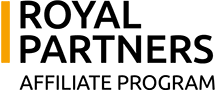

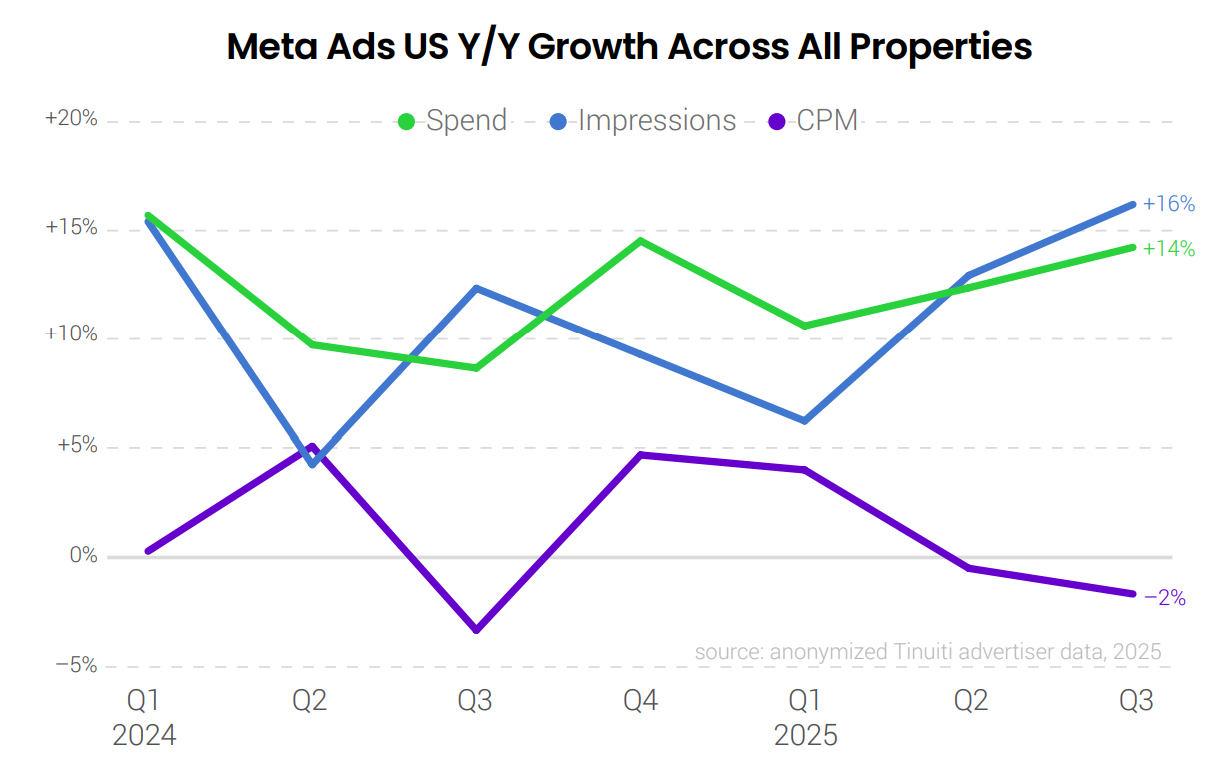

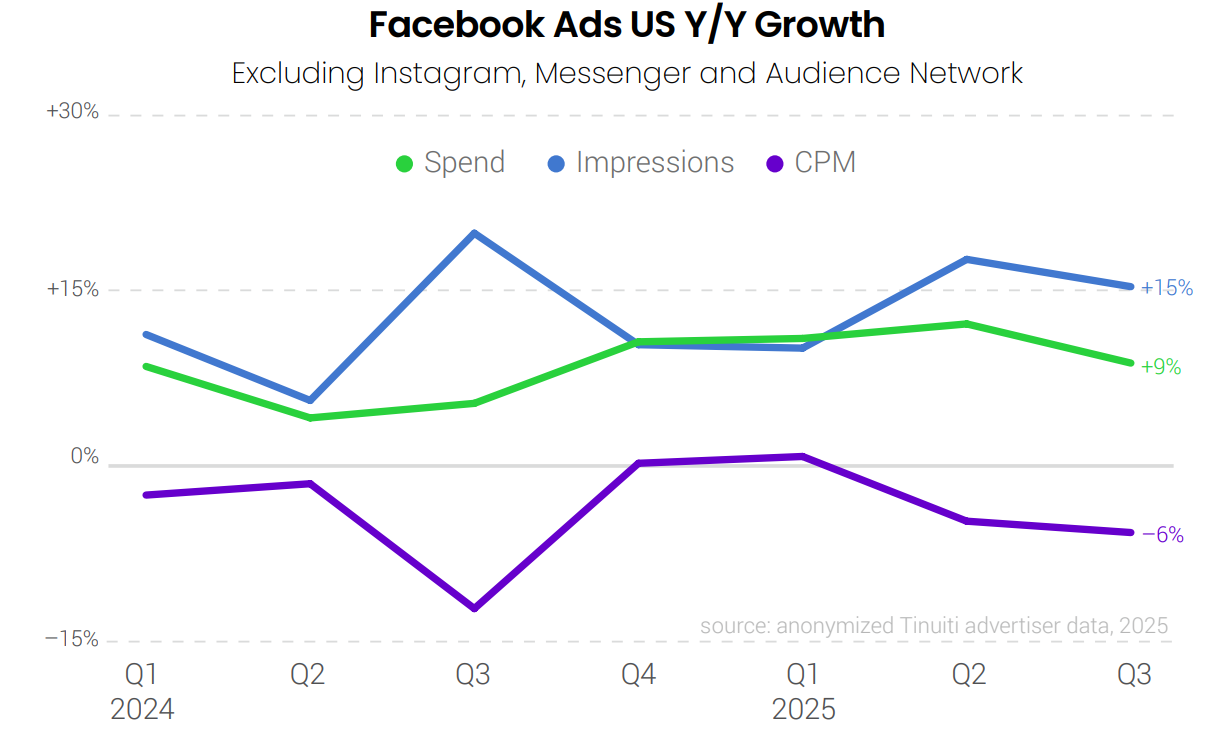

The Tinuiti Digital Ads Benchmark report, based on anonymised data from US advertising campaigns with annual spending of over $4 billion, recorded an acceleration in advertising spending on Meta platforms in the third quarter of 2025. Spending grew by 14% compared to 12% in the previous quarter. On Facebook, with a 9% increase in spending, advertising traffic increased by 15%, leading to a 6% decrease in CPM, while on Instagram, spending increased by 21% and was accompanied by an 11% increase in CPM with only a 9% increase in reach.

Overall spending growth

- Advertising investment on Meta platforms grew 14% year-on-year, which is 2 percentage points higher than in the second quarter.

- CPM (cost per thousand impressions) decreased by 2%, demonstrating momentum amid accelerating investment for the second consecutive quarter.

- The number of impressions grew by 16%, the strongest growth since the fourth quarter of 2023.

- Advertising on Threads, available since April, accounts for 0.04% of Meta’s total advertising spending.

- The average cost per thousand impressions (CPM) decreased by 6% compared to last year. This is the 11th decline in the last 13 quarters.

- Total advertising spending increased by 9%, contributing to a 15% increase in impressions.

- The share of ad impressions on Facebook attributable to video ads in Reels grew from 7% in Q3 2024 to 14% in Q3 2025.

- Reels overlay ads, which are banners and stickers on videos, remained at the same level as in Q3 2024, accounting for 16% of all impressions.

- Investments grew by 21% year-on-year (Y/Y), which is almost twice the growth rate of the second quarter (+11%).

- CPM has grown at double-digit rates for the sixth consecutive quarter, +11% since Q2 2024.

- The number of impressions increased by 9%, showing the best result since the beginning of 2024.

