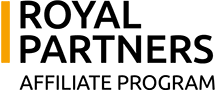

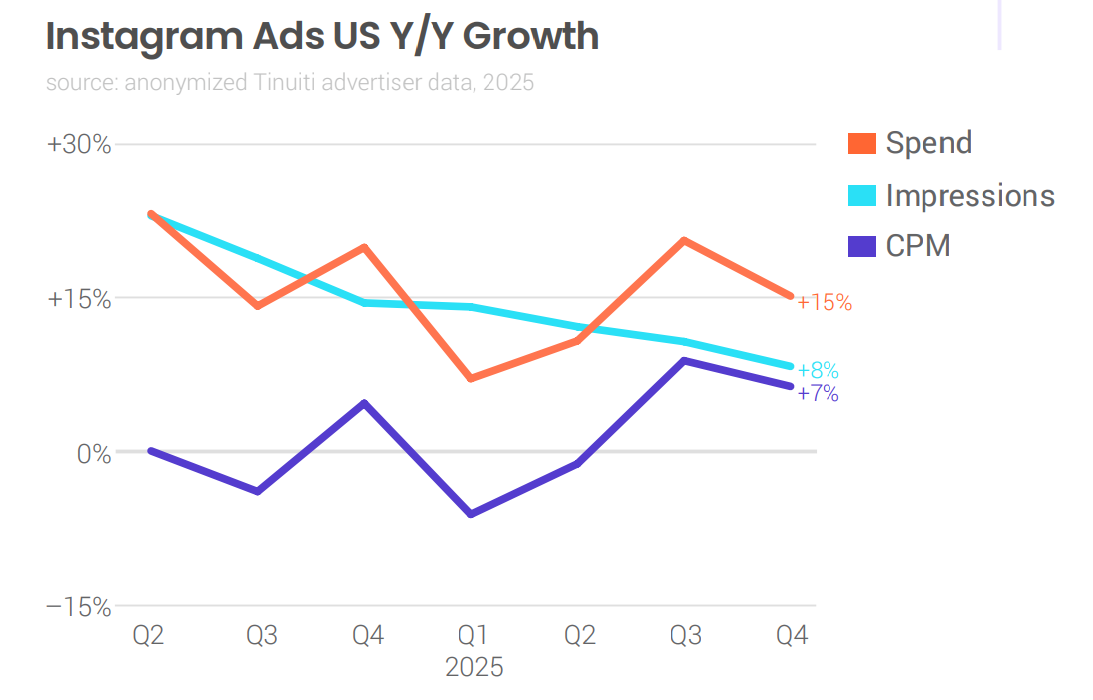

In Q4 2025, the number of ad impressions on Meta platforms grew by 17%, while their cost (CPM) fell by 7% thanks to cheaper traffic on Reels. Expenditure growth slowed to 9% from 14% in Q3 2025. Impressions on Facebook grew by 19% and spending by 3%. The average cost of advertising (CPM) fell by 13%, but for 44% of advertisers, the price actually rose. On Instagram, CPM growth slowed to 8% in Q4, while the number of impressions increased by 7%.

The Tinuiti Digital Ads Benchmark report served as the methodological basis for the analysis. The study is based on an array of anonymised data on the effectiveness of advertising campaigns in the United States managed by the Tinuiti agency, with a combined annual budget exceeding $4 billion.

Meta’s overall metrics

- Ad impressions increased by 17% year-on-year. This is the highest rate in the last nine quarters.

- Advertising spending grew by 9%, indicating a 14% decline in advertiser activity compared to the previous quarter.

- The cost of advertising CPM decreased by 7%. While CPM grew by +5% in Q4 a year ago, it has now been declining for the third consecutive quarter.

