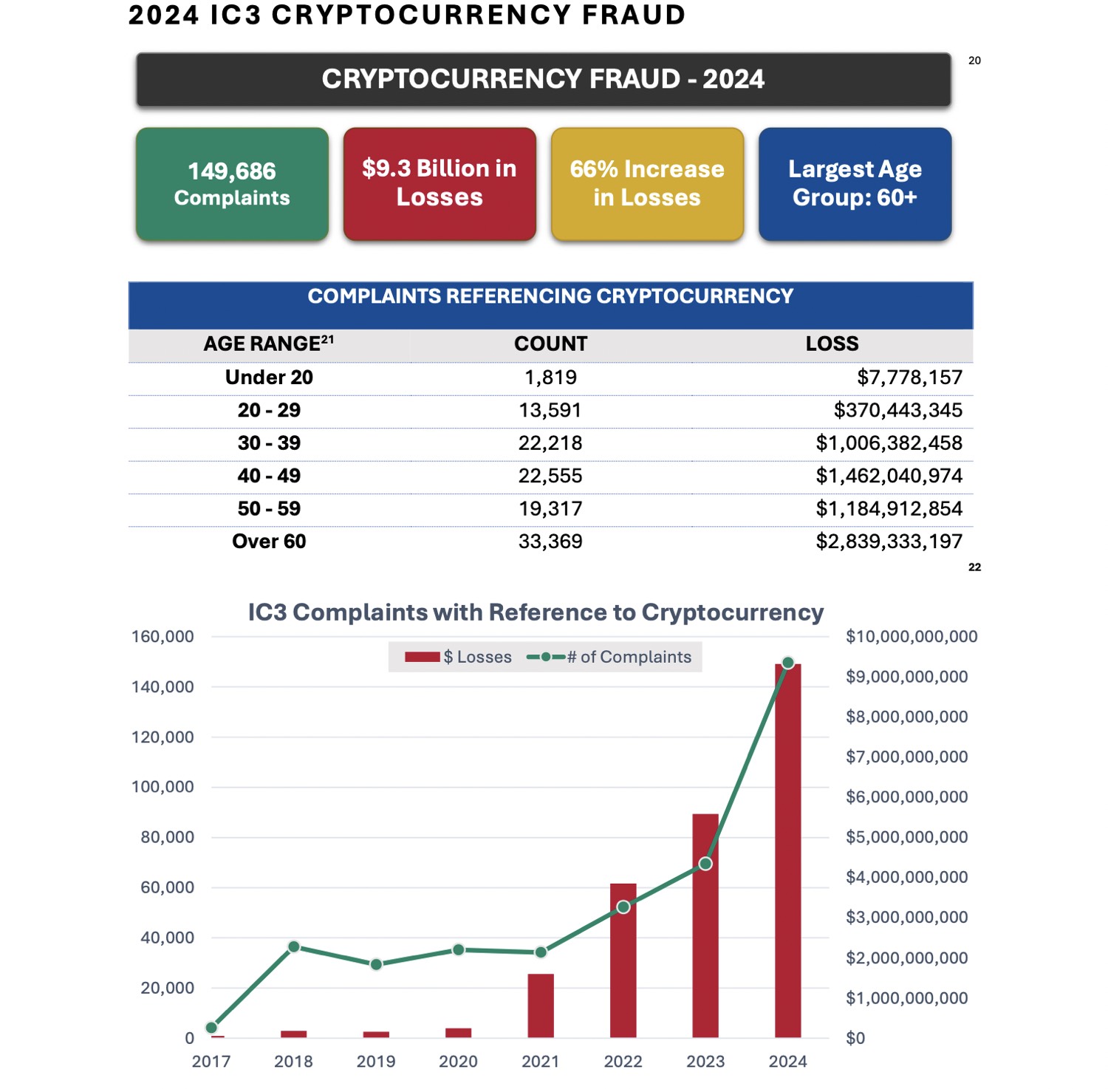

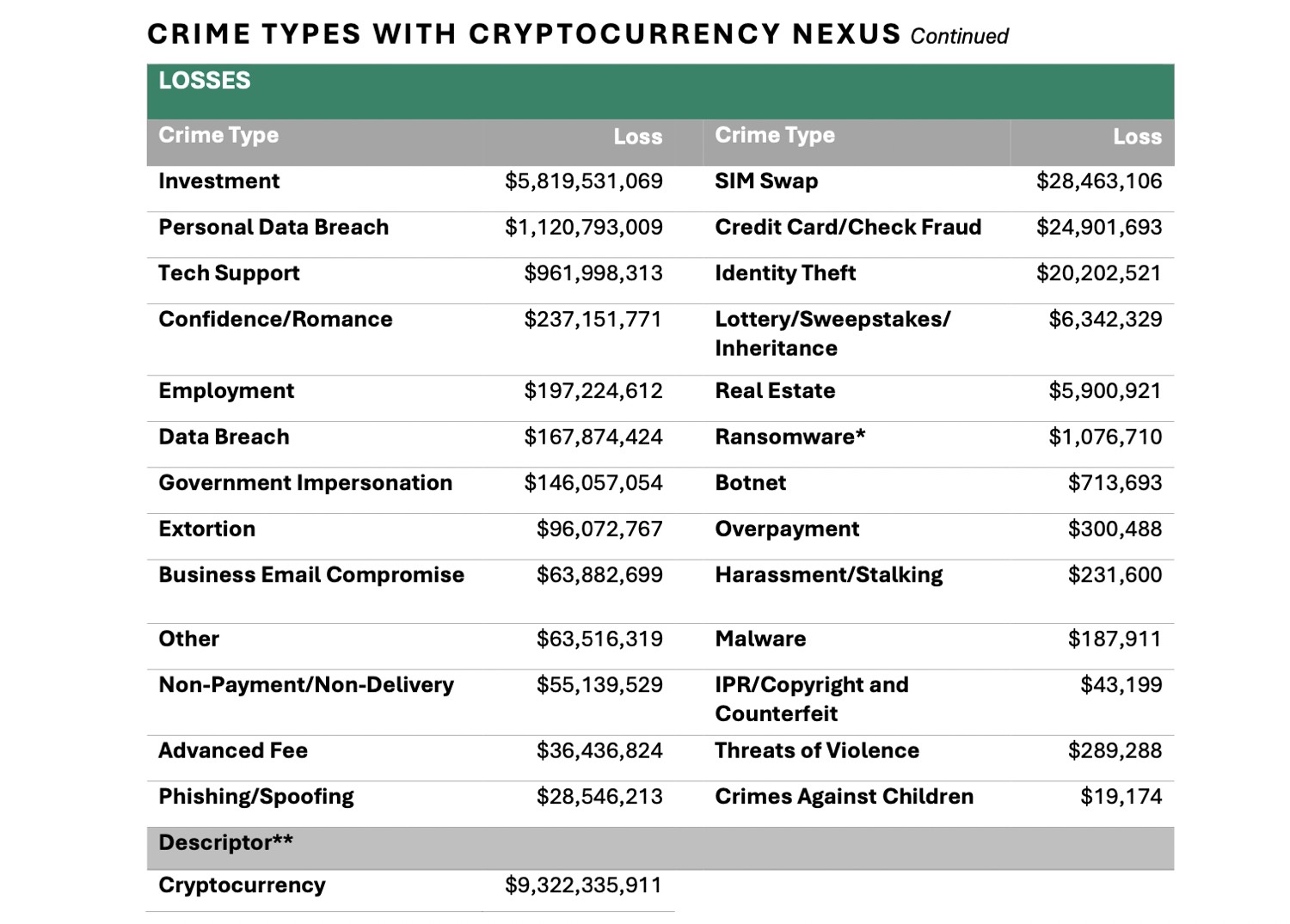

Cryptocurrency fraud statistics

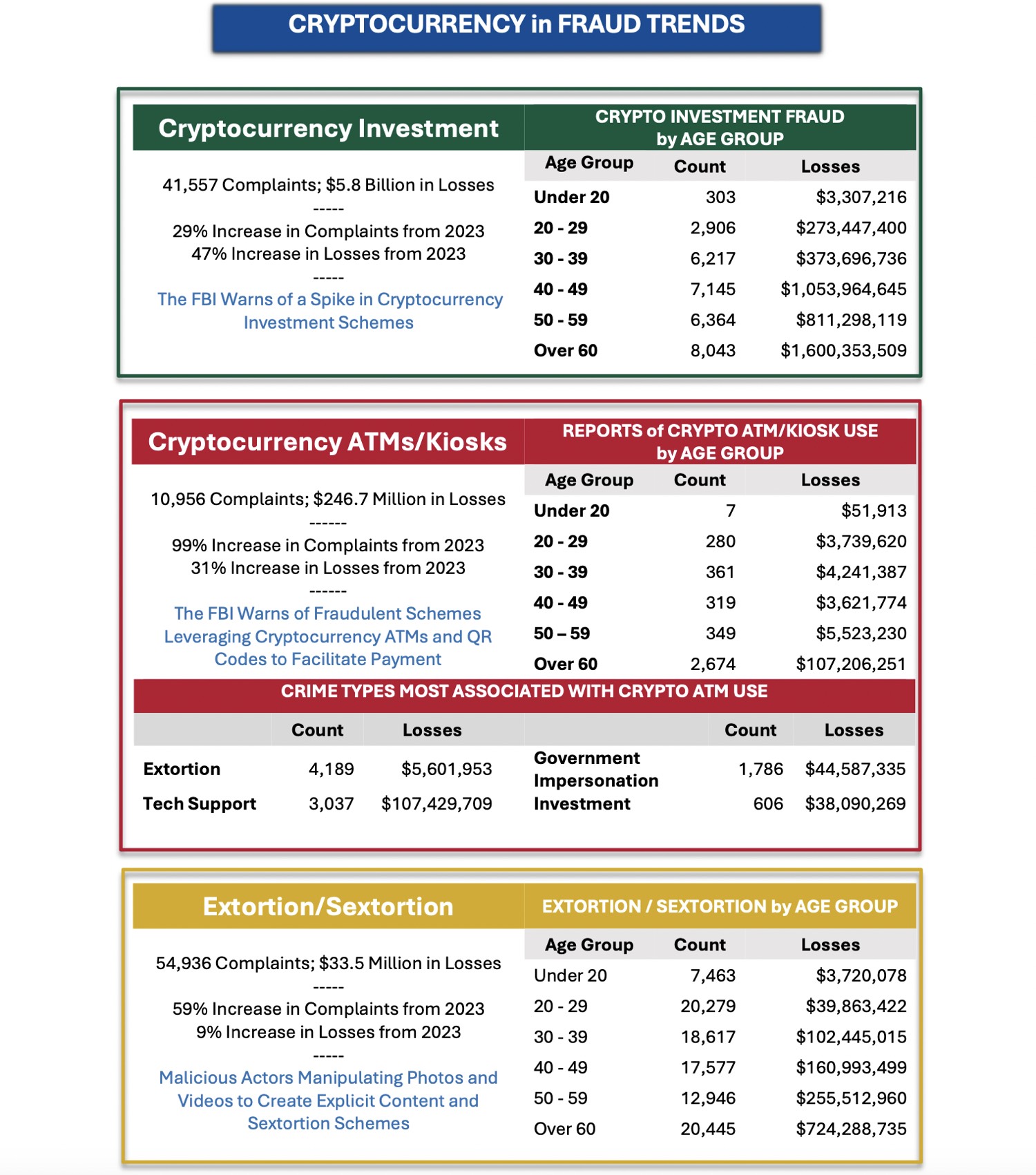

In 2024, crypto scams received ~150k complaints, people lost $9.3 billion (money +66% by 2023-ish), with 60+ being the hardest hit – 33k claims and $2.8 billion in losses.

The distribution of crypto scam schemes is as follows: “investment” – 41,557 complaints minus $5.8 billion (60+ people lose the most), followed by cryptocurrency ATM scams – 10,956 complaints and $246.7 million in losses (again, mostly elderly), and the most massive is extortion: 54,936 complaints but “only” $33.5 million.

Most crypto complaints are extortion 47k and investment scams 42k, personal leaks 12k, fake “tech support” 11k, and fake jobs 6.5k; everything else is less than 4k cases.

The share of crypto losses is investment fraud $5.8 billion; identity leaks $1.1 billion and fake tech support $0.96 billion; the rest are in the hundreds of millions or less.