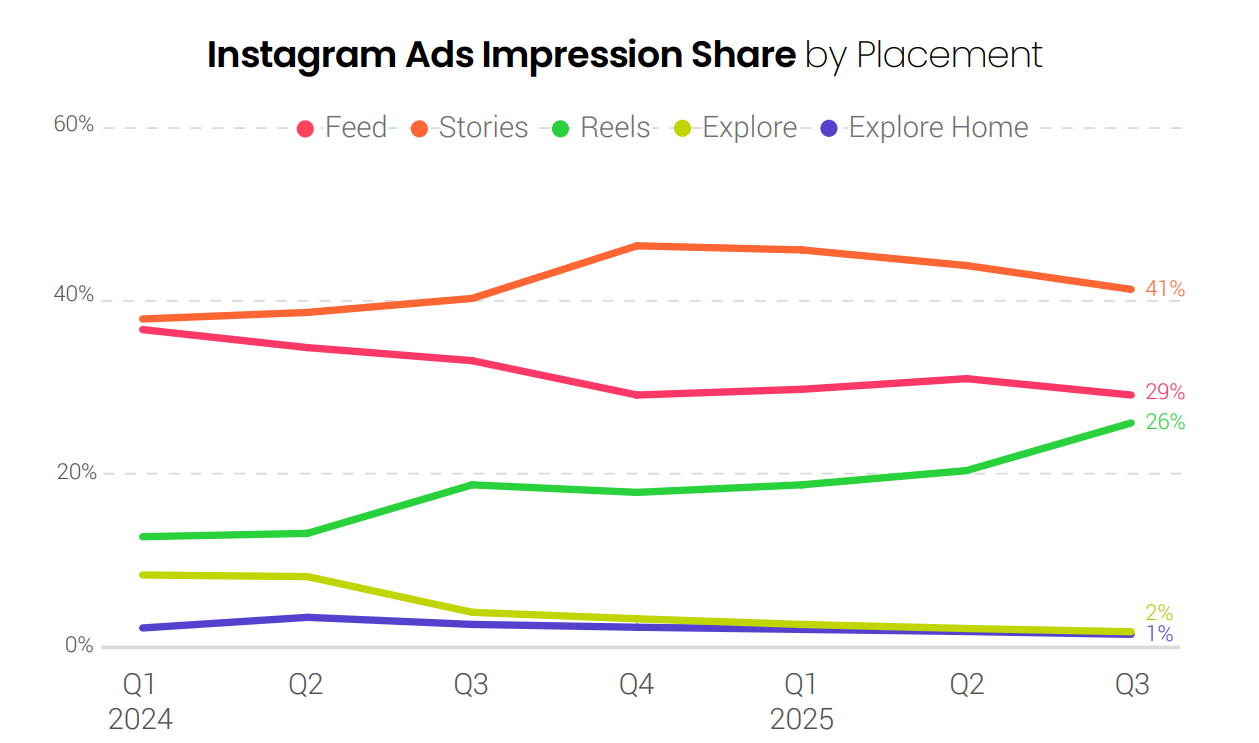

- Stories remain the main placement with 41%, but their share is declining after peaking at the end of 2024.

- Reels’ share on Instagram has grown to 26%, up from 19% a year earlier. The growth of advertising in Reels, which has a lower CPM than advertising in Feed and Stories, is reducing CPM over time.

- The classic feed is losing ground, falling to 29%.

Advantage+ (AI-based advertising)

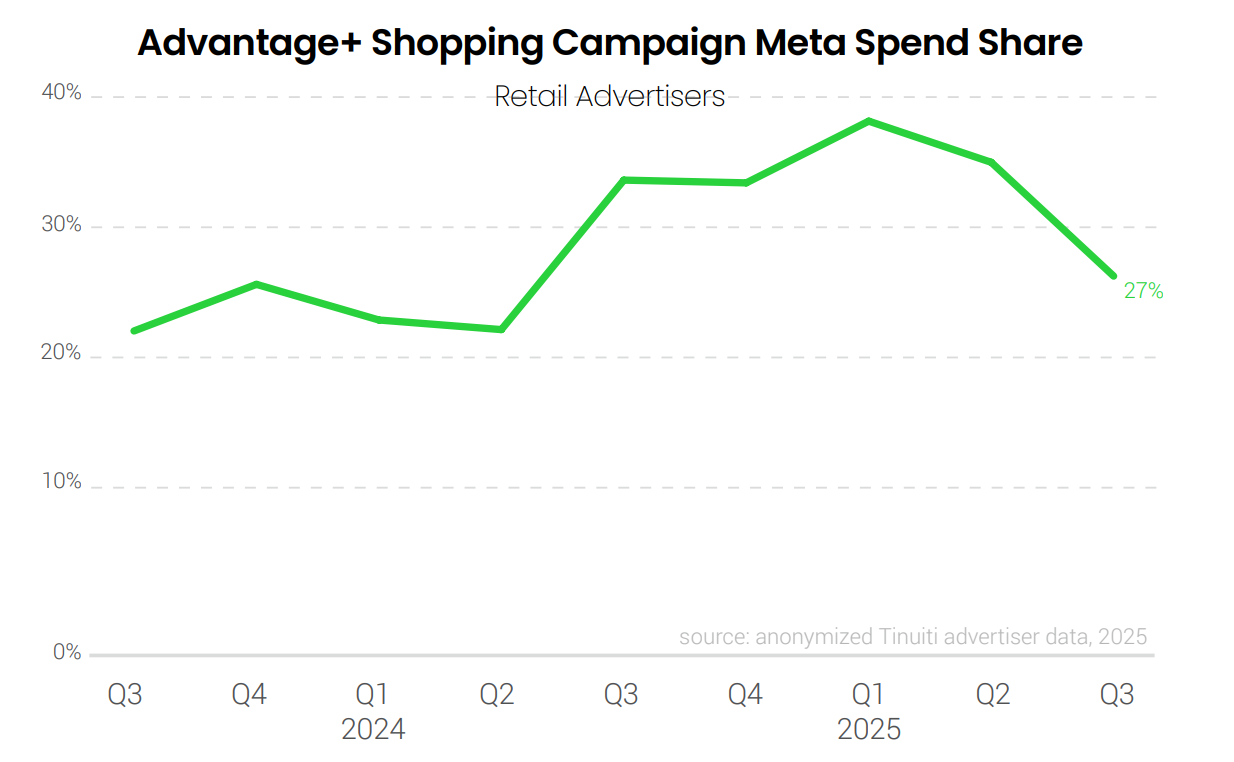

- Advantage+ campaigns (ASCs), which use artificial intelligence for optimisation, declined to 27% of all retail and e-commerce spending in the third quarter, after accounting for 35% in the second quarter and 38% in the first quarter.

The decline from 34% to 27% over the year may indicate that advertisers have become less trusting of automated AI tools, returning to manual settings for more precise control over traffic quality.

Advertising expenditure in Q3 2025 relative to Meta

Most advertisers use Meta as their primary source of traffic, allocating only 10–25% of their total budget to all other social networks.

This data demonstrates steady growth in advertising on Meta platforms, with an emphasis on formats such as Reels, while advertisers are returning to manual control instead of AI (Advantage+) and keeping Meta as their top budget priority over other platforms.

- For more details, see the Tinuiti Digital Ads Benchmark.