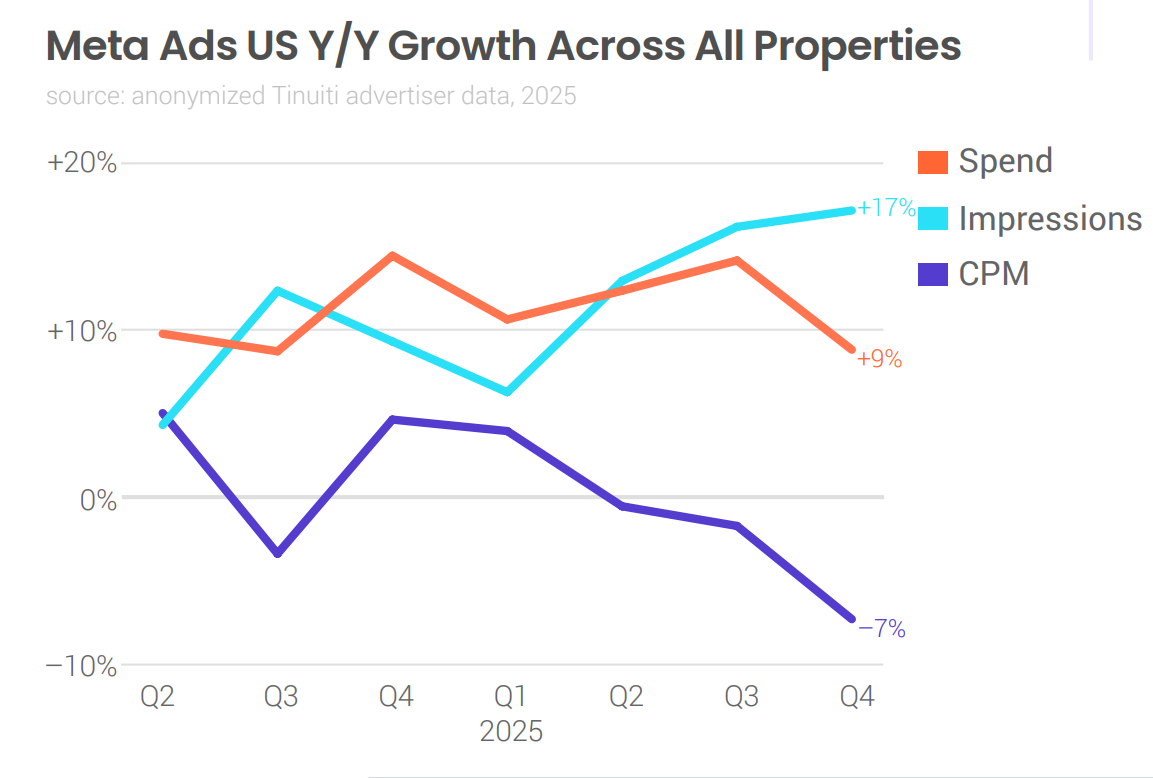

- The number of ad impressions increased by 19% compared to last year. This is almost twice the growth rate recorded at the same time a year ago, which was around 10%.

- Advertising spending grew by 3%. This is a significant slowdown compared to the third quarter, when growth was 9%.

- The price fell by 13%. The decline in cost accelerated compared to the previous quarter, whereas a year ago, prices were stable and showed zero growth during this period.