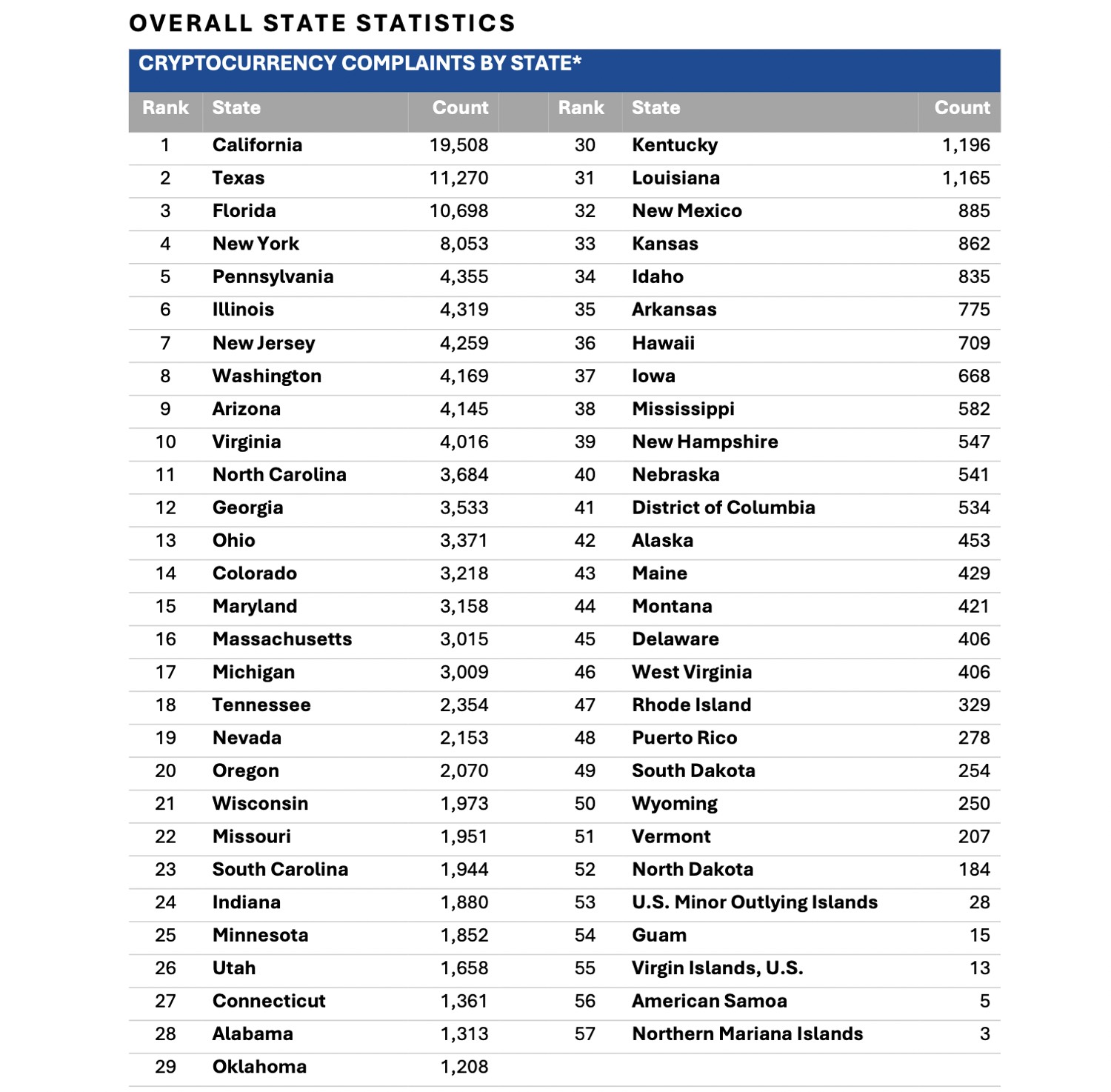

The most crypto complaints came from California (~19.5k), Texas (11.3k), and Florida (10.7k), and the least from the Northern Marianas (3), Virgin Islands (13), and Guam (15).

The most on crypto was lost in California – $ 1.39 billion, followed by Texas (0.74 billion) and Florida (0.58 billion), and the least – Guam (0.75 million), American Samoa (0.15 million) and Northern Mariana Islands (0.02 million).