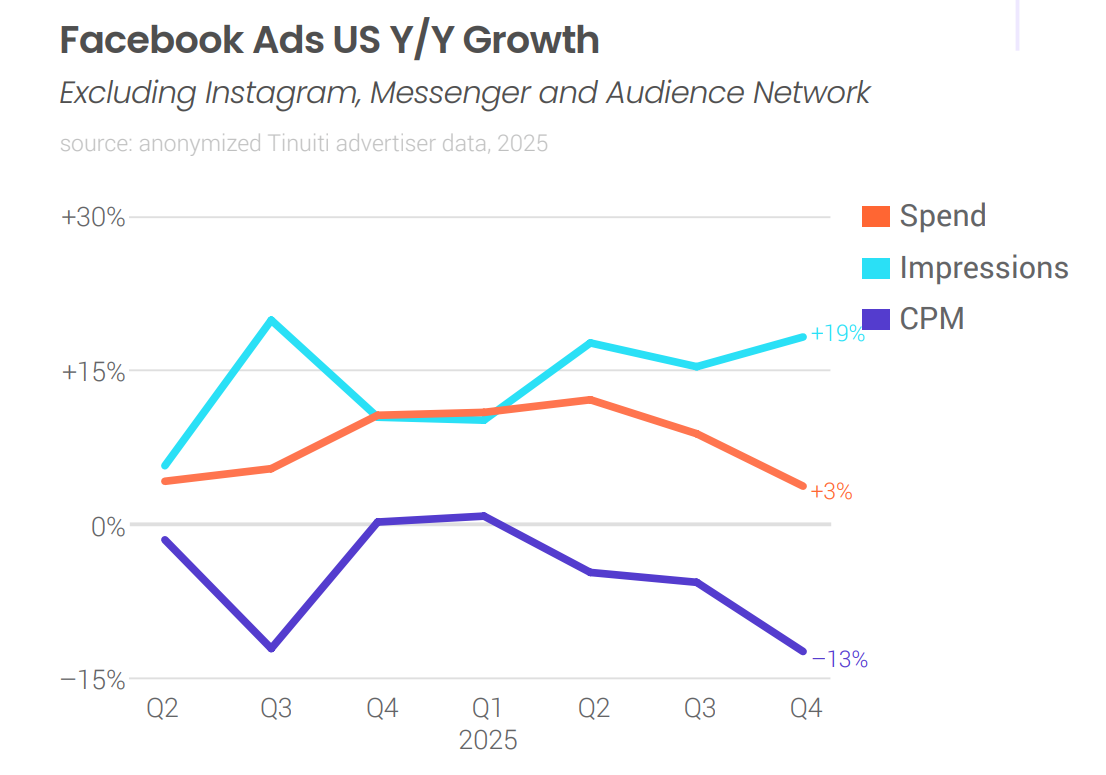

- By the end of 2025, the shares of the two types of placements were almost equal. The gap narrowed to a minimum: 15% for Ads on Reels (banners and stickers on videos) versus 14% for Facebook Reels.

- This was due to the steady growth of video advertising (Facebook Reels), which doubled its share from 7% to 14%, catching up with the leader.

- Advertising expenditure increased by 15%. This is lower than the previous quarter and below the figures for the same period last year, when growth reached approximately 20%.

- The number of impressions increased by 8%. The trend continues to decline: a year ago, in Q4, the growth rate was almost twice as high, at around 15%.

- Unlike Facebook, the cost per impression (CPM) on Instagram increased by 7%. Although price growth slowed slightly compared to Q3, it is still higher than a year ago, at around 5%.

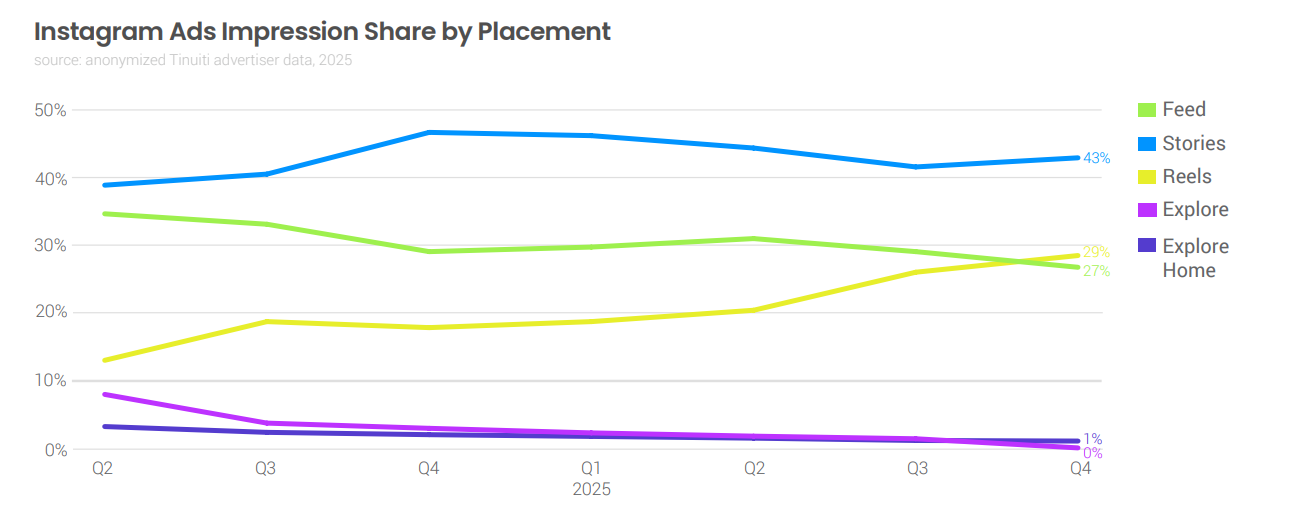

- Stories placement retains its top spot, accounting for 43% of all impressions. The share of Stories increased by 2% compared to Q3.

- For the first time, the share of impressions in Reels exceeded the share in the main Feed. Reels grew to 29%, while Feed dropped to 27%.

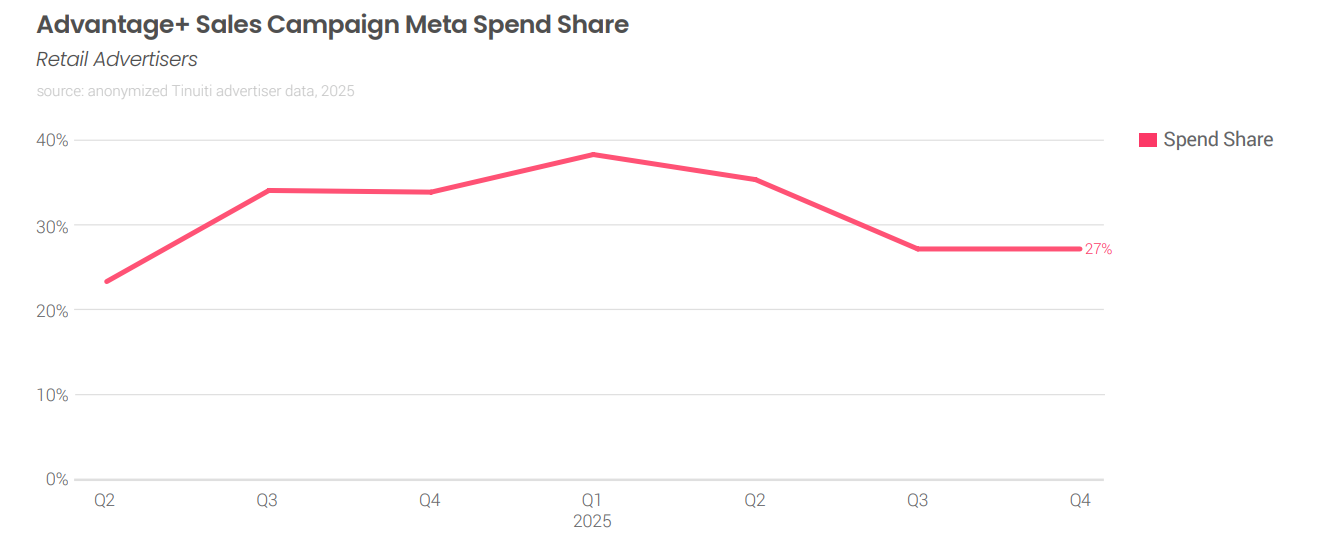

Advantage+ (AI-based advertising)

- In Q4, the share of spending on automated AI campaigns remained at 27%, the same as in the previous quarter.

This may indicate that the market has found the optimal balance for using this tool.

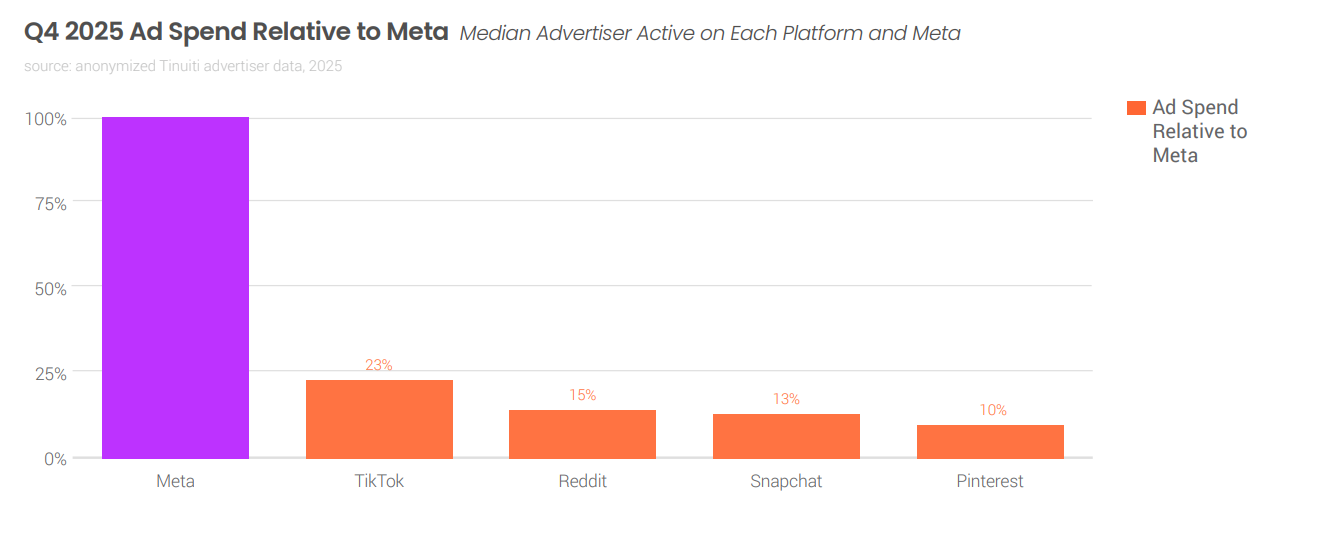

Advertising spending in Q4 2025 relative to Meta

- Meta continues to lead in terms of advertising budget share, being the main channel for most advertisers.

- Among alternative platforms, TikTok leads the way, attracting 23% of Meta’s budget (among advertisers who use both platforms), down 3% from the previous quarter.

- The Reddit platform is showing rapid growth, reaching 15% of Meta’s volume. Although the number of active advertisers on Reddit is still significantly lower than on TikTok, growth was 5% for the quarter.

- For more details, see the Tinuiti Digital Ads Benchmark.